Question: Current Attempt in Progress Sheridan Inc. has 0 . 9 5 million common shares outstanding as at January 1 , 2 0 2 3 .

Current Attempt in Progress

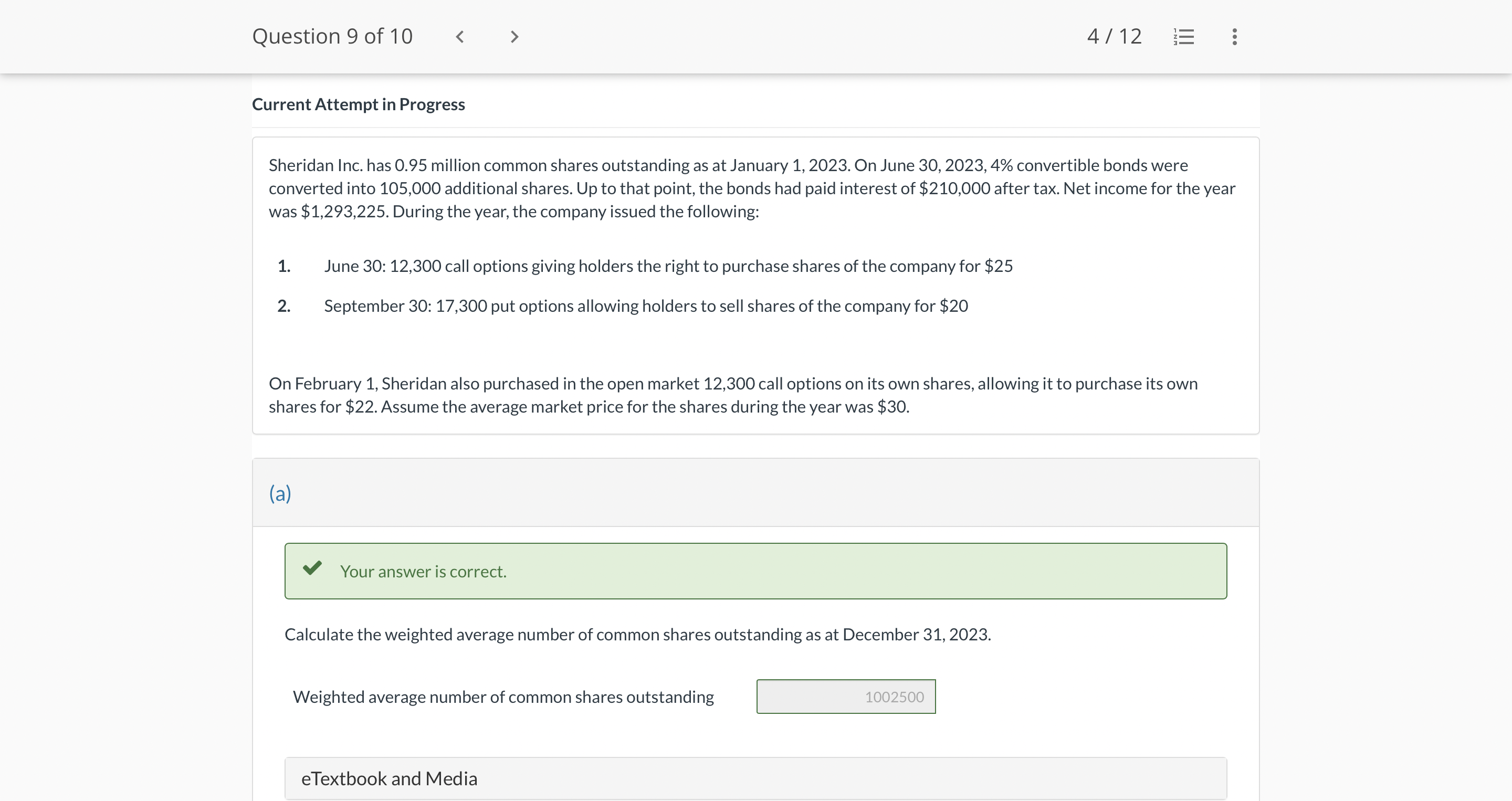

Sheridan Inc. has million common shares outstanding as at January On June convertible bonds were converted into additional shares. Up to that point, the bonds had paid interest of $ after tax. Net income for the year was $ During the year, the company issued the following:

June : call options giving holders the right to purchase shares of the company for $

September : put options allowing holders to sell shares of the company for $

On February Sheridan also purchased in the open market call options on its own shares, allowing it to purchase its own shares for $ Assume the average market price for the shares during the year was $

a

Your answer is correct.

Calculate the weighted average number of common shares outstanding as at December

Weighted average number of common shares outstanding

eTextbook and Media

Your answer is incorrect.

Calculate the required EPS numbers under IFRS. For simplicity, ignore the impact that would result from the convertible debt

being a hybrid security. Round answers to decimal places, eg

Basic EPS

Diluted EPS

eTextbook and Media

Last saved hours ago.

Attempts: of used

Saved work will be autosubmitted on the due date. Auto

submission can take up to minutes.

c

The parts of this question must be completed in order. This part will be available when you complete the part above. ANSWER CORRECTLY PLEASE OR I WILL THUMBS DOWN AND GIVE BAD RATING PLEASE AND THANK YOU

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock