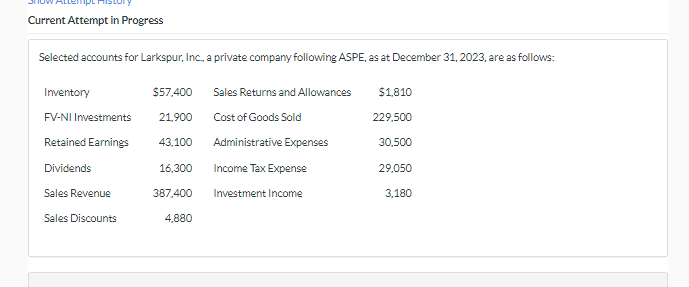

Question: Current Attempt in Progress Selected accounts for Larkspur, Inc., a private company following ASPE, as at December 31,2023 , are as follows: Assume instead that

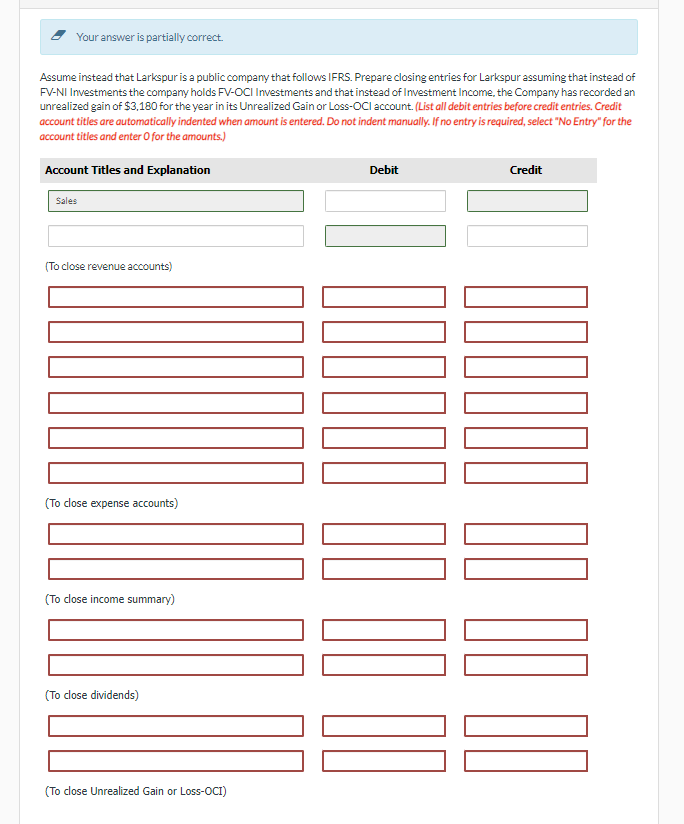

Current Attempt in Progress Selected accounts for Larkspur, Inc., a private company following ASPE, as at December 31,2023 , are as follows: Assume instead that Larkspur is a public company that follows IFRS. Prepare closing entries for Larkspur assuming that instead of FV-NI Investments the company holds FV-OCl Investments and that instead of Investment Income, the Company has recorded an unrealized gain of $3,180 for the year in its Unrealized Gain or Loss-OCl account. (List all debit entries before credit entries. Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts