Question: Current Attempt in Progress Prepare Swifty general journal entry to record the adjusting entry for December 3 1 , 2 0 2 2 . (

Current Attempt in Progress Prepare Swifty general journal entry to record the adjusting entry for December Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter for

the amounts. List debit entry before credit entry.

Account Titles and Explanation

Debit

Credit

Investment Income or Loss

eTextbook and Media

List of Accounts

Attempts: of used

b

Your answer is partially correct.

Prepare Swifty general journal entry to record the sale of the David Jones shares. Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries.

Account Titles and Explanation

Credit

Investment Income or Loss Prepare Swifty general journal entry to record the purchase of the Oberto shares. Credit account titles are automatically indented

when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for the

amounts. List all debit entries before credit entries.

Account Titles and Explanation

Debit

Credit

FVNI Investments

Investment Income or Loss

Cash

eTextbook and Media

List of Accounts

Attempts: of used

d

Prepare Swifty general journal entry to record the adjusting entry for December Credit account titles are automatically

indented when the amount is entered. Do not indent manually. If no entry is required, select No Entry" for the account titles and enter O for

the amounts. List debit entry before credit entry.

Account Titles and Explanation

Debit

Credit

Investment Income or Loss

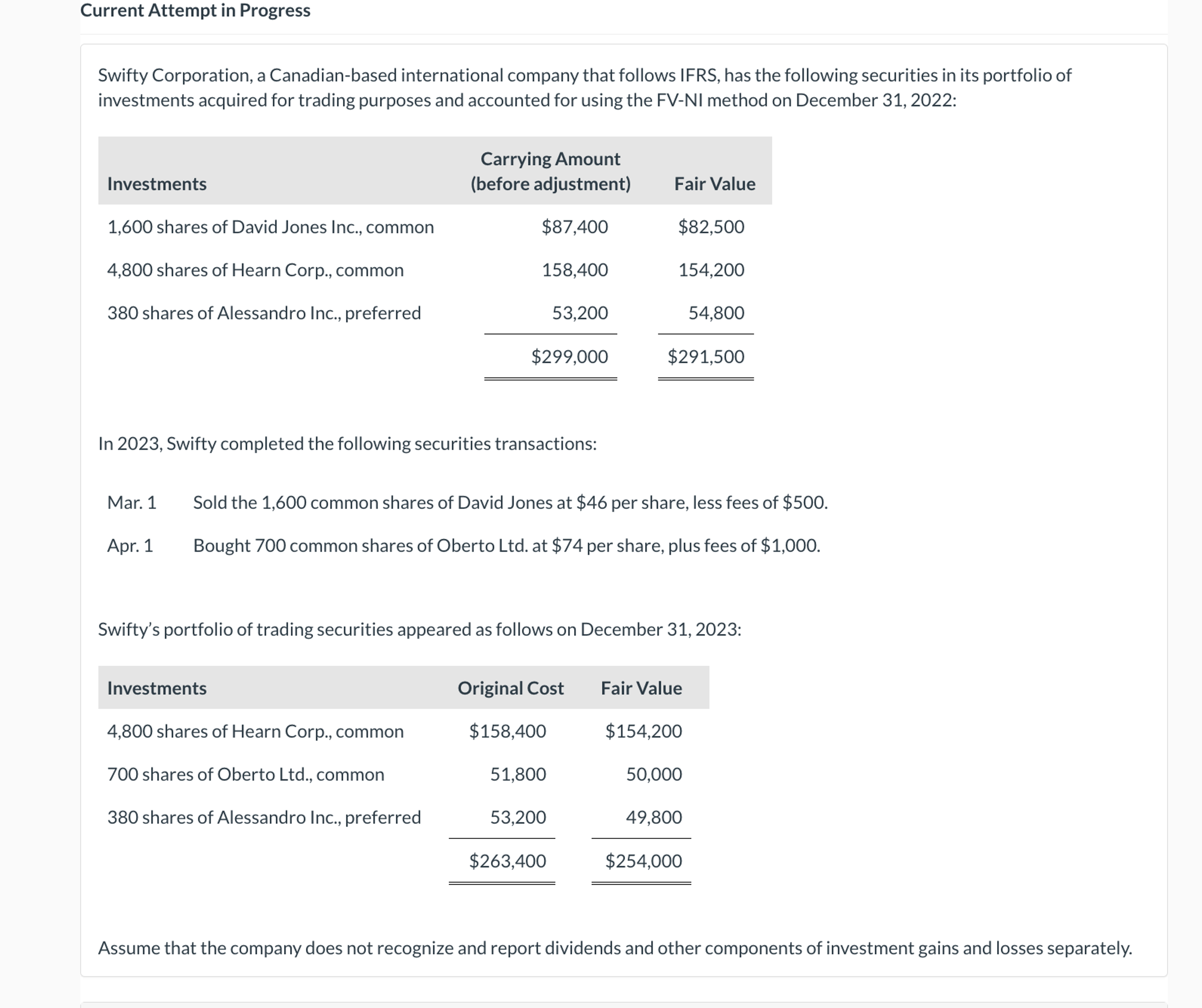

Swifty Corporation, a Canadianbased international company that follows IFRS, has the following securities in its portfolio of

investments acquired for trading purposes and accounted for using the FVNI method on December :

In Swifty completed the following securities transactions:

Mar. Sold the common shares of David Jones at $ per share, less fees of $

Apr. Bought common shares of Oberto Ltd at $ per share, plus fees of $

Swifty's portfolio of trading securities appeared as follows on December :

Assume that the company does not recognize and report dividends and other compoments of investment gains and losses separatley. ONLY GIVE ME THE RIGHT AMOUNTS FOR d IN THE QUESTION PLZ

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock