Question: Current Attempt in Progress Sandhill Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over

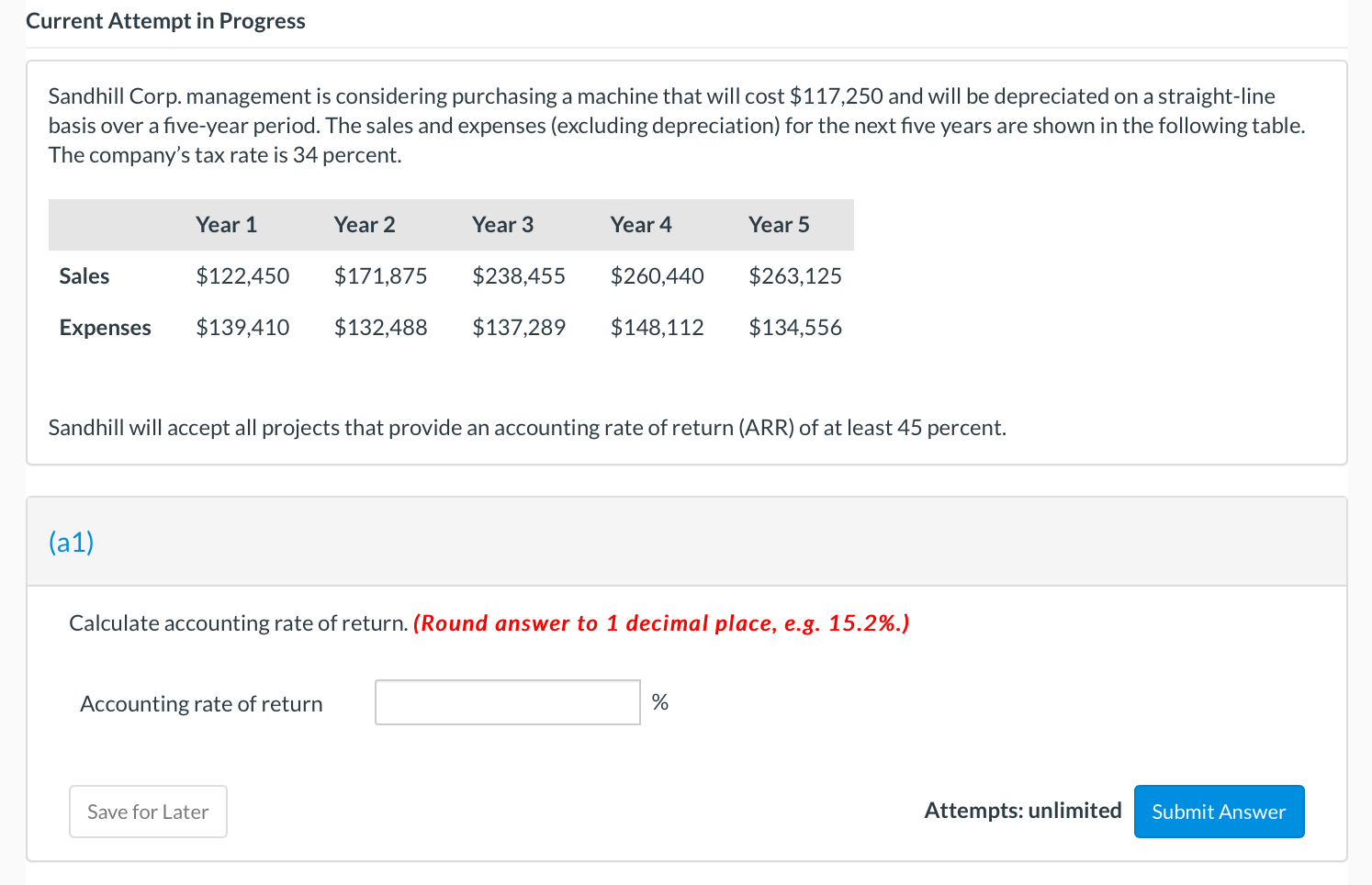

Current Attempt in Progress Sandhill Corp. management is considering purchasing a machine that will cost $117,250 and will be depreciated on a straight-line basis over a five-year period. The sales and expenses (excluding depreciation) for the next five years are shown in the following table. The company's tax rate is 34 percent. Year 1 Year 2 Year 3 Year 4 Year 5 Sales $122,450 $171,875 $238,455 $260,440 $263,125 Expenses $139,410 $132,488 $137,289 $148,112 $134,556 Sandhill will accept all projects that provide an accounting rate of return (ARR) of at least 45 percent. (a1) Calculate accounting rate of return. (Round answer to 1 decimal place, e.g. 15.2%.) Accounting rate of return % Save for Later Attempts: unlimited Submit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts