Question: Current Attempt in Progress Oriole Co. has a capital structure, based on current market values, that consists of 50 percent debt, 4 percent preferred stock,

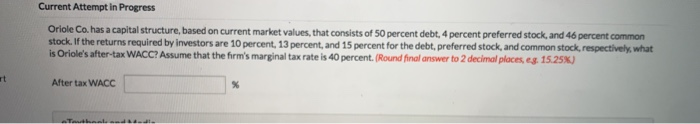

Current Attempt in Progress Oriole Co. has a capital structure, based on current market values, that consists of 50 percent debt, 4 percent preferred stock, and 46 percent common stock. If the returns required by investors are 10 percent, 13 percent, and 15 percent for the debt, preferred stock, and common stock, respectively, what is Oriole's after-tax WACC? Assume that the firm's marginal tax rate is 40 percent. (Round final answer to 2 decimal places, eg. 15.25%) After tax WACC

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts