Question: Current Attempt in Progress Natalie has prepared the balance sheet and income statement of Cookie Current Attempt in Progress Natalie has prepared the balance sheet

Current Attempt in Progress

Natalie has prepared the balance sheet and income statement of Cookie Current Attempt in Progress

Natalie has prepared the balance sheet and income statement of Cookie

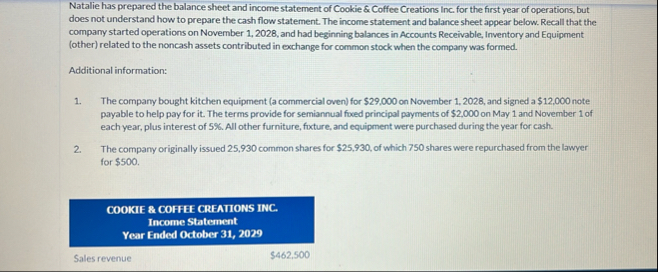

Natalie has prepared the balance sheet and income statement of Cookie & Coffee Creations Inc. for the first year of operations, but does not understand how to prepare the cash flow statement. The income statement and balance sheet appear below. Recall that the company started operations on November and had beginning balances in Accounts Receivable, Inventory and Equipment other related to the noncash assets contributed in exchange for common stock when the company was formed.

Additional information:

The company bought kitchen equipment a commercial oven for $ on November and signed a $ note payable to help pay for it The terms provide for semiannual foxed principal payments of $ on May and November of each year, plus interest of All other furniture, future, and equipment were purchased during the year for cash.

The company originally issued common shares for $ of which shares were repurchased from the lawyer for $

COOKIE & COFFEE CREATIONS INC.

Income Statement

Year Ended October

Sales revenue

$

tableCost of goods sold,Gross profit,,Operating expensesSalaries and wages expense,$Depreciation expense,Other operating expenses,Income from operations,,Other expensesInterest expense,,Income before income tax,,Income tax expense,,Net Income,,$

Current assuets

Canh

Accounts receivable

Inventory

Prepiifopennen

Property, plant, and equipment

furmberesulature

Accumdated depreciation furnilure and fieluers

Comotarsolumint

Accumulated depreciationCorrputer equipnent

equipment

Rocumulated depreciationKiethen equipment

$

$

tableCurrent figbilibesAcoounts payable,,Income tax payalle,,Dividents payable,,Saluries and wages payable,,Anterest pay able,,Nobte payslecurrent portion,,tongternfablitiesNote paydifetone term portion,,,Total

The company declared a semiannual dividend to the preferred stockholders on April and the dividend was paid on June The second semiannual dividend was declared to the preferred stockholders on October and the dividend is to be paid on December

Prepaid expenses relate only to operating expenses.

a

b

Prepare a statement of cash flows for Cookie & Coffee Creations Inc. for the year ended October using the direct method. Show amounts that decrease cash flow with either a sign eg or in parenthesis eg Do not leave any answer field blank. Enter O for amounts.liabilitiesStockholders equity.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock