Question: Current Attempt in Progress On January 1 , 2 0 2 3 , ELR Ltd . purchased the right to extract oil from proven oil

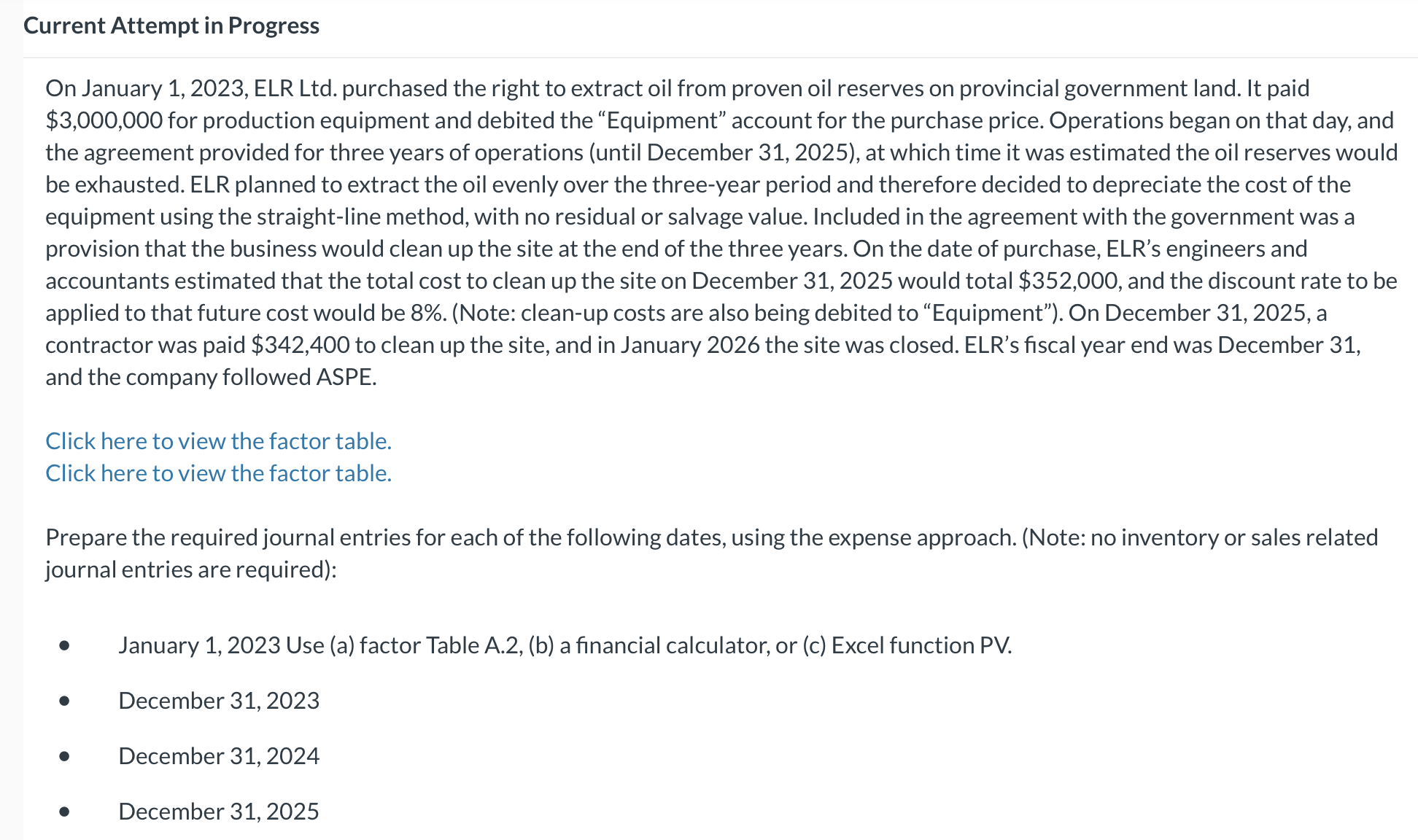

Current Attempt in Progress

On January ELR Ltd purchased the right to extract oil from proven oil reserves on provincial government land. It paid $ for production equipment and debited the "Equipment" account for the purchase price. Operations began on that day, and the agreement provided for three years of operations until December at which time it was estimated the oil reserves would be exhausted. ELR planned to extract the oil evenly over the threeyear period and therefore decided to depreciate the cost of the equipment using the straightline method, with no residual or salvage value. Included in the agreement with the government was a provision that the business would clean up the site at the end of the three years. On the date of purchase, ELR's engineers and accountants estimated that the total cost to clean up the site on December would total $ and the discount rate to be applied to that future cost would be Note: cleanup costs are also being debited to "Equipment" On December a contractor was paid $ to clean up the site, and in January the site was closed. ELR's fiscal year end was December and the company followed ASPE.

Click here to view the factor table.

Click here to view the factor table.

Prepare the required journal entries for each of the following dates, using the expense approach. Note: no inventory or sales related journal entries are required:

January Use a factor Table Ab a financial calculator, or c Excel function PV

December

December

December

Jan.

Equipment

square

To record accretion expense

Accumulated Depreciation Drilling Platform

To record depreciation for the production equipmentTo record accretion expense

To record depreciation for the production equipment

To record accretion expense

To record depreciation for the production equipmentTo record depreciation for the production equipment

Ca

square

To record settlement of asset retirement obligation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock