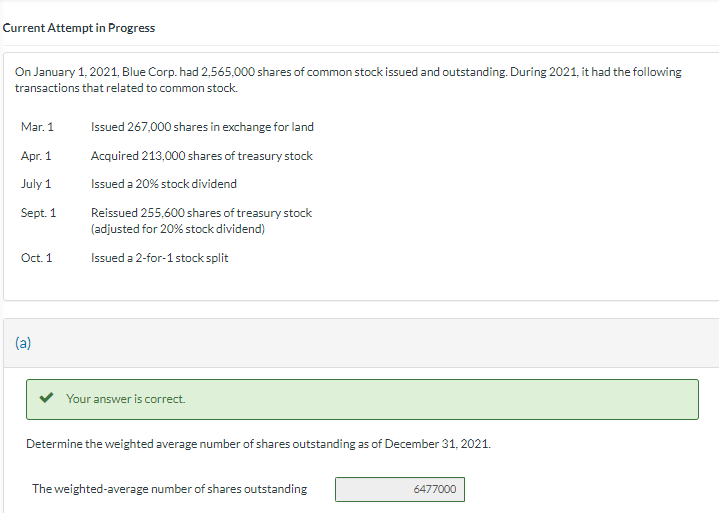

Question: Current Attempt in Progress On January 1, 2021, Blue Corp. had 2,565,000 shares of common stock issued and outstanding. During 2021, it had the following

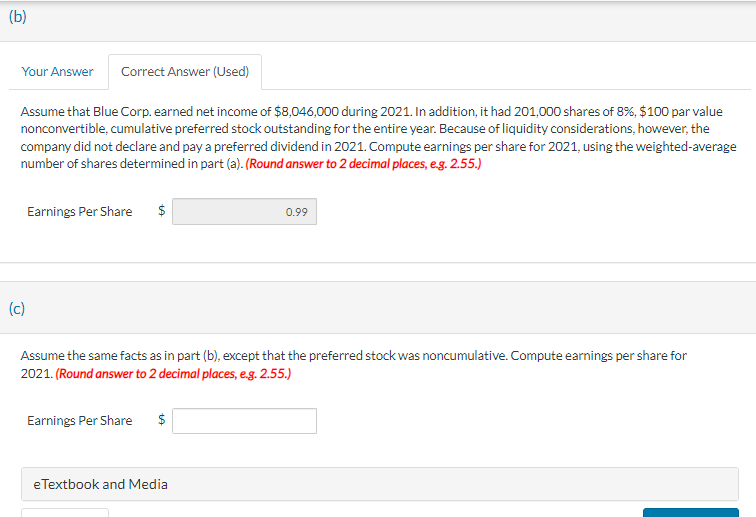

Current Attempt in Progress On January 1, 2021, Blue Corp. had 2,565,000 shares of common stock issued and outstanding. During 2021, it had the following transactions that related to common stock. Mar. 1 Issued 267,000 shares in exchange for land Apr. 1 Acquired 213,000 shares of treasury stock July 1 Issued a 20% stock dividend Sept. 1 Reissued 255,600 shares of treasury stock (adjusted for 20% stock dividend) Oct. 1 Issued a 2-for-1 stock split (a) Your answer is correct. Determine the weighted average number of shares outstanding as of December 31,2021. The weighted-average number of shares outstanding Assume that Blue Corp. earned net income of $8,046,000 during 2021. In addition, it had 201,000 shares of 8%,$100 par value nonconvertible, cumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2021. Compute earnings per share for 2021, using the weighted-average number of shares determined in part (a). (Round answer to 2 decimal places, e.g. 2.55.) (c) Assume the same facts as in part (b), except that the preferred stock was noncumulative. Compute earnings per share for 2021. (Round answer to 2 decimal places, e.g. 2.55.) Current Attempt in Progress On January 1, 2021, Blue Corp. had 2,565,000 shares of common stock issued and outstanding. During 2021, it had the following transactions that related to common stock. Mar. 1 Issued 267,000 shares in exchange for land Apr. 1 Acquired 213,000 shares of treasury stock July 1 Issued a 20% stock dividend Sept. 1 Reissued 255,600 shares of treasury stock (adjusted for 20% stock dividend) Oct. 1 Issued a 2-for-1 stock split (a) Your answer is correct. Determine the weighted average number of shares outstanding as of December 31,2021. The weighted-average number of shares outstanding Assume that Blue Corp. earned net income of $8,046,000 during 2021. In addition, it had 201,000 shares of 8%,$100 par value nonconvertible, cumulative preferred stock outstanding for the entire year. Because of liquidity considerations, however, the company did not declare and pay a preferred dividend in 2021. Compute earnings per share for 2021, using the weighted-average number of shares determined in part (a). (Round answer to 2 decimal places, e.g. 2.55.) (c) Assume the same facts as in part (b), except that the preferred stock was noncumulative. Compute earnings per share for 2021. (Round answer to 2 decimal places, e.g. 2.55.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts