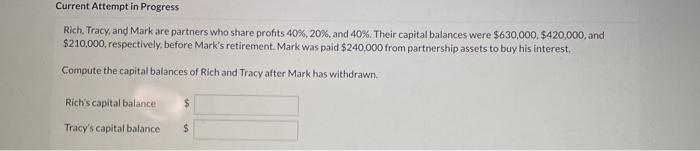

Question: Current Attempt in Progress Rich, Tracy, and Mark are partners who share profits 40%, 20%, and 40%. Their capital balances were $630,000, $420,000, and $210,000,

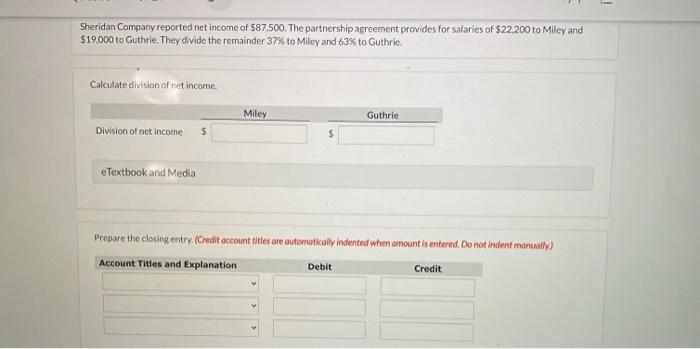

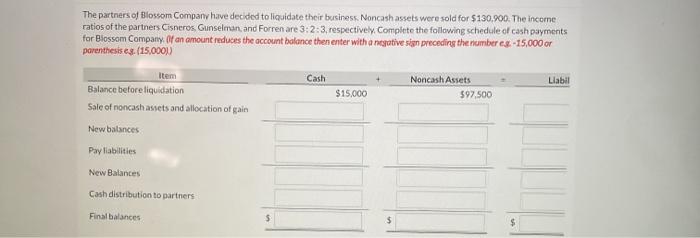

Current Attempt in Progress Rich, Tracy, and Mark are partners who share profits 40%, 20%, and 40%. Their capital balances were $630,000, $420,000, and $210,000, respectively, before Mark's retirement, Mark was paid $240,000 from partnership assets to buy his interest Compute the capital balances of Rich and Tracy after Mark has withdrawn. Rich's capital balance $ Tracy's capital balance - Sheridan Company reported net income of $87.500. The partnership agreement provides for salaries of $22 200 to Miley and $19.000 to Guthrie. They divide the remainder 37% to Miley and 63% to Guthrie Calculate division of net income Miley Guthrie Division of net income $ $ Textbook and Media Prepare the closing entry. (Credit account titles are automatically indented when amount is entered. Do not indent manually) Account Titles and Explanation Debit Credit The partners of Blossom Company have decided to liquidate their business. Noncash assets were sold for $130.900. The income ratios of the partners Cisneros, Gunselman, and Forren are 3: 2:3, respectively. Complete the following schedule of cash payments for Blossom Company of an amount reduces the account balance then enter with a nerative sin preceding the number eg.-15.000 or parenthesis es (15,0001) Cash Liabil Noncash Assets $97.500 $15,000 Item Balance before liquidation Sale of noncash assets and allocation of gain New balances Paylabilities New Balances Cash distribution to partners Final balances $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts