Question: Current Attempt in Progress Please view the following video before answering this question. Video Solution: 10.04-PRO03 Henredon purchases a high-precision programmable router for shaping furniture

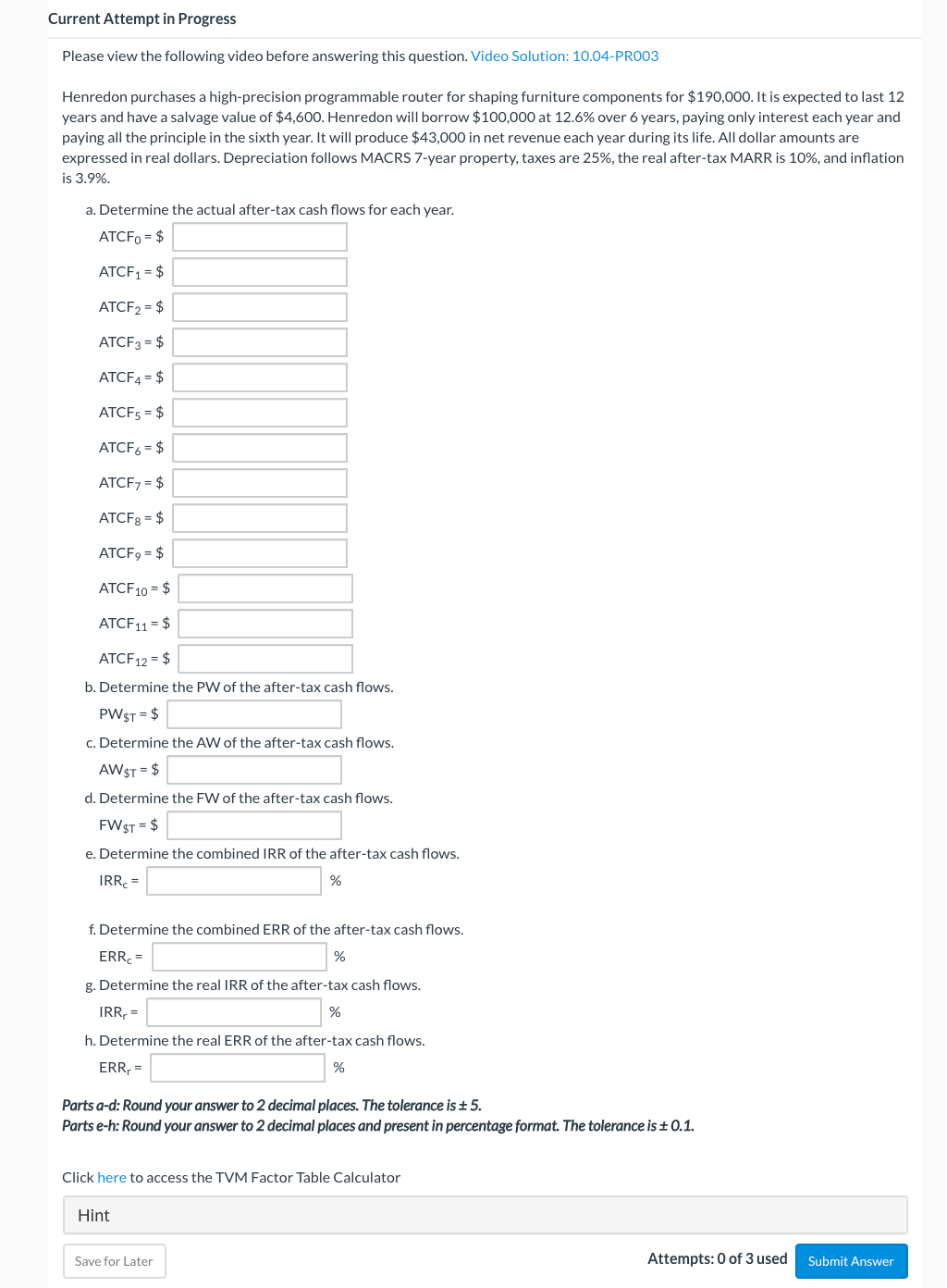

Current Attempt in Progress Please view the following video before answering this question. Video Solution: 10.04-PRO03 Henredon purchases a high-precision programmable router for shaping furniture components for $190,000. It is expected to last 12 years and have a salvage value of $4,600. Henredon will borrow $100,000 at 12.6% over 6 years, paying only interest each year and paying all the principle in the sixth year. It will produce $43,000 in net revenue each year during its life. All dollar amounts are expressed in real dollars. Depreciation follows MACRS 7-year property, taxes are 25%, the real after-tax MARR is 10%, and inflation is 3.9% a. Determine the actual after-tax cash flows for each year. ATCFO = $ ATCF1 = $ ATCF2 = $ ATCF3 = $ ATCF4 = $ ATCF5 = $ ATCF = $ ATCF7 = $ ATCF8 = $ ATCF, = $ ATCF 10 = $ ATCF11 = $ ATCF 12 = $ b. Determine the PW of the after-tax cash flows. PW$T = $ c. Determine the AW of the after-tax cash flows. AW$T = $ d. Determine the FW of the after-tax cash flows. FW$T = $ e. Determine the combined IRR of the after-tax cash flows. IRR = % f. Determine the combined ERR of the after-tax cash flows. ERR = % g. Determine the real IRR of the after-tax cash flows. IRR = % h. Determine the real ERR of the after-tax cash flows. ERR = % Parts a-d: Round your answer to 2 decimal places. The tolerance is +5. Parts e-h: Round your answer to 2 decimal places and present in percentage format. The tolerance is +0.1. Click here to access the TVM Factor Table Calculator Hint Save for Later Attempts: 0 of 3 used Submit Answer Current Attempt in Progress Please view the following video before answering this question. Video Solution: 10.04-PRO03 Henredon purchases a high-precision programmable router for shaping furniture components for $190,000. It is expected to last 12 years and have a salvage value of $4,600. Henredon will borrow $100,000 at 12.6% over 6 years, paying only interest each year and paying all the principle in the sixth year. It will produce $43,000 in net revenue each year during its life. All dollar amounts are expressed in real dollars. Depreciation follows MACRS 7-year property, taxes are 25%, the real after-tax MARR is 10%, and inflation is 3.9% a. Determine the actual after-tax cash flows for each year. ATCFO = $ ATCF1 = $ ATCF2 = $ ATCF3 = $ ATCF4 = $ ATCF5 = $ ATCF = $ ATCF7 = $ ATCF8 = $ ATCF, = $ ATCF 10 = $ ATCF11 = $ ATCF 12 = $ b. Determine the PW of the after-tax cash flows. PW$T = $ c. Determine the AW of the after-tax cash flows. AW$T = $ d. Determine the FW of the after-tax cash flows. FW$T = $ e. Determine the combined IRR of the after-tax cash flows. IRR = % f. Determine the combined ERR of the after-tax cash flows. ERR = % g. Determine the real IRR of the after-tax cash flows. IRR = % h. Determine the real ERR of the after-tax cash flows. ERR = % Parts a-d: Round your answer to 2 decimal places. The tolerance is +5. Parts e-h: Round your answer to 2 decimal places and present in percentage format. The tolerance is +0.1. Click here to access the TVM Factor Table Calculator Hint Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts