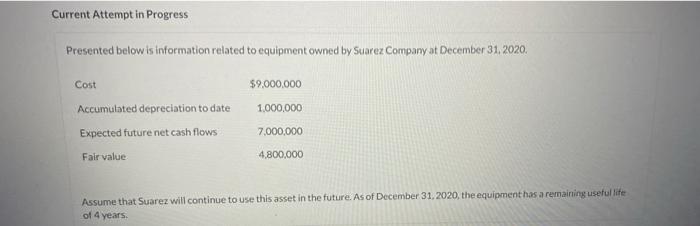

Question: Current Attempt in Progress Presented below is information related to equipment owned by Suarez Company at December 31, 2020. $9.000.000 1.000.000 Cost Accumulated depreciation to

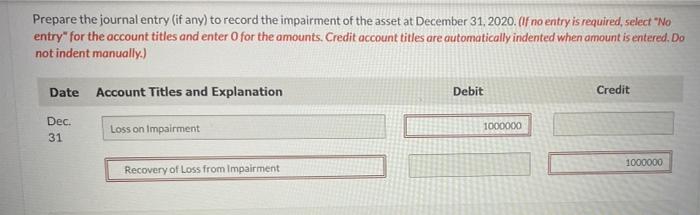

Current Attempt in Progress Presented below is information related to equipment owned by Suarez Company at December 31, 2020. $9.000.000 1.000.000 Cost Accumulated depreciation to date Expected future net cash flows Fair value 7,000,000 4,800,000 Assume that Suarez will continue to use this asset in the future. As of December 31, 2020, the equipment has a remaining useful life of 4 years. Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2020. (If no entry is required, select "No entry" for the account titles and enter O for the amounts. Credit account titles are automatically indented when amount is entered. Do not indent manually.) Date Account Titles and Explanation Debit Credit Dec. 31 Loss on impairment 1000000 1000000 Recovery of Loss from Impairment

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts