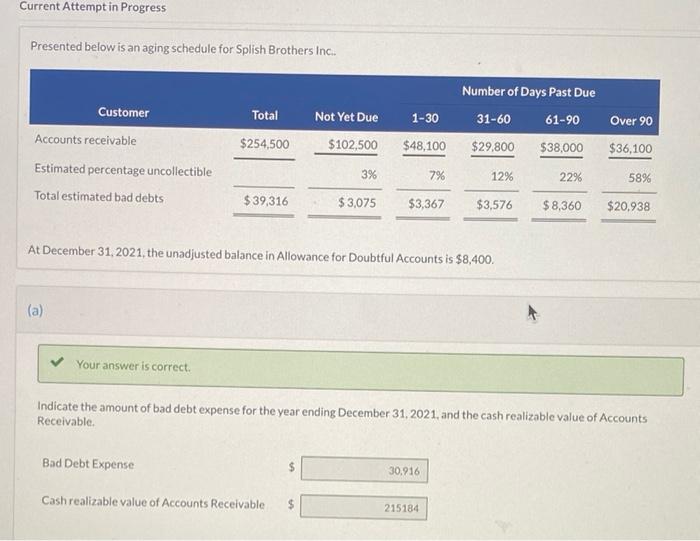

Question: Current Attempt in Progress Presented below is an aging schedule for Splish Brothers Inc. Number of Days Past Due 31-60 61-90 Total 1-30 Over 90

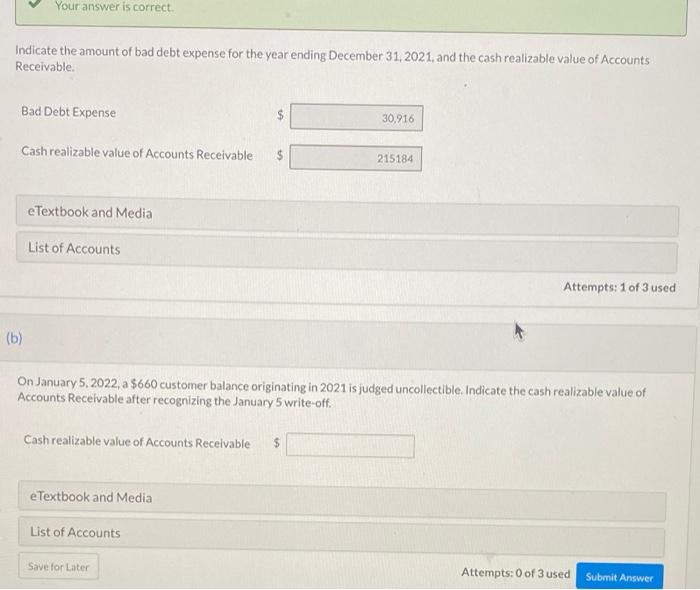

Current Attempt in Progress Presented below is an aging schedule for Splish Brothers Inc. Number of Days Past Due 31-60 61-90 Total 1-30 Over 90 $254,500 Customer Accounts receivable Estimated percentage uncollectible Total estimated bad debts Not Yet Due $102,500 3% $48,100 $29,800 $38,000 $36,100 7% 12% 22% 58% $39,316 $3,075 $3,367 $3,576 $8,360 $20.938 At December 31, 2021, the unadjusted balance in Allowance for Doubtful Accounts is $8,400. a (a) Your answer is correct. Indicate the amount of bad debt expense for the year ending December 31, 2021, and the cash realizable value of Accounts Receivable. Bad Debt Expense $ 30.916 Cash realizable value of Accounts Receivable 215184 Your answer is correct Indicate the amount of bad debt expense for the year ending December 31, 2021, and the cash realizable value of Accounts Receivable Bad Debt Expense 30.916 Cash realizable value of Accounts Receivable 215184 eTextbook and Media List of Accounts Attempts: 1 of 3 used (b) On January 5, 2022, a $660 customer balance originating in 2021 is judged uncollectible Indicate the cash realizable value of Accounts Receivable after recognizing the January 5 write-off. Cash realizable value of Accounts Recevable $ eTextbook and Media List of Accounts Save for Later Attempts: 0 of 3 used Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts