Question: Current Attempt in Progress In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Crane Company enters sales

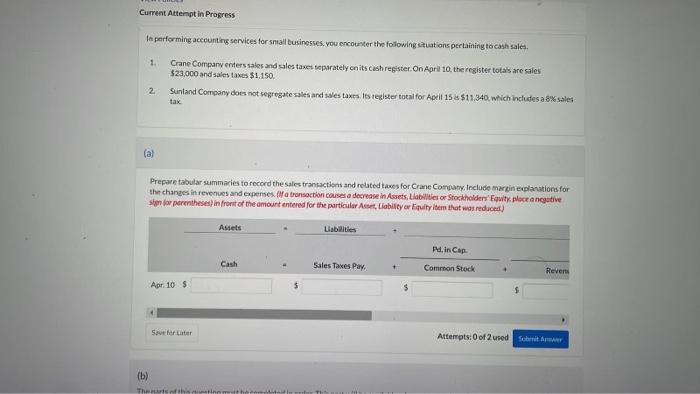

Current Attempt in Progress In performing accounting services for small businesses, you encounter the following situations pertaining to cash sales. 1. Crane Company enters sales and sales taxes separately on its cash register. On April 10, the register totals are sales $23,000 and sales taxes $1,150, 2 Sunland Company does not segregate sales and sales taxes. Its register total for April 15 is $11.340, which includes a 8% sales tax (a) Prepare tabular summaries to record the sales transactions and related taxes for Crane Company. Include margin explanations for the changes in revenues and expenses. (If a transaction causes a decrease in Assets, Liabilities or Stockholders' Equity ploce a negative sign for parentheses) in front of the amount entered for the particular Asset, Liability or Equity item that was reduced) Assets Liabilities Pd. In Cap Common Stock Cash Sales Taxes Pay. Revens Apr. 10 $ Save for Later (b) The parts of this stingr Attempts: 0 of 2 used Submit Apower

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts