Question: Current Attempt in Progress On July 1, 2024, when its $1 par value common stock was selling for $66 per share, Swifty Corp. issued $25,900,000

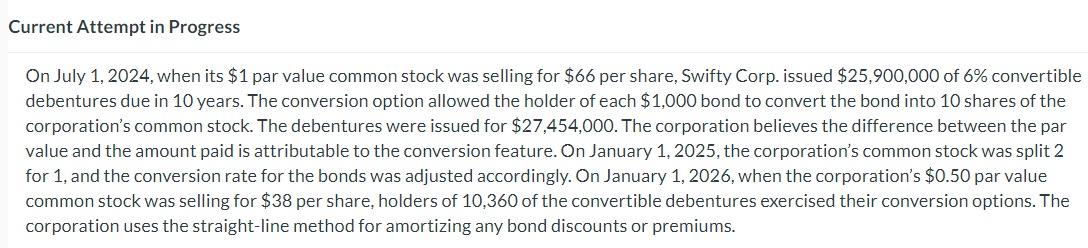

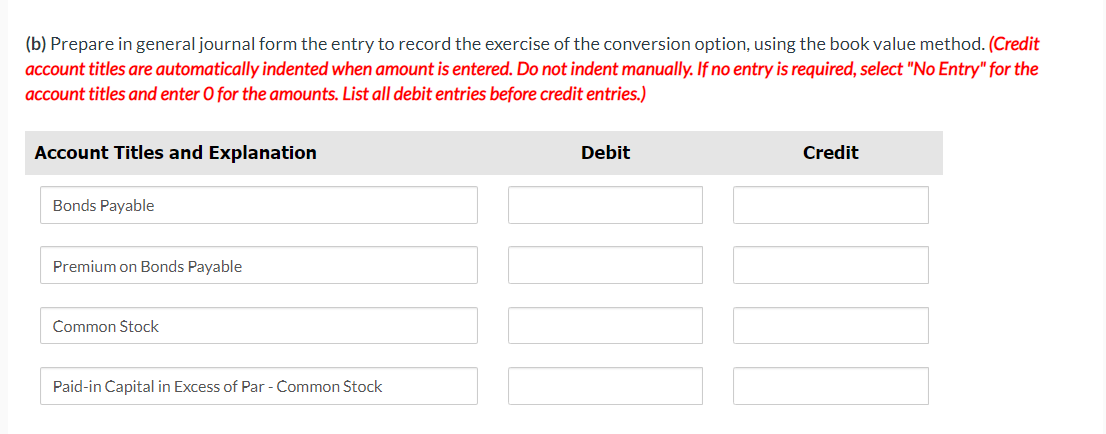

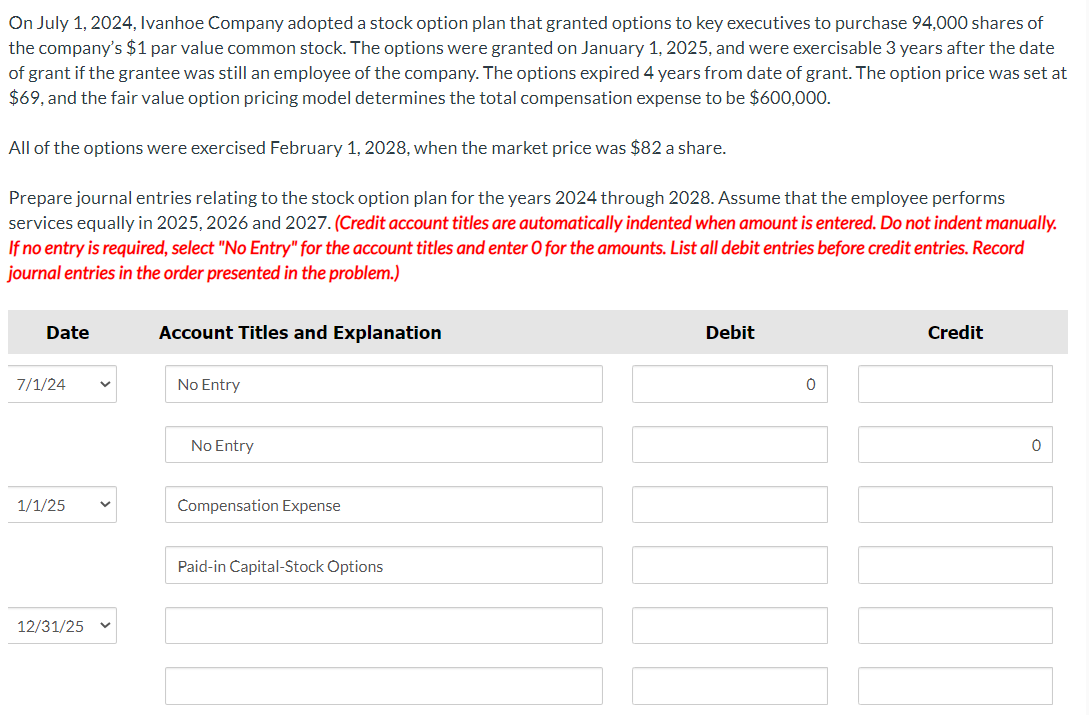

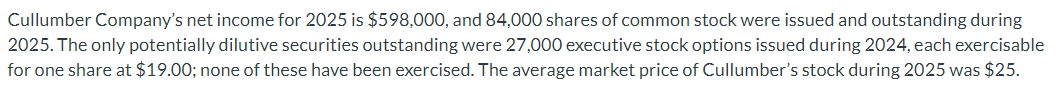

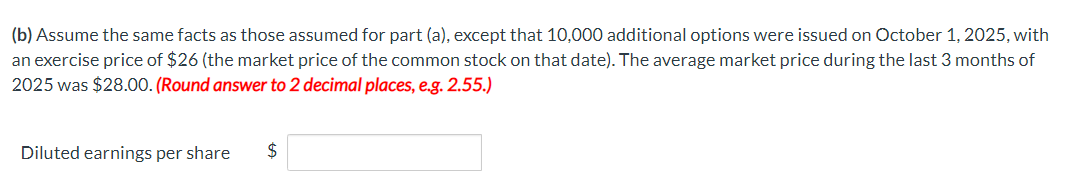

Current Attempt in Progress On July 1, 2024, when its $1 par value common stock was selling for $66 per share, Swifty Corp. issued $25,900,000 of 6% convertible debentures due in 10 years. The conversion option allowed the holder of each $1,000 bond to convert the bond into 10 shares of the corporation's common stock.The debentures were issued for $27,454,000. The corporation believes the difference between the par value and the amount paid is attributable to the conversion feature. On January 1, 2025, the corporation's common stock was split 2 for 1, and the conversion rate for the bonds was adjusted accordingly. On January 1, 2026, when the corporation's $0.50 par value common stock was selling for $38 per share, holders of 10,360 of the convertible debentures exercised their conversion options. The corporation uses the straightline method for amortizing any bond discounts or premiums. {b} Prepare in general journal form the entry to record the exercise of the conversion option, using the book value method. [Credit account titles are automatically indented when amount is entered. Do not indent manually. l f no entry is required. select "No Entry" for the acc0unt titles and enter 0 for the amounts List all debit entries befOre credit entries.) Account Titles and Explanation Debit Credit Bonds Payable Premium on Bonds Payable Common Stock Paid-in Capital in Excess of Par - Common Stock On July 1, 2024, Ivanhoe Company adopted a stock option plan that granted options to key executives to purchase 94,000 shares of the company's $1 par value common stock. The options were granted on January 1, 2025, and were exercisable 3 years after the date of grant if the grantee was still an employee of the company. The options expired 4 years from date of grant. The option price was set at $69, and the fair value option pricing model determines the total compensation expense to be $600,000. All of the options were exercised February 1, 2028, when the market price was $82 a share. Prepare journal entries relating to the stock option pla n for the years 2024 through 2028. Assume that the employee pe rforms services equally in 202 5, 2026 a nd 2027. [Credit account titles are automatically indented when amount is entered. Do not indent manually. if no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. List all debit entries before credit entries. Record journal entries in the order presented in the problem.) Date Account Titles and Explanation Debit Credit 7/1024 v No Entry 0 No Entry 0 1/1025 V Compensation Expense Paidin Ca pitalStock Options 12,53 U25 V 12/31/26 V' 12/31/2? V' ' 2/1/28 V' Cash Paidin CapitalStock Options Common Stock Paidin Capital in Excess of Par Common Stock Cullumber Company's net income for 2025 is $5 98,000, and 84,000 shares of common stock were issued and outstanding during 2025. The only potentially dilutive securities outstanding were 27,000 executive stock options issued during 2024, each exercisable for one share at $19.00; none of these have been exercisedThe average market price of Cullumber's stock during 2025 was $25. {b} Assume the same facts as those assumed for pa rt {a}, except that 10,000 additional options were issued on October 1, 2025, with an exercise price of $26 [the market price of the common stock on that date}. The average market price during the last 3 months of 202 5 was $28.00. (Round answer to 2 decimal places, e3. 2.55.} Diluted earnings per share $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts