Question: Current Attempt in Progress In recent years, Crane Company has purchased three machines. Because of frequent employee turnover in the accounting department, a different accountant

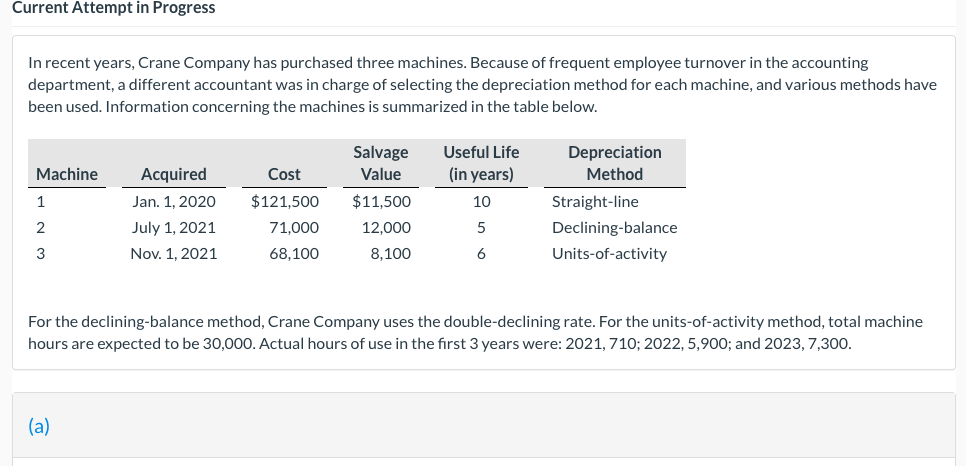

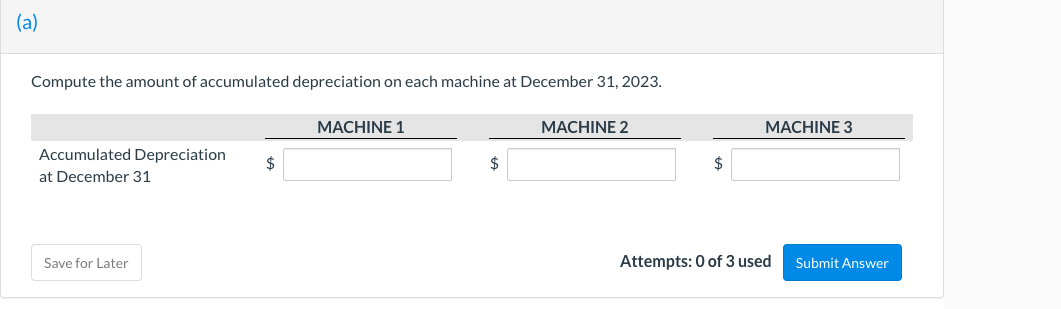

Current Attempt in Progress In recent years, Crane Company has purchased three machines. Because of frequent employee turnover in the accounting department, a different accountant was in charge of selecting the depreciation method for each machine, and various methods have been used. Information concerning the machines is summarized in the table below. Useful Life (in years) Machine Cost 1 Acquired Jan. 1, 2020 July 1, 2021 Nov. 1. 2021 10 Salvage Value $11,500 12,000 8,100 $121,500 71,000 Depreciation Method Straight-line Declining-balance Units-of-activity 2 5 3 68,100 6 For the declining-balance method, Crane Company uses the double-declining rate. For the units-of-activity method, total machine hours are expected to be 30,000. Actual hours of use in the first 3 years were: 2021, 710; 2022, 5,900; and 2023,7,300. (a) (a) Compute the amount of accumulated depreciation on each machine at December 31, 2023. MACHINE 1 MACHINE 2 MACHINE 3 Accumulated Depreciation at December 31 $ $ $ Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts