Question: Current Attempt in Progress Gilman is another company that operates in the apparel industry, fike Aritzla and Canada Goose. It reported the following selected information

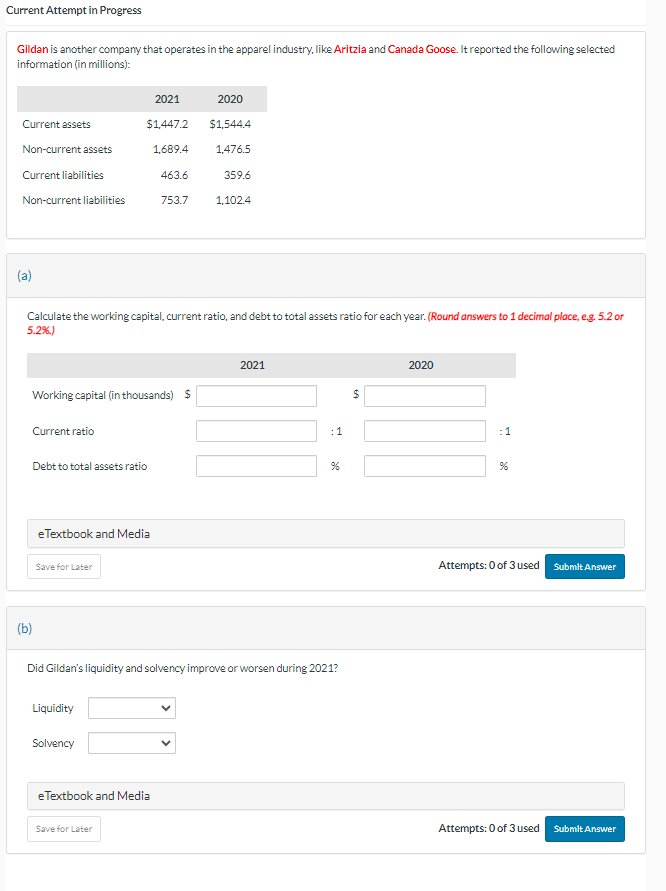

Current Attempt in Progress Gilman is another company that operates in the apparel industry, fike Aritzla and Canada Goose. It reported the following selected information (in millions): 2021 2020 Current assets $1,447.2 $1,544.4 Non-current assets 1,689.4 1,476.5 Current liabilities 46.6 359.6 Non-currentliabilities 753.7 1,102.4 (a) Calculate the working capital, current ratio, and debt to total assets ratio for each year. (Round answers to 1 decimal place, e.g. 5.2 or 5.2%.) 2021 Working capital (in thousands) $ Current ratio Debt to total assets ratio 2020 $ +-1 % % eTextbook and Media (b) Did Gildan's liquidity and solvency improve or worsen during 2021 ? Liquidity Solvency Attempts: 0 of 3 used eTextbook and Media Attempts: 0 of 3 used

Current Attempt in Progress Gilman is another company that operates in the apparel industry, fike Aritzla and Canada Goose. It reported the following selected information (in millions): 2021 2020 Current assets $1,447.2 $1,544.4 Non-current assets 1,689.4 1,476.5 Current liabilities 46.6 359.6 Non-currentliabilities 753.7 1,102.4 (a) Calculate the working capital, current ratio, and debt to total assets ratio for each year. (Round answers to 1 decimal place, e.g. 5.2 or 5.2%.) 2021 Working capital (in thousands) $ Current ratio Debt to total assets ratio 2020 $ +-1 % % eTextbook and Media (b) Did Gildan's liquidity and solvency improve or worsen during 2021 ? Liquidity Solvency Attempts: 0 of 3 used eTextbook and Media Attempts: 0 of 3 used

Gildan is another company that operates in the apparel industry, like Aritzia and Canada Goose. It reported the following selected information (in millions): (a) Calculate the working capital, current ratio, and debt to total assets ratio for each year. (Round answers to 1 decimal place, e.g. 5.2 or 5.2\%.) eTextbook and Media Attempts: 0 of 3 used (b) Did Gildan's liquidity and solvency improve or worsen during 2021

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts