Question: Current Attempt in Progress Natalie is considering hiring two permanent employees who are paid on an hourly basis plus time-and-a-half for all hours worke hypothetical

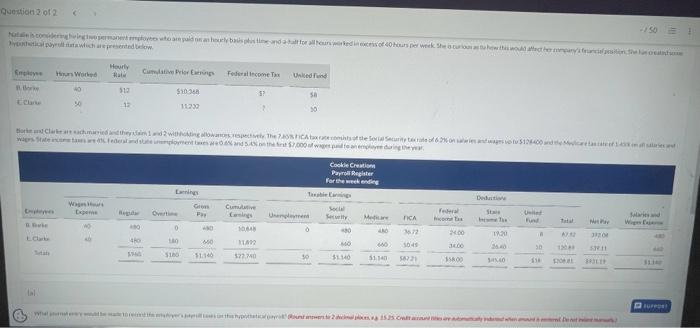

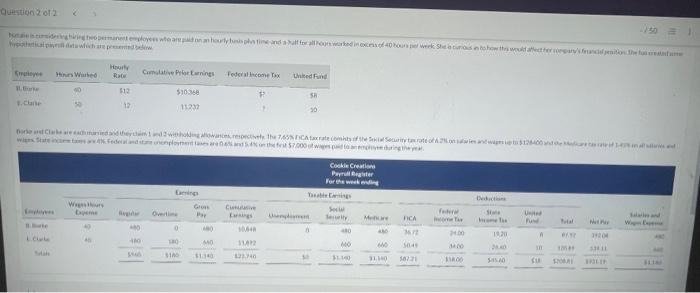

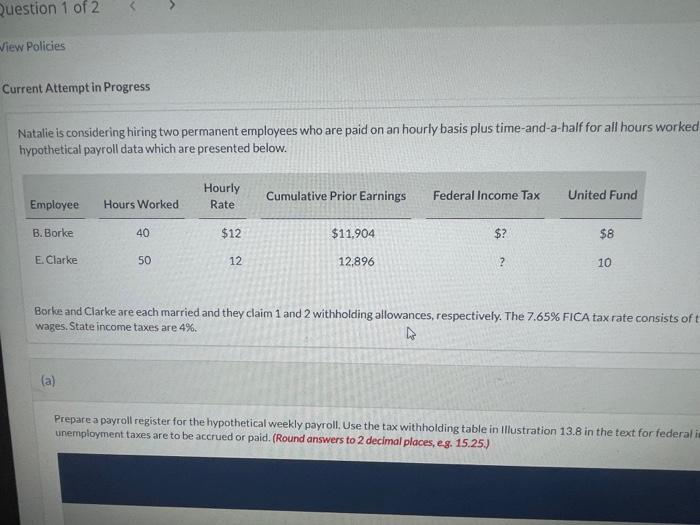

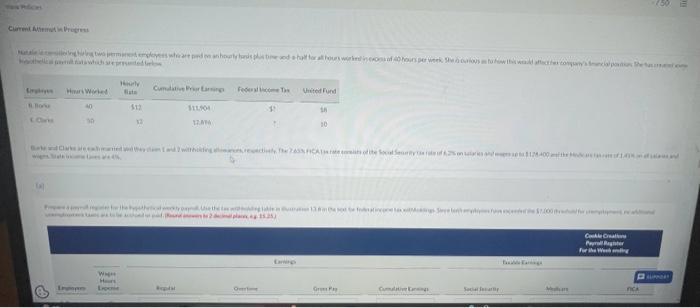

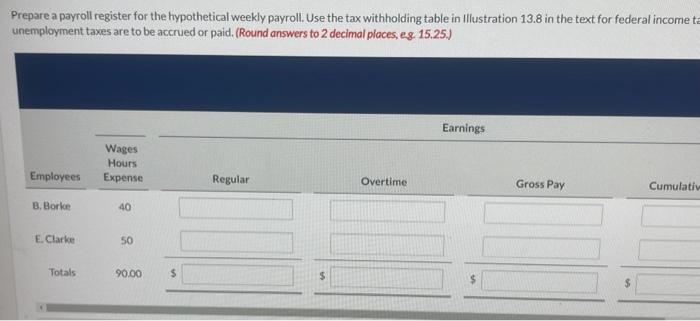

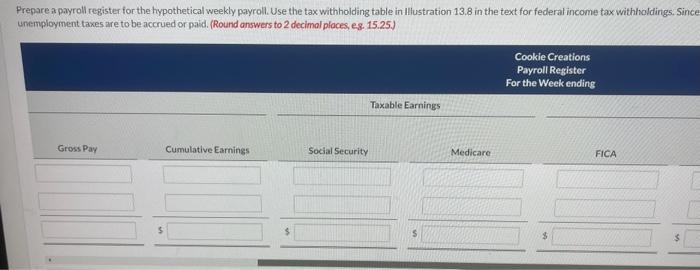

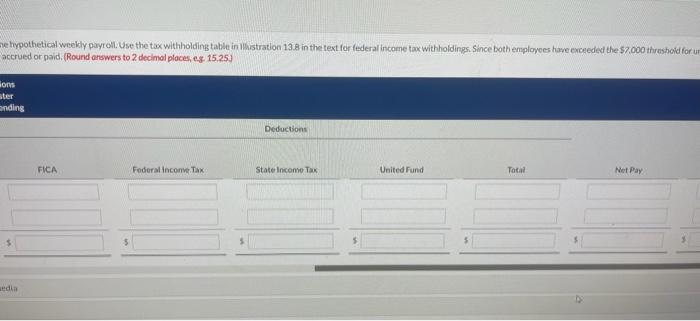

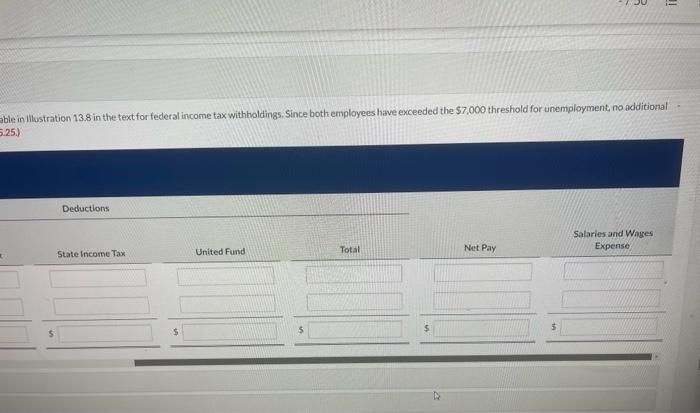

Current Attempt in Progress Natalie is considering hiring two permanent employees who are paid on an hourly basis plus time-and-a-half for all hours worke hypothetical payroll data which are presented below. Borke and Clarke are each married and they claim 1 and 2 withholding allowances, respectively. The 7.65% FICA tax rate consists of wages. State income taxes are 4%. (a) Prepare a payroll register for the hypothetical weekly payroll. Use the tax withholding table in Illustration 13.8 in the text for federal unemployment taxes are to be accrued or paid. (Round answers to 2 decimal places, eg. 15.25.) Prepare a payroll register for the hypothetical weekly payroll. Use the tax withholding table in Illustration 13.8 in the text for federal income unemployment taxes are to be accrued or paid. (Round answers to 2 decimal ploces, eg. 15.25.) repare a payroll register for the hypothetical weekly payroll. Use the tax withholding table in Illustration 13,8 in the text for federal income tax withholdings. Sinc unemployment taxes are to be accrued or pald. (Round answers to 2 decimal ploces, es. 15.25.) ehpothetical weelly payroli. Use the tax withholding table in 116 istration 13.8 in the text for federal income tax withholdings. Since both employees have erceeded the $7.000 threshold for accrued or paid, (Round answers to 2 decimal places, es. 15.25] ble in lilustration 13.8 in the text for federal income tax withholdings. Since both employees have exceeded the $7,000 threshold for unemployment, no additional 25)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts