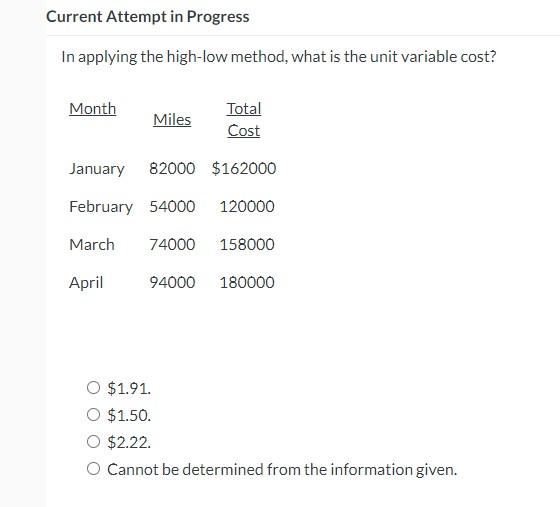

Question: Current Attempt in Progress In applying the high-low method, what is the unit variable cost? $1.91$1.50$2.22 Cannot be determined from the information given. In 2019,5

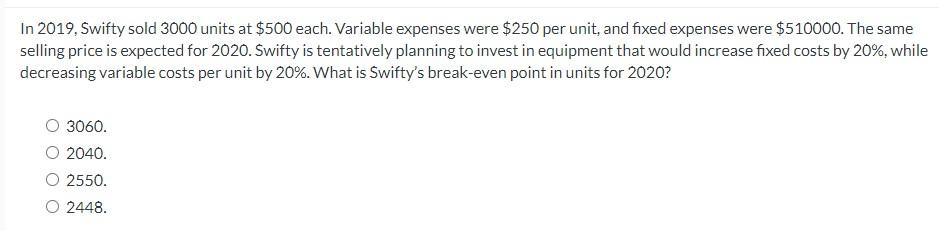

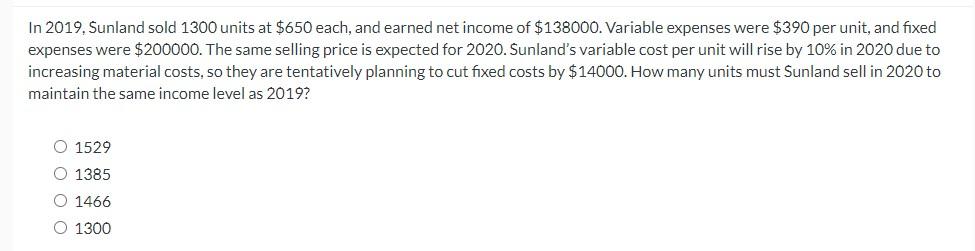

Current Attempt in Progress In applying the high-low method, what is the unit variable cost? $1.91$1.50$2.22 Cannot be determined from the information given. In 2019,5 wifty sold 3000 units at $500 each. Variable expenses were $250 per unit, and fixed expenses were $510000. The same selling price is expected for 2020 . Swifty is tentatively planning to invest in equipment that would increase fixed costs by 20%, while decreasing variable costs per unit by 20%. What is Swifty's break-even point in units for 2020 ? 3060.204025502448 In 2019 , Sunland sold 1300 units at $650 each, and earned net income of $138000. Variable expenses were $390 per unit, and fixed expenses were $200000. The same selling price is expected for 2020 . Sunland's variable cost per unit will rise by 10% in 2020 due to increasing material costs, so they are tentatively planning to cut fixed costs by $14000. How many units must Sunland sell in 2020 to maintain the same income level as 2019 ? 1529138514661300

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts