Question: Current Attempt in Progress Ivanhoe Company has a machine that affixes labels to bottles. The machine has a book value of $ 6 8 ,

Current Attempt in Progress

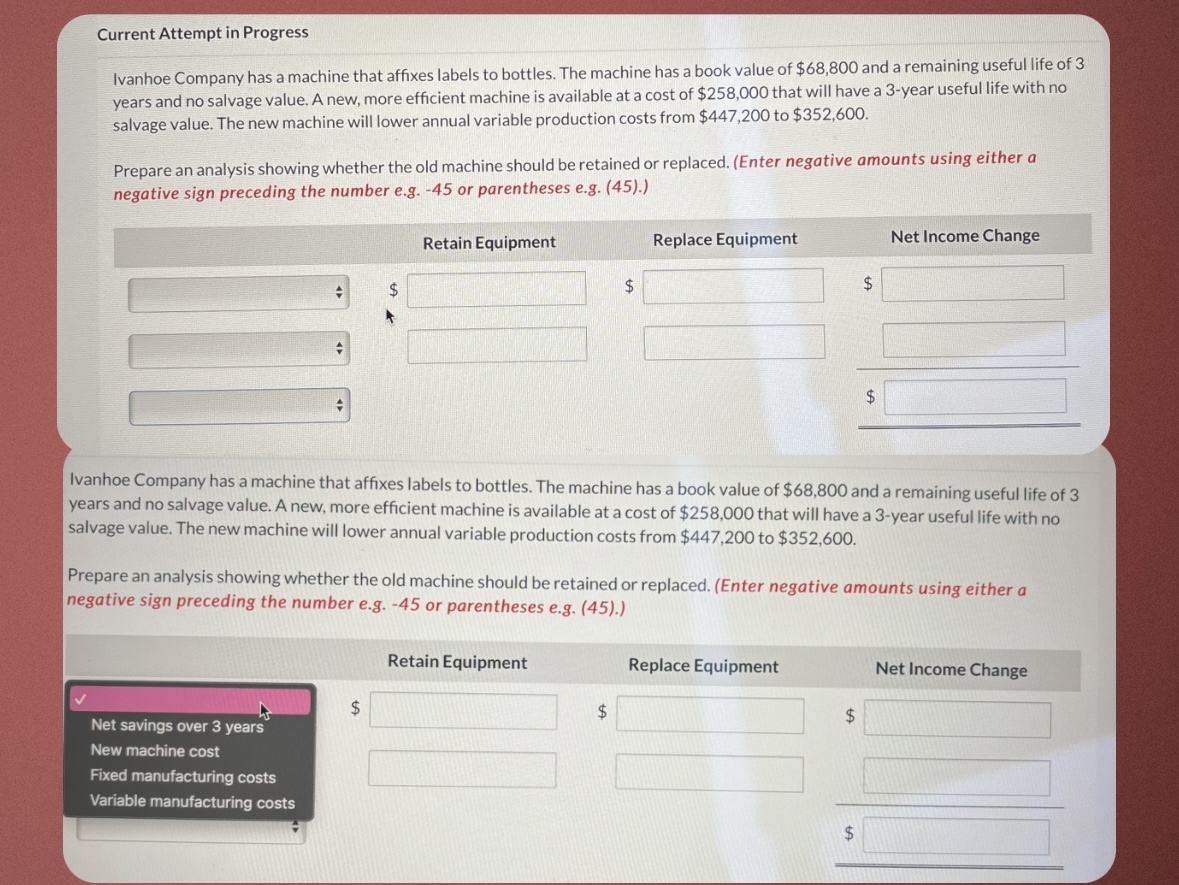

Ivanhoe Company has a machine that affixes labels to bottles. The machine has a book value of $ and a remaining useful life of years and no salvage value. A new, more efficient machine is available at a cost of $ that will have a year useful life with no salvage value. The new machine will lower annual variable production costs from $ to $

Prepare an analysis showing whether the old machine should be retained or replaced. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Ivanhoe Company has a machine that affixes labels to bottles. The machine has a book value of $ and a remaining useful life of years and no salvage value. A new, more efficient machine is available at a cost of $ that will have a year useful life with no salvage value. The new machine will lower annual variable production costs from $ to $

Prepare an analysis showing whether the old machine should be retained or replaced. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Retain Equipment

Replace Equipment

Net Income Change

Net savings over years

$ $ $

New machine cost

Fixed manufacturing costs

Variable manufacturing costsCurrent Attempt in Progress

Ivanhoe Company has a machine that affixes labels to bottles. The machine has a book value of $ and a remaining useful life of years and no salvage value. A new, more efficient machine is available at a cost of $ that will have a year useful life with no salvage value. The new machine will lower annual variable production costs from $ to $

Prepare an analysis showing whether the old machine should be retained or replaced. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Ivanhoe Company has a machine that affixes labels to bottles. The machine has a book value of $ and a remaining useful life of years and no salvage value. A new, more efficient machine is available at a cost of $ that will have a year useful life with no salvage value. The new machine will lower annual variable production costs from $ to $

Prepare an analysis showing whether the old machine should be retained or replaced. Enter negative amounts using either a negative sign preceding the number eg or parentheses eg

Retain Equipment

Replace Equipment

Net Income Change

Net savings over years

$ $ $

New machine cost

Fixed manufacturing costs

Variable manufacturing costs

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock