Question: Current Attempt in Progress Pina Corp has a deferred tax asset account with a balance of $73.800 at the end of 2024 due to a

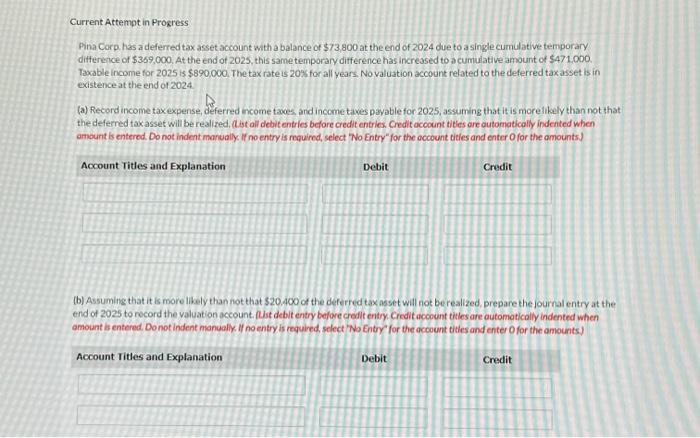

Current Attempt in Progress Pina Corp has a deferred tax asset account with a balance of $73.800 at the end of 2024 due to a single cumulative temporary difference of $369,000. At the end of 2025, this same temporary difference has increased to a cumulative amount of $471,000. Taxable income for 2025 is $890,000. The tax rate is 209 for all years. No valuation account related to the deferred taxasset is in existence at the end of 2024 (a) Record income tax expense, deferred income taces, and income taves pavable for 2025 , assuming that it is morelikely than not that the deferred tax asset will be realized, (Lot all debit entries before credit entries. Credit account tities are outomaticolly indented when amount is entered. Do not indent manually If no entry is mequired, select "No Entry" for the occount tities and enter O for the amounts) (b) Assuming that it is more libely than not that $20.400 of the deferred tax asset will not be realized, prepare the fournal entry at the end of 2025 to rocord the valuation account. (Wist debit entry before crofit entry Credit acoount tisles are automoticolly indented when amount is entered. Do not indent manualix. I no entry is requined, select 'No Entry' for the account titles and enter O for the amounts)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts