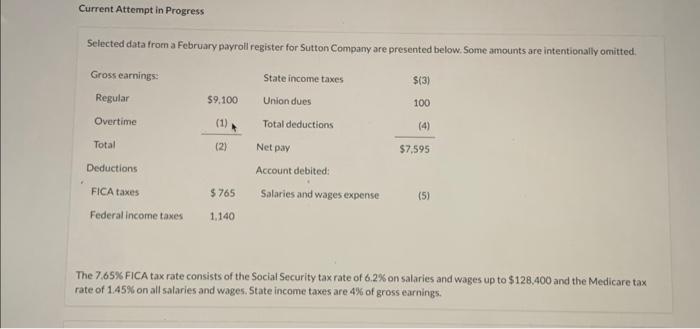

Question: Current Attempt in Progress Selected data from a February payroll register for Sutton Company are presented below. Some amounts are intentionally omitted. The 7.65%) FICA

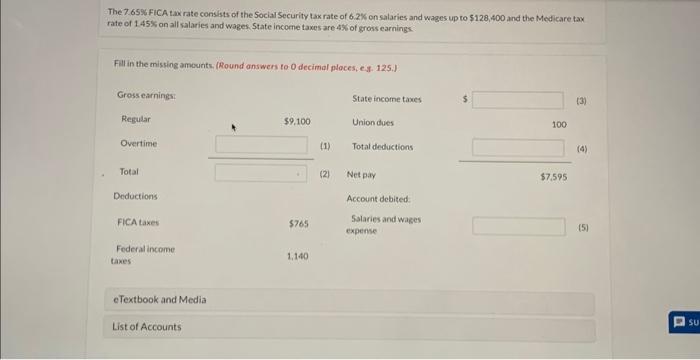

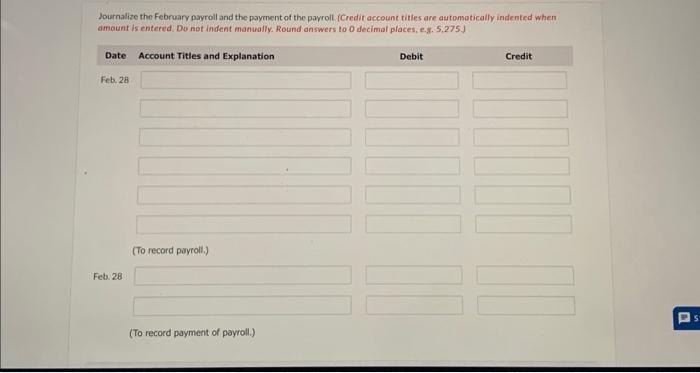

Current Attempt in Progress Selected data from a February payroll register for Sutton Company are presented below. Some amounts are intentionally omitted. The 7.65\%) FICA tax rate consists of the Social Security tax rate of 6.2% on salaries and wages up to $128.400 and the Medicare tax rate of 1.45% on all salaries and wages. 5 tate income taxes are 4% of gross earnings. The 7.65% FICA tax rate consists of the SocialSecurity tax rate of 6.2% on salaries and wages up to $128,400 and the Medicare tax rate of 1.45% on all salaries and wages State incorne taxes are 4% of gross earnings. Fill in the missing amounts, (Round answers to 0 decimal ploces, est. 125.) Journalize the February payroll and the payment of the parroll (Credit account titles are automatically indented when amount is entered. Do not indent manually, Round answers to 0 decimal places, e., 5,275

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts