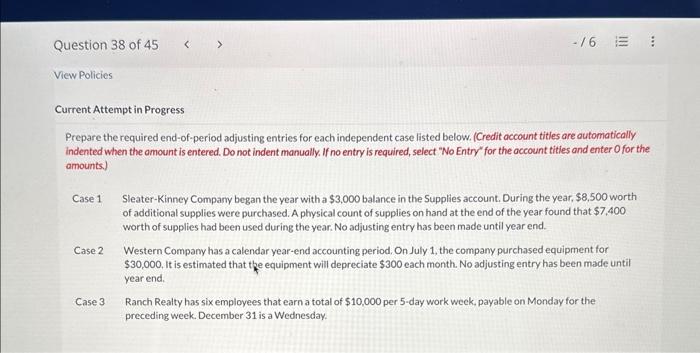

Question: Current Attempt in Progress Prepare the required end-of-period adjusting entries for each independent case listed below. (Credit account tities are automatically indented when the omount

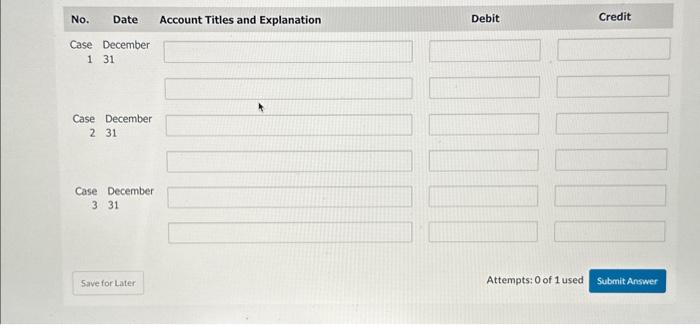

Current Attempt in Progress Prepare the required end-of-period adjusting entries for each independent case listed below. (Credit account tities are automatically indented when the omount is entered. Do not indent manually. If no entry is required, select "No Entry" for the occount tities and enter Ofor the amounts.) Case 1 Sleater-Kinney Company began the year with a $3,000 balance in the Supplies account. During the year, $8,500 worth of additional supplies were purchased. A physical count of supplies on hand at the end of the year found that $7,400 worth of supplies had been used during the year. No adjusting entry has been made until year end. Case 2 Western Company has a calendar year-end accounting period. On July 1 , the company purchased equipment for $30,000, It is estimated that the equipment will depreciate $300 each month. No adjusting entry has been made until year end. Case 3 Ranch Realty has six employees that earn a total of $10,000 per 5-day work week, payable on Monday for the preceding week. December 31 is a Wednesday. No.Case1DateDecember31 Case December 231 Case December 331 Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts