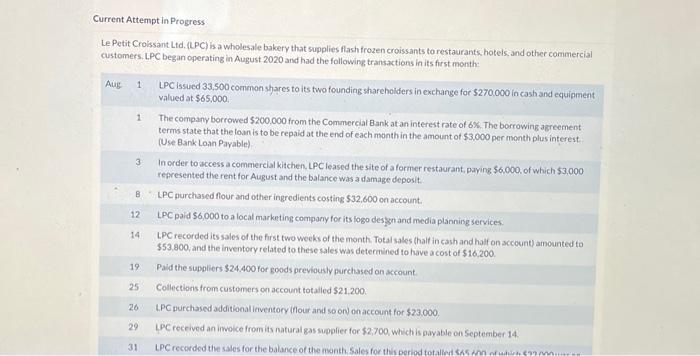

Question: Current Attempt in Progress Le Petit Croissant Ltd. (LPC) is a wholesale bakery that supplies flash frozen croissants to restaurants, hotels, and other commercial customers.

Current Attempt in Progress Le Petit Crolssant Ltd, (LPC) is a wholesale bakery that supplies flash frozen croissants to restaurants, hotels, and other commercial customers. LPC began operating in August 2020 and had the following transactions in its first month: Aug 1 LPC issued 33,500 common shares to its two founding shareholders in exchange for 5270,000 in cash and equipment valued at $65,000 1 The company borrowed $200,000 from the Commercial 8 ank at an interest rate of 6%. The borrowing agreement terms state that the loan is to be repaid at the end of eachmonth in the amount of $3.000 per month plus interest (Use Bank Loan Payable) 3 In order to access a commercial kitchen, LPC leased the site of a former restaurant, paying $6,000, of which $3,000 represented the rent for August and the balance was a damage deposit. 8 - LPC purchased flour and other ingredients costing $32,600 on account. 12 LPC paid $6,000 to a local marketing company for its logo desfzn and media planning services 14. LPC recorded its sales of the first two weeks of the month. Total sales (half in cash and half on account) amounted to $53,800, and the inventory related to these sales was determined to have a cost of $16,200. 19. Paid the suppliers $24,400 for goods previounly purchased on account. 25 Collections from customers on account totalled $21.200. 26. LPC purchased additional inventory (four and so on on account for $23,000. 29 LPC received an imoice from its natural gas supplier for $2,700 which is payable on 5eptember 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts