Question: Current Attempt in Progress Sharon currently manages the polished chrome division of Oriole Broadway, a business that specializes in ceiling light fixtures. Its performance has

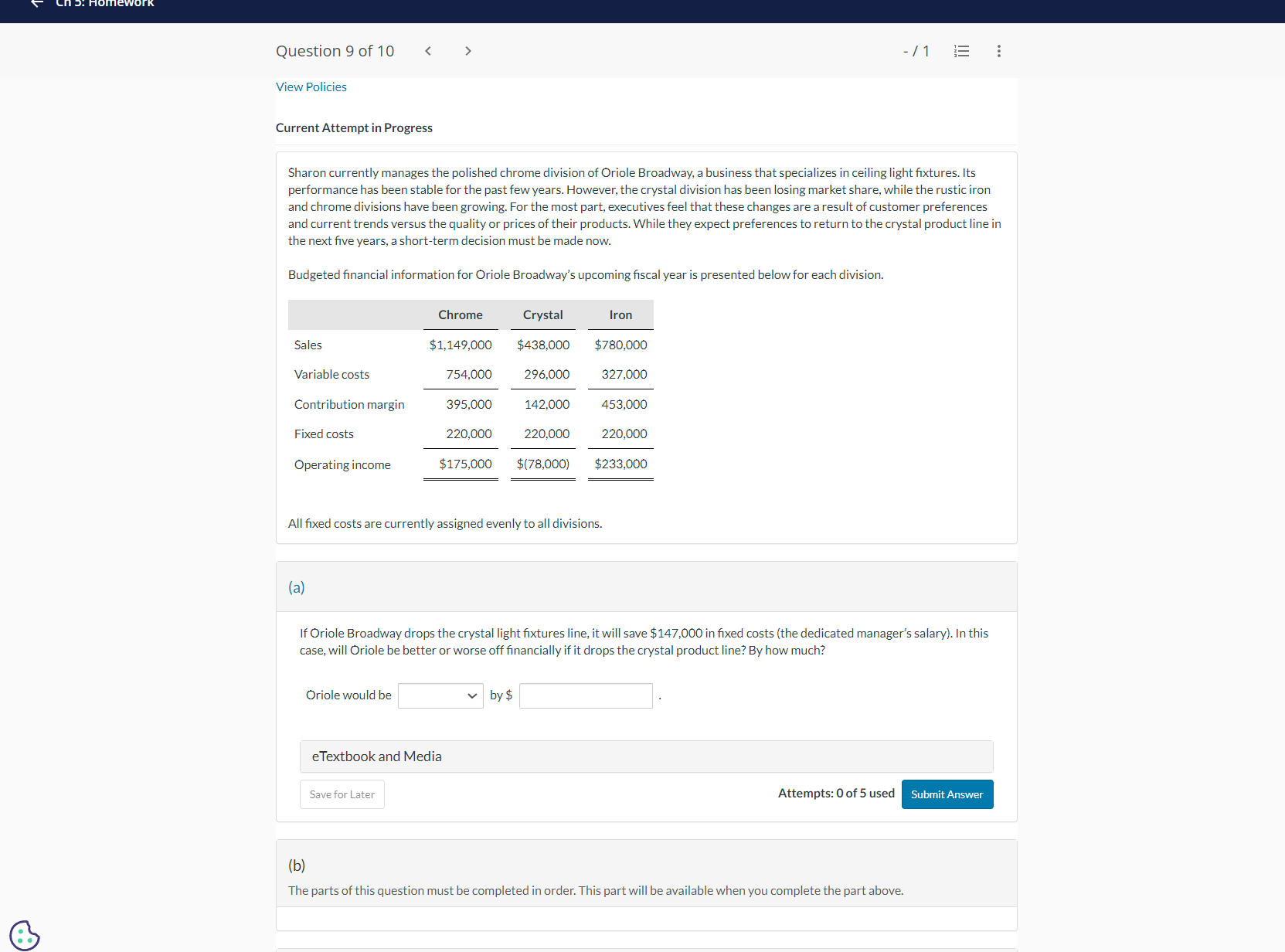

Current Attempt in Progress Sharon currently manages the polished chrome division of Oriole Broadway, a business that specializes in ceiling light fixtures. Its performance has been stable for the past few years. However, the crystal division has been losing market share, while the rustic iron and chrome divisions have been growing. For the most part, executives feel that these changes are a result of customer preferences and current trends versus the quality or prices of their products. While they expect preferences to return to the crystal product line in the next five years, a short-term decision must be made now. Budgeted financial information for Oriole Broadway's upcoming fiscal year is presented below for each division. All fixed costs are currently assigned evenly to all divisions. (a) If Oriole Broadway drops the crystal light fixtures line, it will save $147,000 in fixed costs (the dedicated manager's salary). In this case, will Oriole be better or worse off financially if it drops the crystal product line? By how much? Oriole would be by $ eTextbook and Media Attempts: 0 of 5 used (b) The parts of this question must be completed in order. This part will be available when you complete the part above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts