Question: . Current Attempt in Progress On July 1, 2020, Sunland Corporation purchased at par 8% bonds having a maturity value of $250,000. The bonds are

.

.

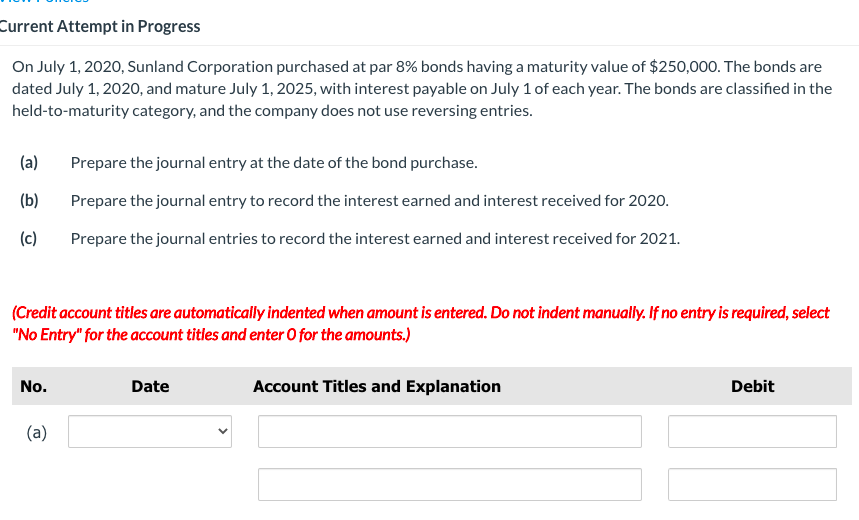

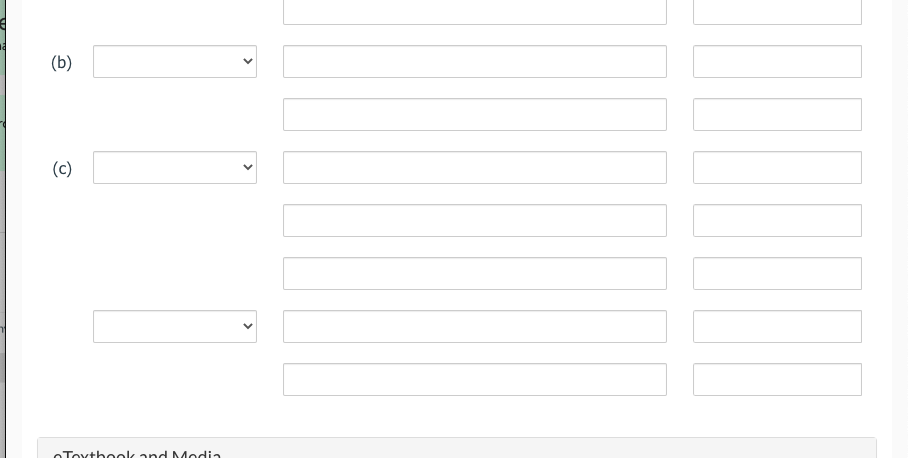

Current Attempt in Progress On July 1, 2020, Sunland Corporation purchased at par 8% bonds having a maturity value of $250,000. The bonds are dated July 1, 2020, and mature July 1, 2025, with interest payable on July 1 of each year. The bonds are classified in the held-to-maturity category, and the company does not use reversing entries. (a) (b) Prepare the journal entry at the date of the bond purchase. Prepare the journal entry to record the interest earned and interest received for 2020. Prepare the journal entries to record the interest earned and interest received for 2021. (c) (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter O for the amounts.) No. Date Account Titles and Explanation Debit (a) !PWP1004+41 (5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts