Question: Current Attempt in Progress Listed below are selected transactions of Vaughn Department Store for the current year ending December 3 1 . 1 . On

Current Attempt in Progress

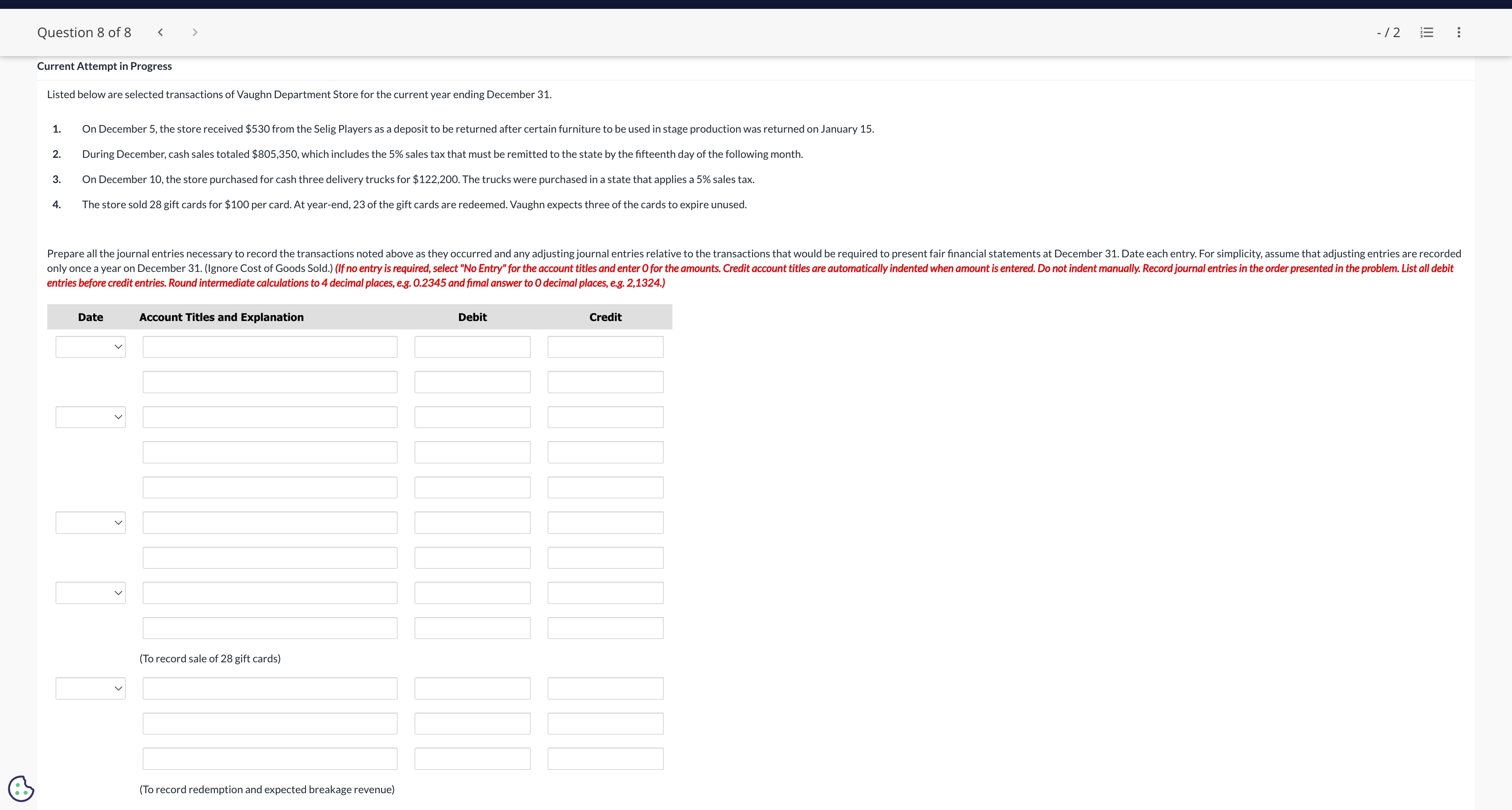

Listed below are selected transactions of Vaughn Department Store for the current year ending December

On December the store received $ from the Selig Players as a deposit to be returned after certain furniture to be used in stage production was returned on January

During December, cash sales totaled $ which includes the sales tax that must be remitted to the state by the fifteenth day of the following month.

On December the store purchased for cash three delivery trucks for $ The trucks were purchased in a state that applies a sales tax.

The store sold gift cards for $ per card. At yearend, of the gift cards are redeemed. Vaughn expects three of the cards to expire unused. entries before credit entries. Round intermediate calculations to decimal places, eg and fimal answer to decimal places, eg

To record redemption and expected breakage revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock