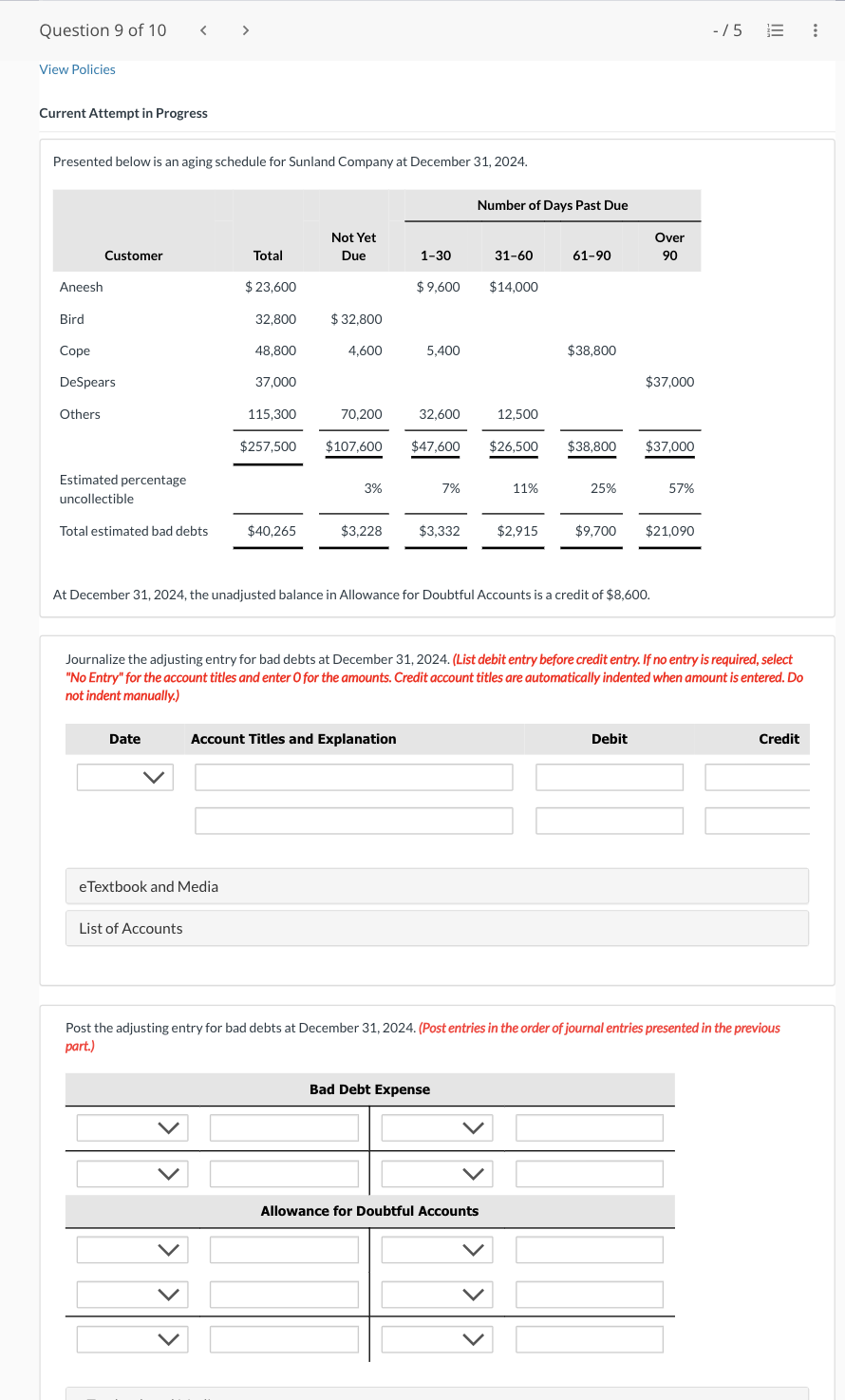

Question: Current Attempt in Progress Presented below is an aging schedule for Sunland Company at December 31, 2024. At December 31, 2024, the unadjusted balance in

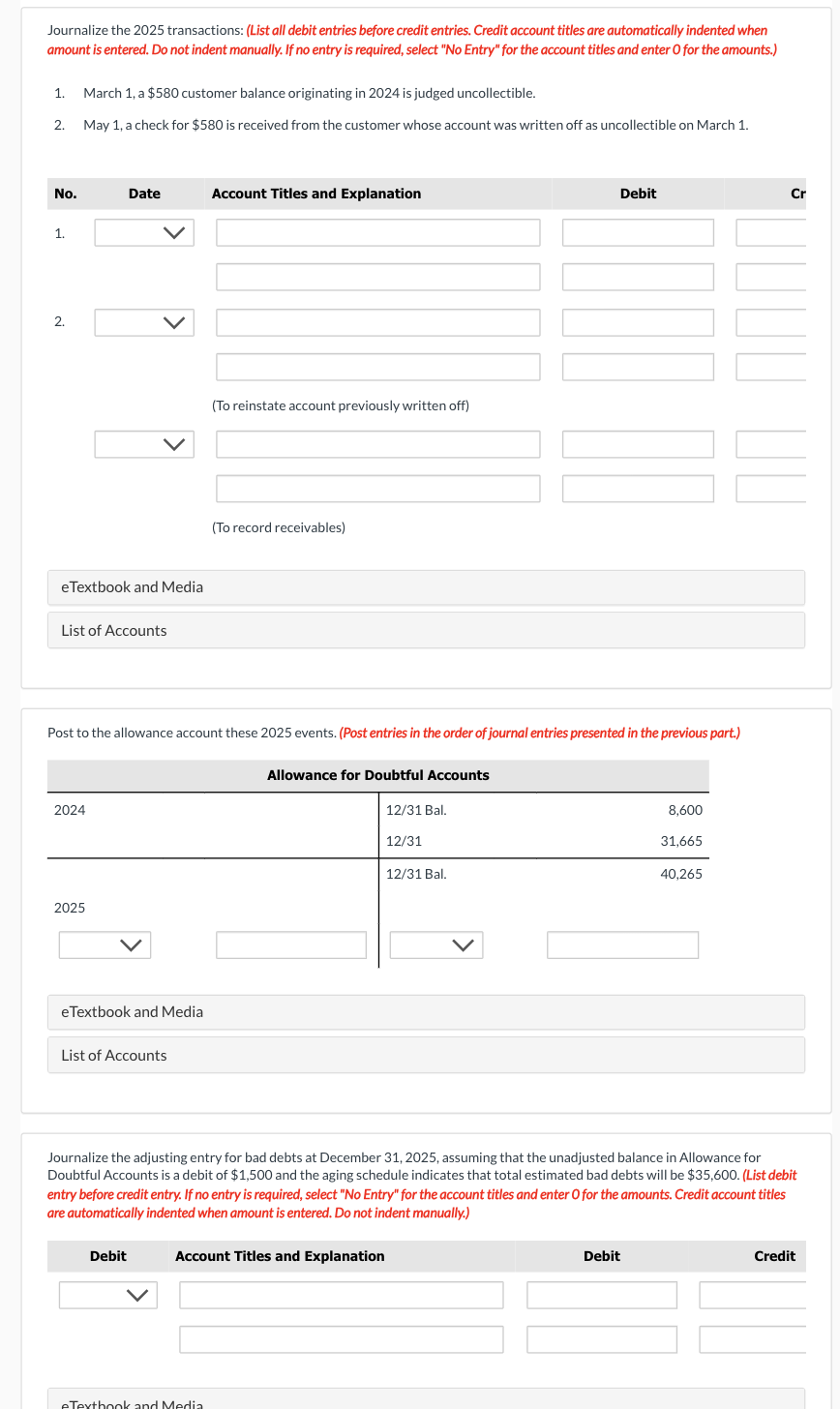

Current Attempt in Progress Presented below is an aging schedule for Sunland Company at December 31, 2024. At December 31, 2024, the unadjusted balance in Allowance for Doubtful Accounts is a credit of $8,600. Journalize the adjusting entry for bad debts at December 31, 2024. (List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Post the adjusting entry for bad debts at December 31, 2024. (Post entries in the order of journal entries presented in the previous part.) Journalize the 2025 transactions: (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.) 1. March 1, a $580 customer balance originating in 2024 is judged uncollectible. 2. May 1, a check for $580 is received from the customer whose account was written off as uncollectible on March 1. Post to the allowance account these 2025 events. (Post entries in the order of journal entries presented in the previous part.) eTextbook and Media List of Accounts Journalize the adjusting entry for bad debts at December 31, 2025, assuming that the unadjusted balance in Allowance for Doubtful Accounts is a debit of $1,500 and the aging schedule indicates that total estimated bad debts will be $35,600. (List debit entry before credit entry. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts