Question: Current Attempt in Progress On January 1 , 2 0 2 5 , Kingbird Co . leased a building to Blossom Inc. The relevant information

Current Attempt in Progress

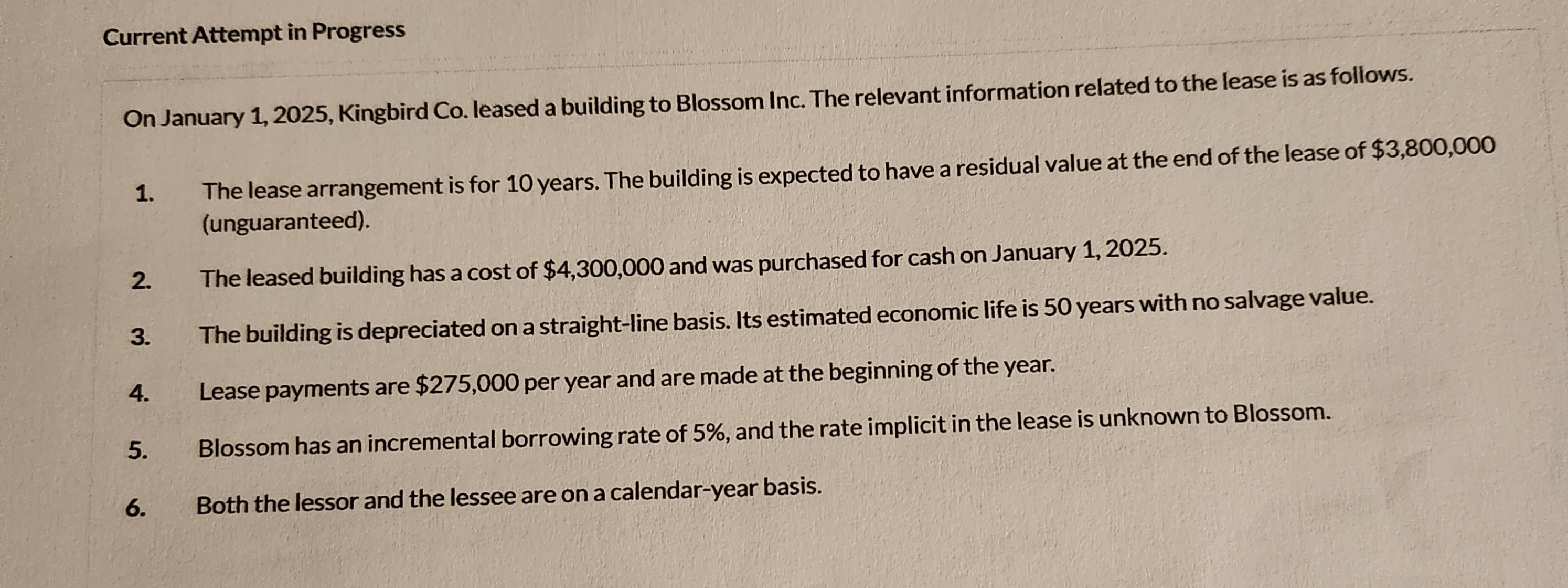

On January Kingbird Co leased a building to Blossom Inc. The relevant information related to the lease is as follows.

The lease arrangement is for years. The building is expected to have a residual value at the end of the lease of $

unguaranteed

The leased building has a cost of $ and was purchased for cash on January

The building is depreciated on a straightline basis. Its estimated economic life is years with no salvage value.

Lease payments are $ per year and are made at the beginning of the year.

Blossom has an incremental borrowing rate of and the rate implicit in the lease is unknown to Blossom.

Both the lessor and the lessee are on a calendaryear basis.

What I need help with is prepare journal entries that blossom should make in

Rightofuse asset.

Lease liability.

To record the lease

Lease liability.

Cash.

To record Lease payment Lease expense.

Lease liability.

Rightofuse asset amounts

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock