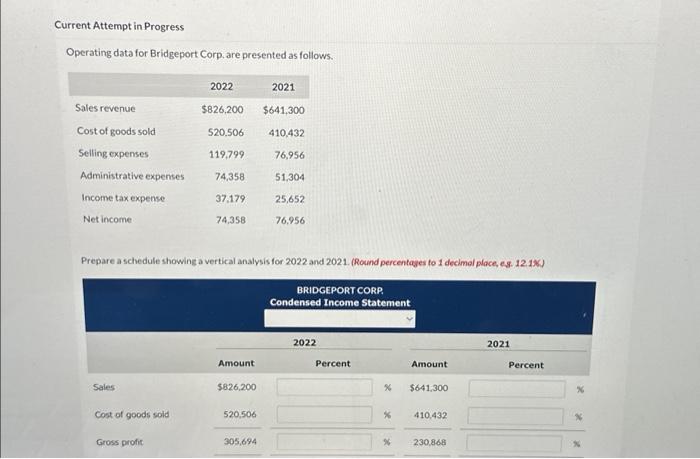

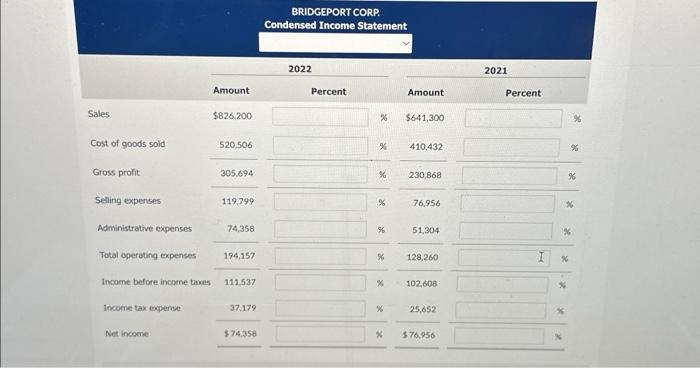

Question: Current Attempt in Progress Operating data for Bridgeport Corp. are presented as follows. Sales revenue Cost of goods sold Selling expenses Administrative expenses Income tax

BRIDGEPORT CORP. Condensed Income Statement 2022 Amount $826,200 Cost of goods sold Gross profit Seling expenses Administrative expenses Total operating expenses Income before income taves Income tax experse Net income Percent \begin{tabular}{|c|} \hline 520,506 \\ \hline 305,694 \\ \hline 119,799 \\ \hline \end{tabular} 74.358 Amount \% $641,300 \& 410,432 2021 Percent 174,157 111.537 \% 230,868 \% 76,956 \% 51,304 \% 128,260 * 102,608: 37,179374,358

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts