Question: Current Attempt in Progress Royalties are recognized when recelved in year 3 for income taxpurposes and recognized when earned in year 4 for firfancial statement

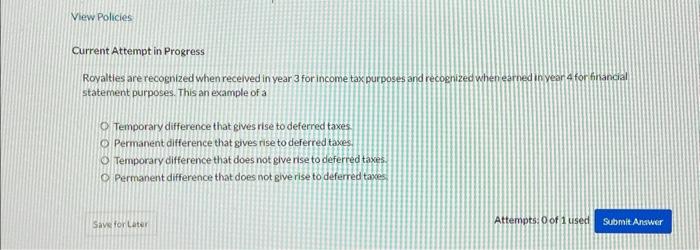

Current Attempt in Progress Royalties are recognized when recelved in year 3 for income taxpurposes and recognized when earned in year 4 for firfancial statement purposes. This an example of a Temporary difference that gives rise to deferred taxes. Permanent difference that gives rise to deferred taxes. Temporary difference that does not give rise to deferred taxes. Permanent difference that does not give rise to deferred takes Attempts: o of 1 used

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts