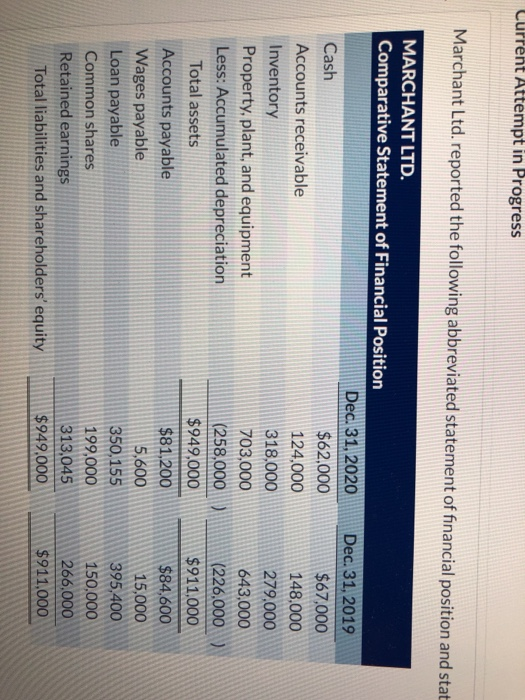

Question: Current Attempt in Progress Marchant Ltd. reported the following abbreviated statement of financial position and stat MARCHANT LTD. Comparative Statement of Financial Position Dec. 31,

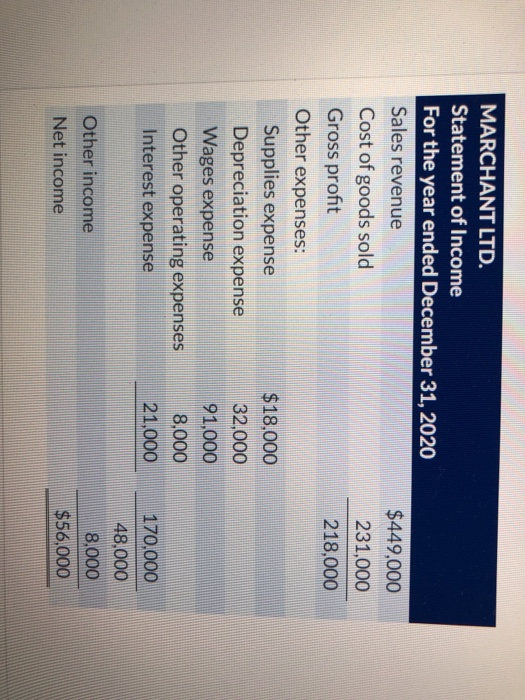

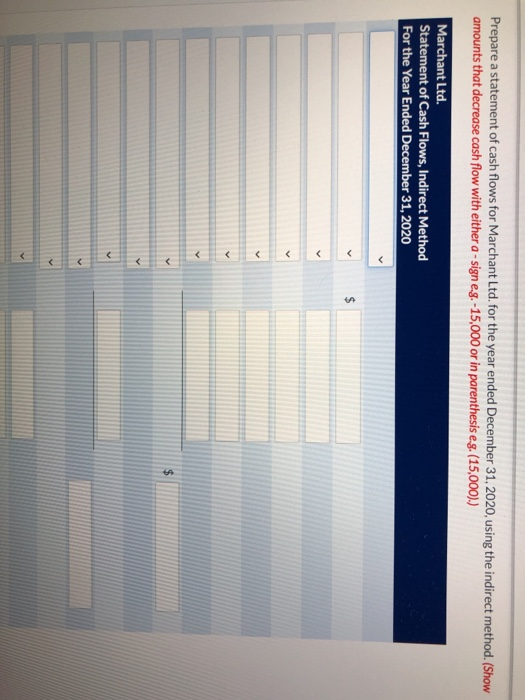

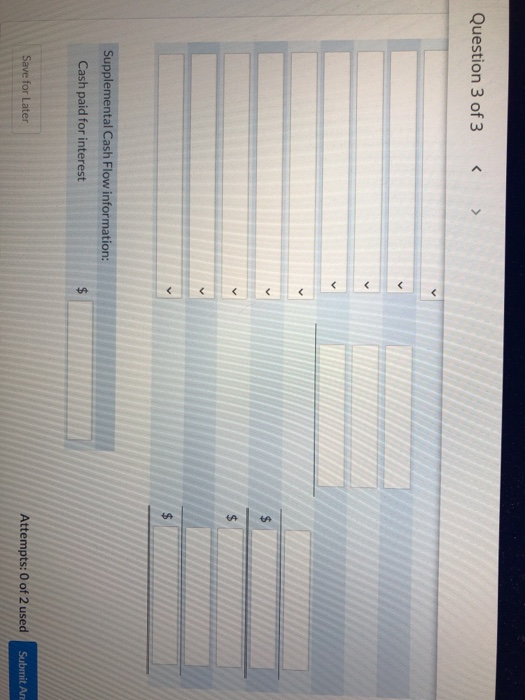

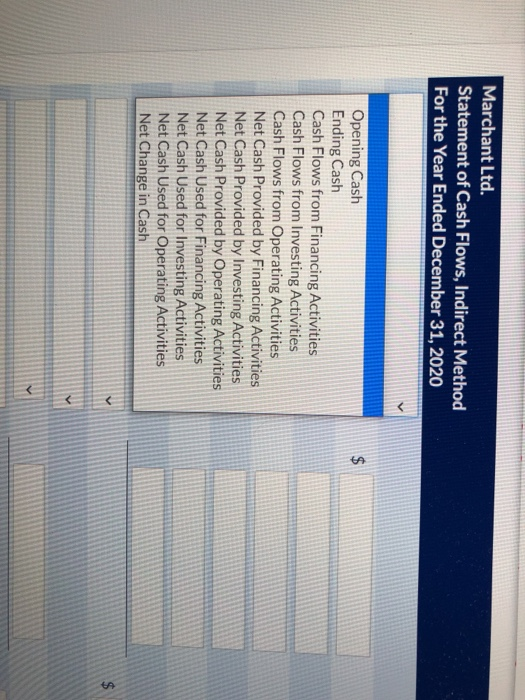

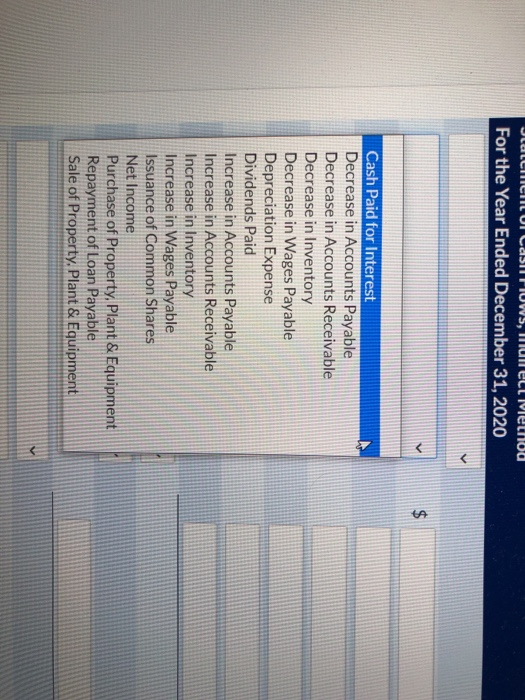

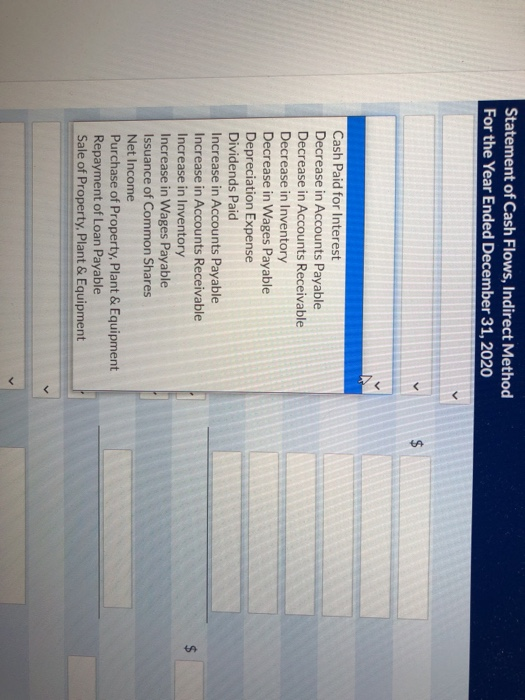

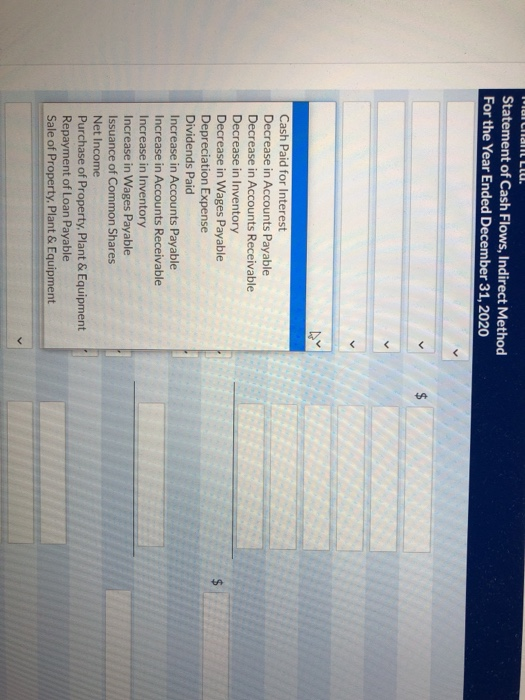

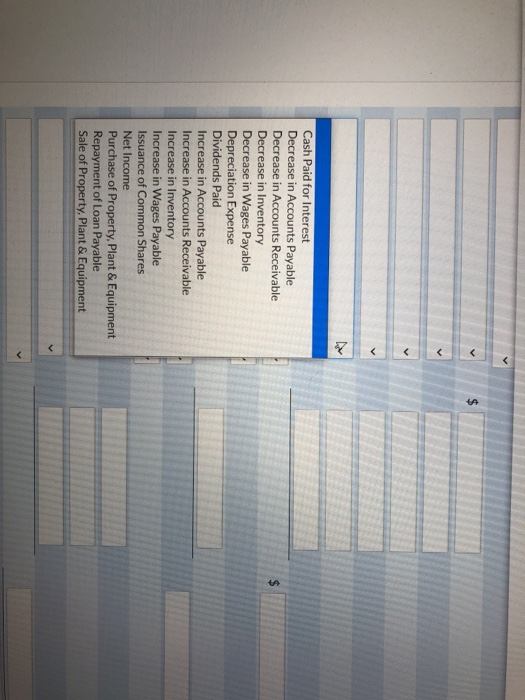

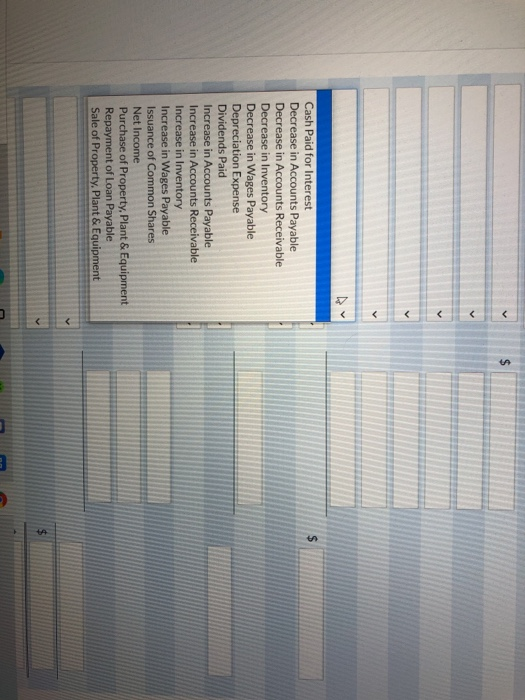

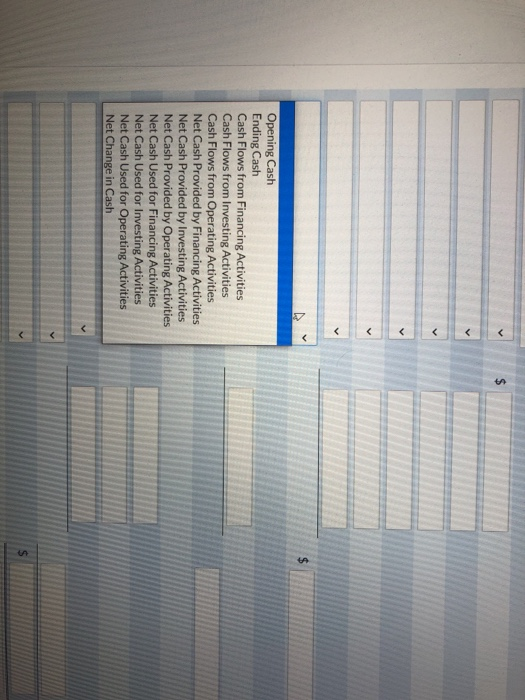

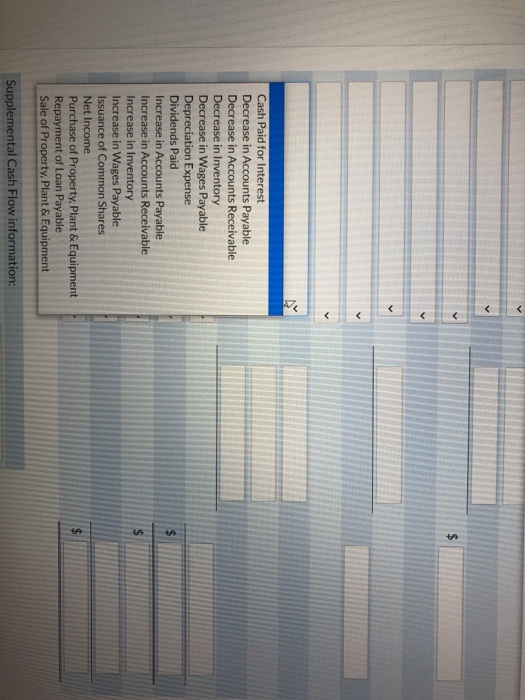

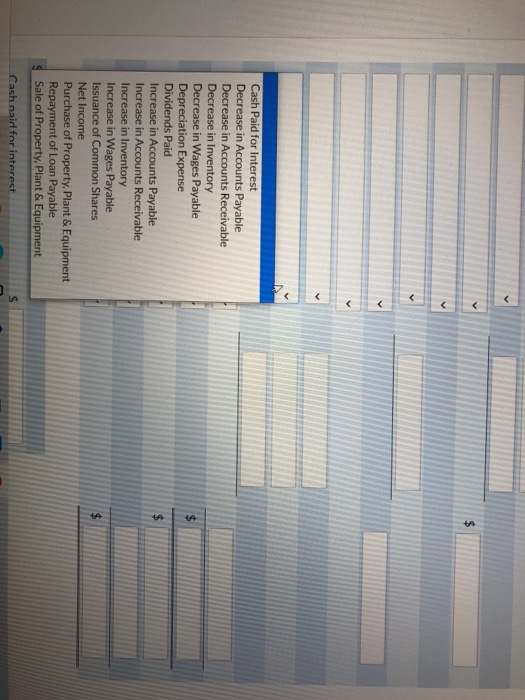

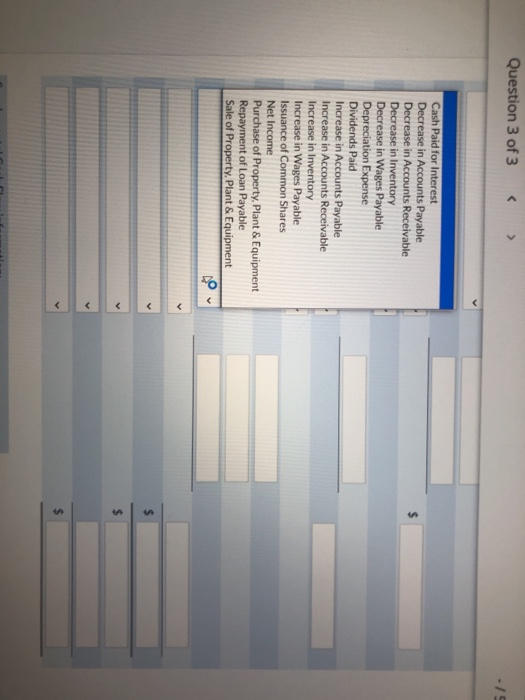

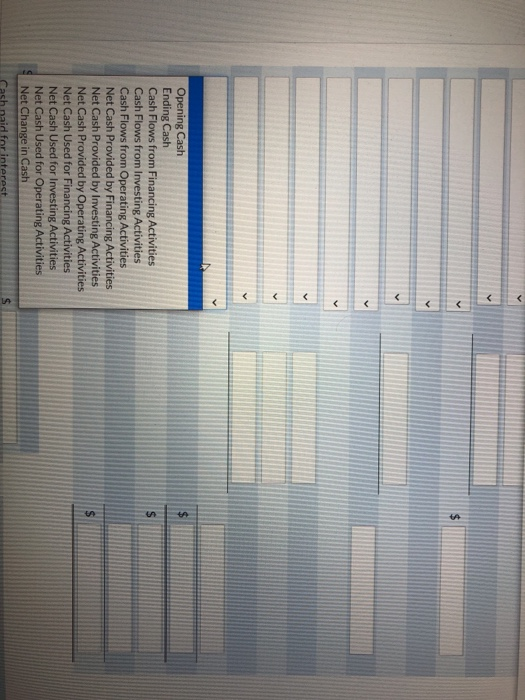

Current Attempt in Progress Marchant Ltd. reported the following abbreviated statement of financial position and stat MARCHANT LTD. Comparative Statement of Financial Position Dec. 31, 2020 Cash $62,000 Accounts receivable 124.000 Inventory 318,000 Property, plant, and equipment 703,000 Less: Accumulated depreciation (258.000 Total assets $949.000 Accounts payable $81.200 Wages payable 5,600 Loan payable 350,155 Common shares 199,000 Retained earnings 313,045 Total liabilities and shareholders' equity $949.000 Dec. 31, 2019 $67,000 148.000 279.000 643,000 (226,000 $911,000 $84,600 15,000 395,400 150,000 266.000 $911,000 $449,000 231,000 218.000 MARCHANT LTD. Statement of Income For the year ended December 31, 2020 Sales revenue Cost of goods sold Gross profit Other expenses: Supplies expense $18.000 Depreciation expense 32.000 Wages expense 91.000 Other operating expenses 8,000 Interest expense 21,000 170.000 48.000 8.000 Other income Net income $56.000 Prepare a statement of cash flows for Marchant Ltd. for the year ended December 31, 2020, using the indirect method. (Show amounts that decrease cash flow with either a-sign e.g.-15,000 or in parenthesis eg. (15,000).) Marchant Ltd. Statement of Cash Flows, Indirect Method For the Year Ended December 31, 2020 $ Question 3 of 3 $ Supplemental Cash Flow information: Cash paid for interest $ $ Save for Later Attempts: 0 of 2 used Submit An Marchant Ltd. Statement of Cash Flows, Indirect Method For the Year Ended December 31, 2020 $ Opening Cash Ending Cash Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used for Financing Activities Net Cash Used for Investing Activities Net Cash Used for Operating Activities Net Change in Cash UlalLICIILUI CASI PIUWS, MONELL MENU For the Year Ended December 31, 2020 $ Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property. Plant & Equipment Repayment of Loan Payable Sale of Property. Plant & Equipment Statement of Cash Flows, Indirect Method For the Year Ended December 31, 2020 $ Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property. Plant & Equipment Repayment of Loan Payable Sale of Property. Plant & Equipment $ J, HUILLIELIU For the Year Ended December 31, 2020 $ Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property, Plant & Equipment Repayment of Loan Payable Sale of Property, Plant & Equipment MILITANI LIU. Statement of Cash Flows, Indirect Method For the Year Ended December 31, 2020 $ Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property, Plant & Equipment Repayment of Loan Payable Sale of Property, Plant & Equipment $ $ $ $ Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property, Plant & Equipment Repayment of Loan Payable Sale of Property. Plant & Equipment $ $ S $ Opening Cash Ending Cash Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used for Financing Activities Net Cash Used for Investing Activities Net Cash Used for Operating Activities Net Change in Cash $ $ $ $ $ $ Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property, Plant & Equipment Repayment of Loan Payable $ Sale of Property. Plant & Equipment $ Cash naid for interest Question 3 of 3 Cash Paid for Interest Decrease in Accounts Payable Decrease in Accounts Receivable Decrease in Inventory Decrease in Wages Payable Depreciation Expense Dividends Paid Increase in Accounts Payable Increase in Accounts Receivable Increase in Inventory Increase in Wages Payable Issuance of Common Shares Net Income Purchase of Property, Plant & Equipment Repayment of Loan Payable Sale of Property. Plant & Equipment V $ Opening Cash Ending Cash Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used for Financing Activities Net Cash Used for Investing Activities Net Cash Used for Operating Activities Net Change in Cash $ $ V $ Supplemental Cash Flow information: Cash naid for interest $ $ V Opening Cash Ending Cash Cash Flows from Financing Activities Cash Flows from Investing Activities Cash Flows from Operating Activities Net Cash Provided by Financing Activities Net Cash Provided by Investing Activities Net Cash Provided by Operating Activities Net Cash Used for Financing Activities Net Cash Used for Investing Activities Net Cash Used for Operating Activities Net Change in Cash $ $ Supplemental Cash Flow information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts