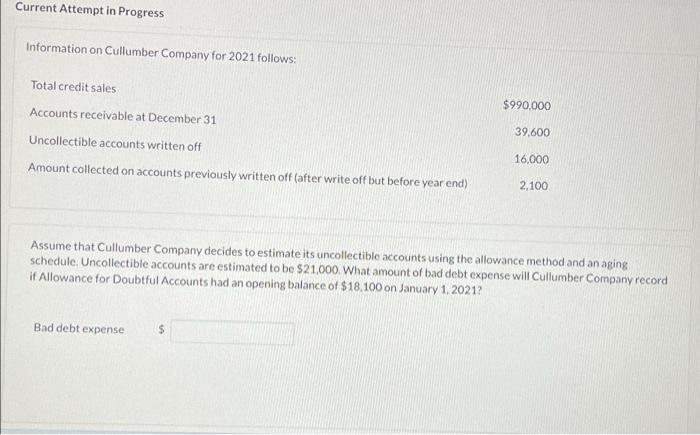

Question: Current Attempt in Progress Information on Cullumber Company for 2021 follows: Total credit sales Accounts receivable at December 31 Uncollectible accounts written off $990,000

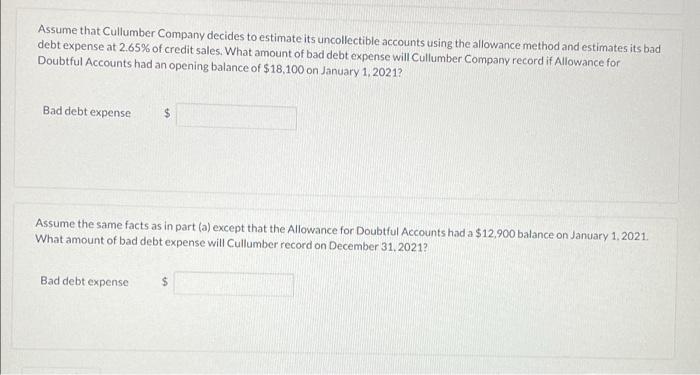

Current Attempt in Progress Information on Cullumber Company for 2021 follows: Total credit sales Accounts receivable at December 31 Uncollectible accounts written off $990,000 39,600 16,000 Amount collected on accounts previously written off (after write off but before year end) 2,100. Assume that Cullumber Company decides to estimate its uncollectible accounts using the allowance method and an aging. schedule. Uncollectible accounts are estimated to be $21,000. What amount of bad debt expense will Cullumber Company record. if Allowance for Doubtful Accounts had an opening balance of $18.100 on January 1, 2021? Bad debt expense

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts