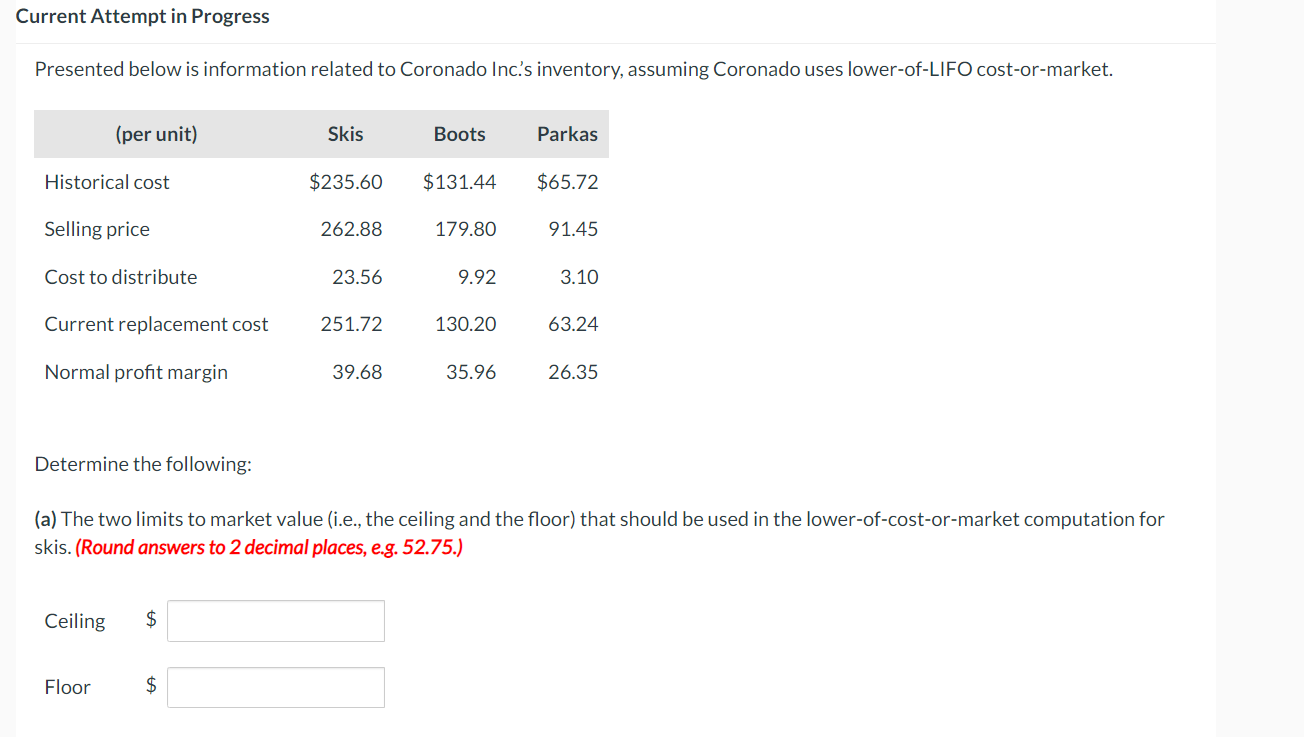

Question: Current Attempt in Progress Presented below is information related to Coronado Inc.'s inventory, assuming Coronado uses lower-of-LIFO cost-or-market. Determine the following: (a) The two limits

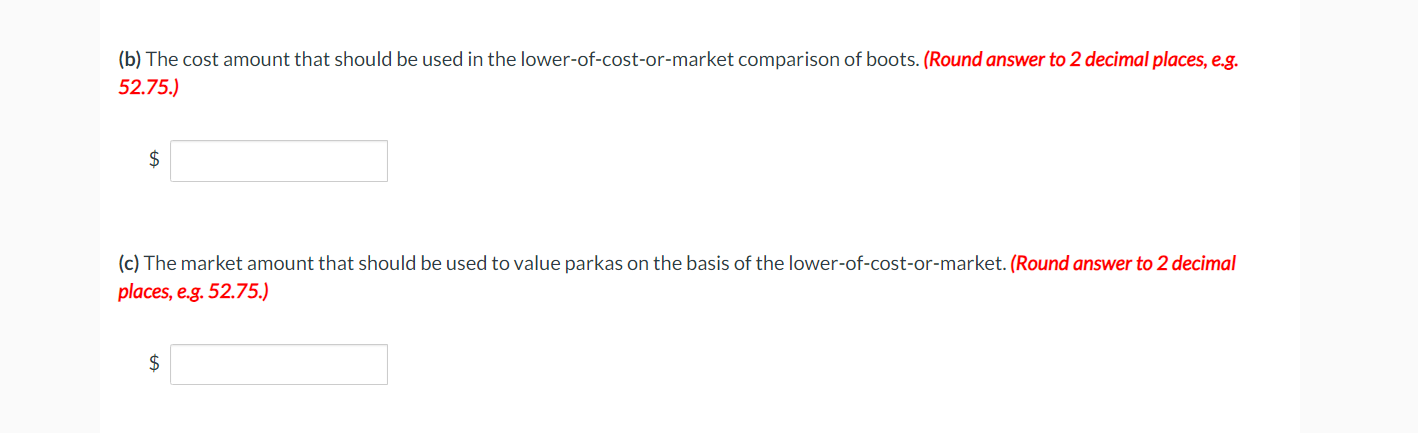

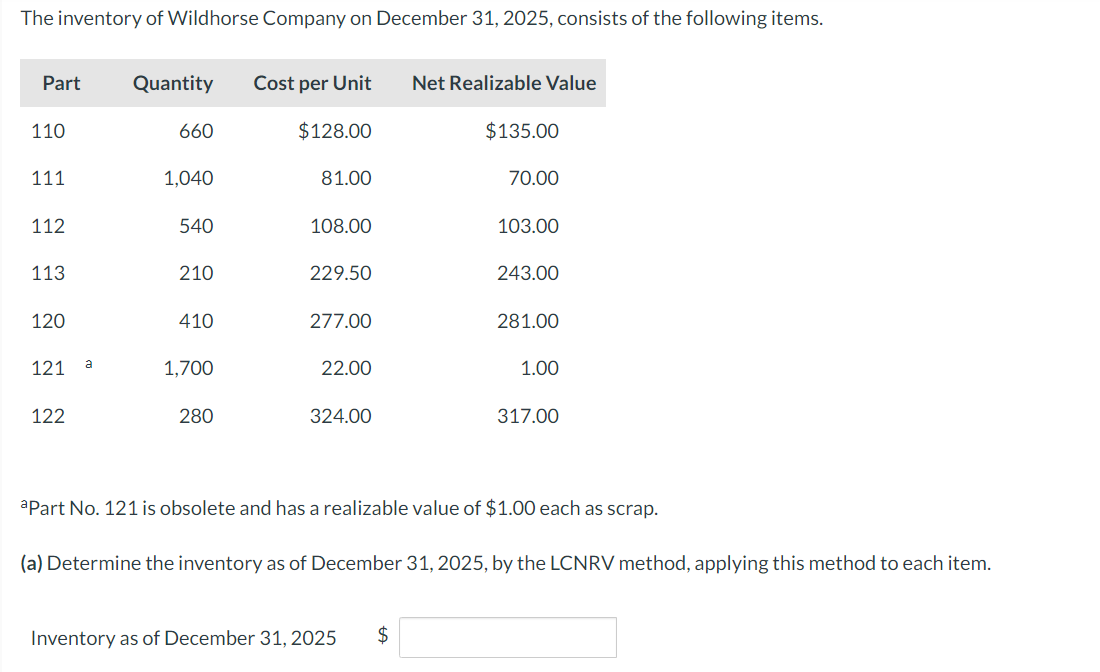

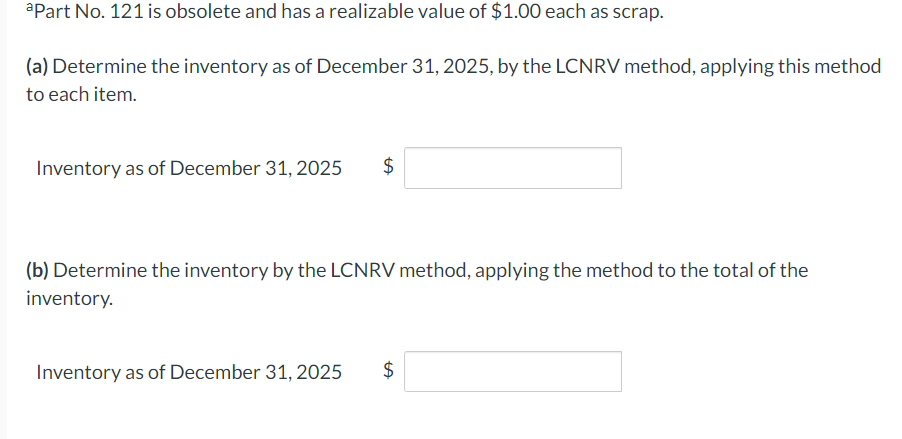

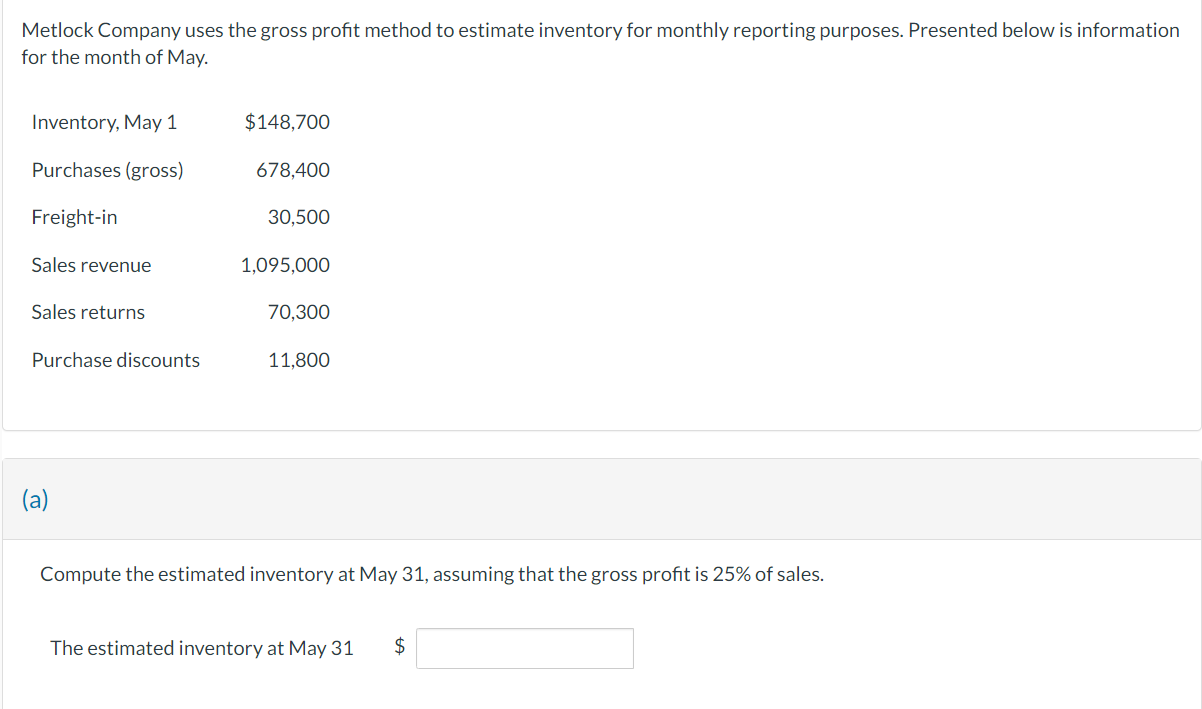

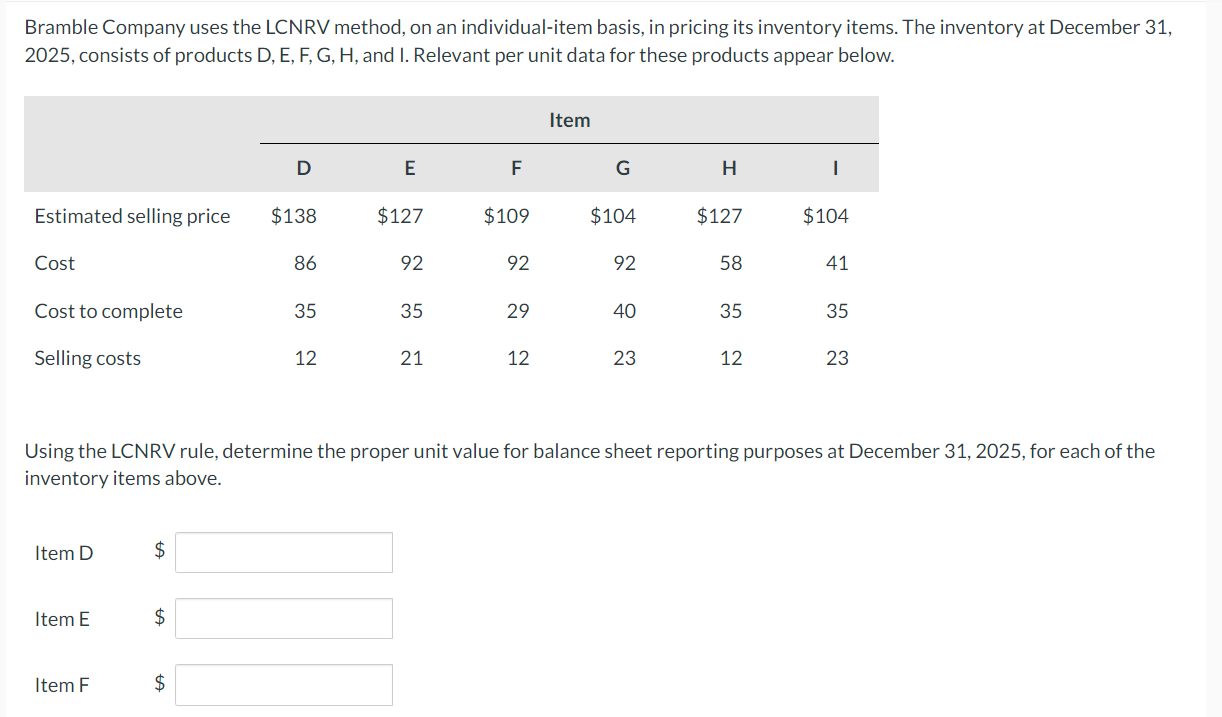

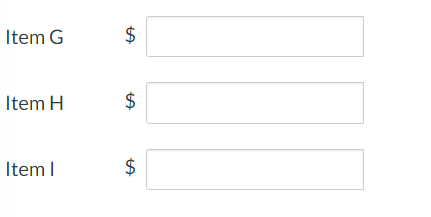

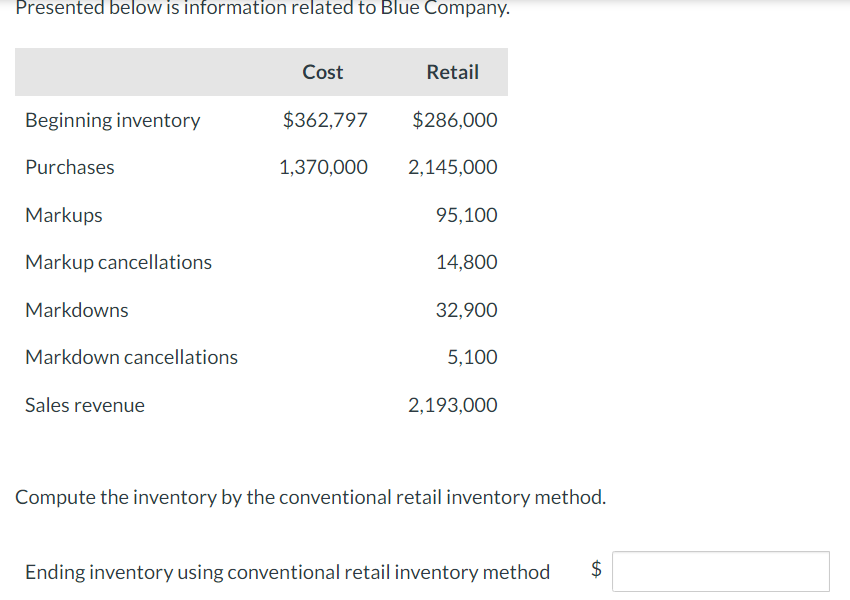

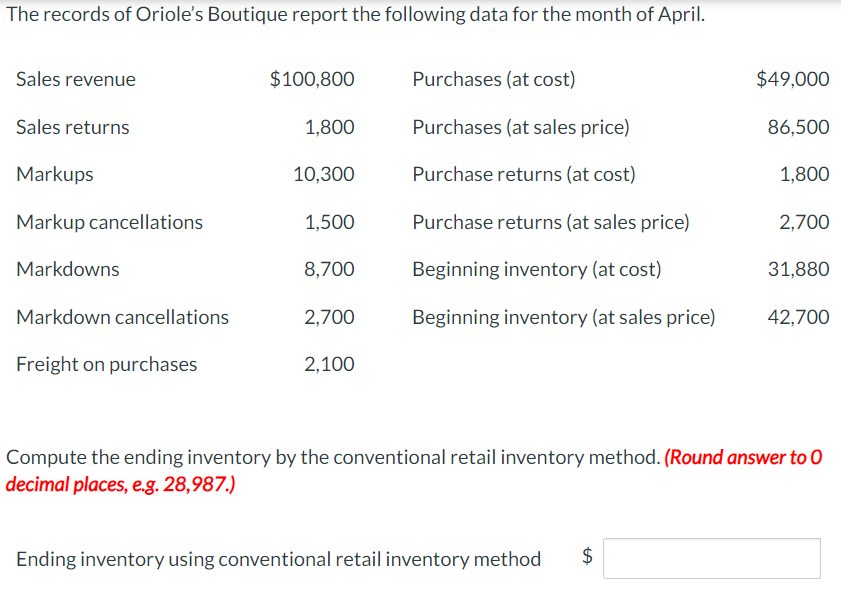

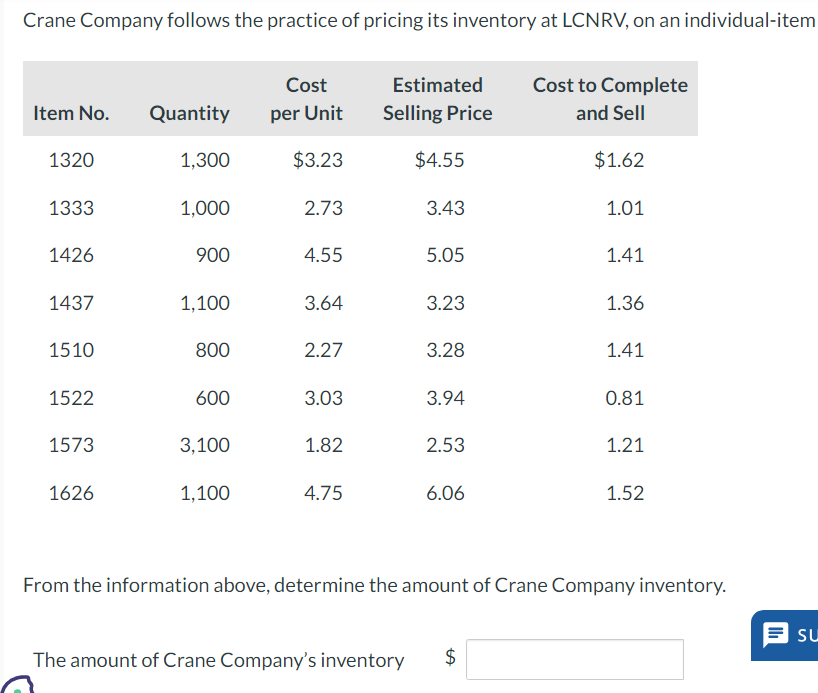

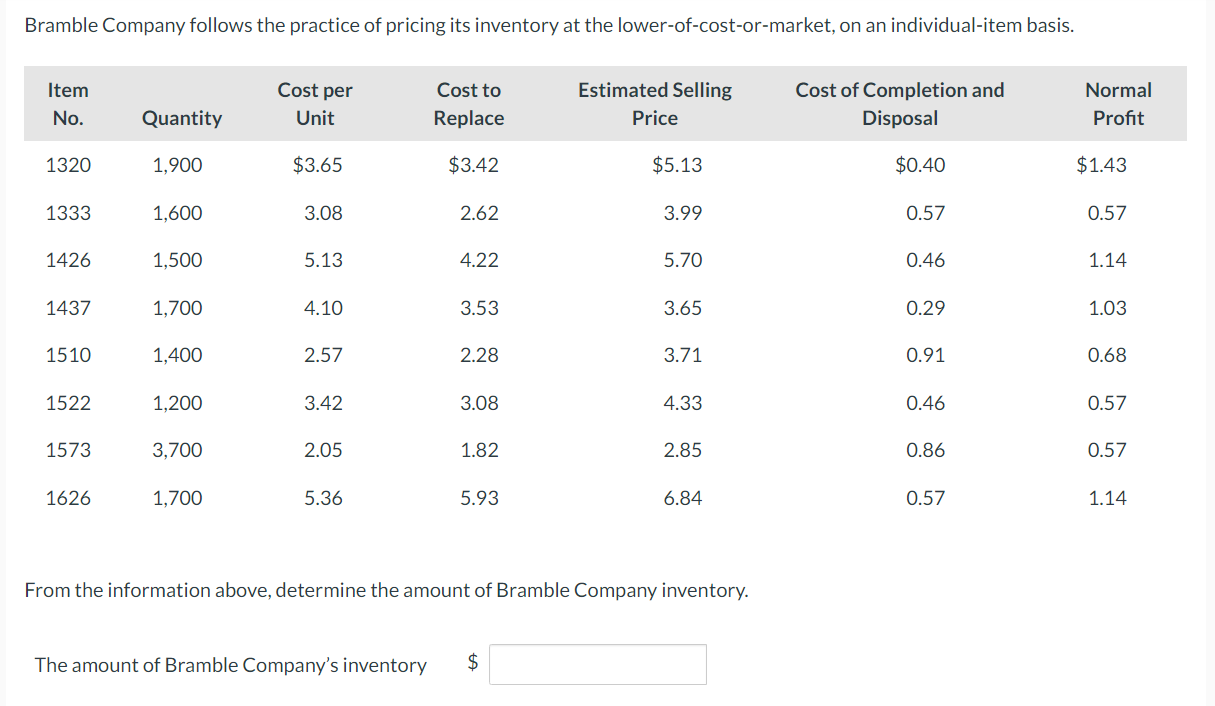

Current Attempt in Progress Presented below is information related to Coronado Inc.'s inventory, assuming Coronado uses lower-of-LIFO cost-or-market. Determine the following: (a) The two limits to market value (i.e., the ceiling and the floor) that should be used in the lower-of-cost-or-market computation for skis. (Round answers to 2 decimal places, e.g. 52.75.) Ceiling \$ Floor \$ (b) The cost amount that should be used in the lower-of-cost-or-market comparison of boots. (Round answer to 2 decimal places, e.g. 52.75.) $ (c) The market amount that should be used to value parkas on the basis of the lower-of-cost-or-market. (Round answer to 2 decimal places, e.g. 52.75.) $ The inventory of Wildhorse Company on December 31, 2025, consists of the following items. apart No. 121 is obsolete and has a realizable value of $1.00 each as scrap. (a) Determine the inventory as of December 31, 2025, by the LCNRV method, applying this method to each item. Inventory as of December 31, 2025 $ (a) Determine the inventory as of December 31, 2025, by the LCNRV method, applying this method to each item. Inventory as of December 31, 2025$ (b) Determine the inventory by the LCNRV method, applying the method to the total of the inventory. Inventory as of December 31, 2025 $ Metlock Company uses the gross profit method to estimate inventory for monthly reporting purposes. Presented below is information for the month of May. (a) Compute the estimated inventory at May 31, assuming that the gross profit is 25% of sales. The estimated inventory at May 31 $ Bramble Company uses the LCNRV method, on an individual-item basis, in pricing its inventory items. The inventory at December 31, 2025 , consists of products D, E, F, G, H, and I. Relevant per unit data for these products appear below. Using the LCNRV rule, determine the proper unit value for balance sheet reporting purposes at December 31, 2025, for each of the inventory items above. Item D \$ Item E \$ Item F \$ \begin{tabular}{ll} Item G & $ \\ Item H & $ \\ Item I & $ \end{tabular} Presented below is information related to Blue Company. Compute the inventory by the conventional retail inventory method. Ending inventory using conventional retail inventory method $ The records of Oriole's Boutique report the following data for the month of April. Compute the ending inventory by the conventional retail inventory method. (Round answer to 0 decimal places, e.g. 28,987.) Ending inventory using conventional retail inventory method $ Crane Company follows the practice of pricing its inventory at LCNRV, on an individual-item From the information above, determine the amount of Crane Company inventory. The amount of Crane Company's inventory $ From the information above, determine the amount of Bramble Company inventory. The amount of Bramble Company's inventory $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts