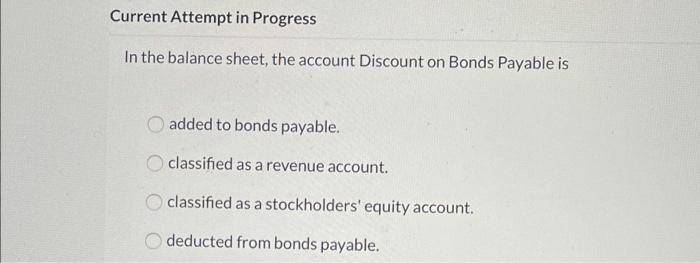

Question: Current Attempt in Progress In the balance sheet, the account Discount on Bonds Payable is added to bonds payable. classified as a revenue account. classified

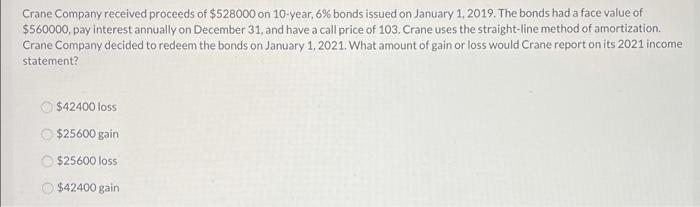

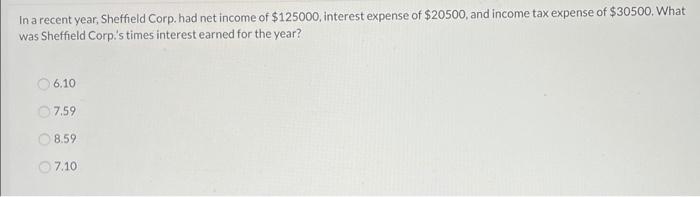

Current Attempt in Progress In the balance sheet, the account Discount on Bonds Payable is added to bonds payable. classified as a revenue account. classified as a stockholders' equity account. deducted from bonds payable. Crane Company received proceeds of $528000 on 10-year, 6% bonds issued on January 1, 2019. The bonds had a face value of $560000, pay interest annually on December 31, and have a call price of 103. Crane uses the straight-line method of amortization. Crane Company decided to redeem the bonds on January 1, 2021. What amount of gain or loss would Crane report on its 2021 income statement? $42400 loss $25600 gain $25600 loss $42400 gain In a recent year, Sheffield Corp, had net income of $125000, interest expense of $20500, and income tax expense of $30500. What was Sheffield Corp.'s times interest earned for the year? 6.10 7.59 8.59 7.10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts