Question: Current Attempt in Progress Sheridan Limited purchased a machine on account on April 1.2021, at an invoice price of $374,390. On April 2, it paid

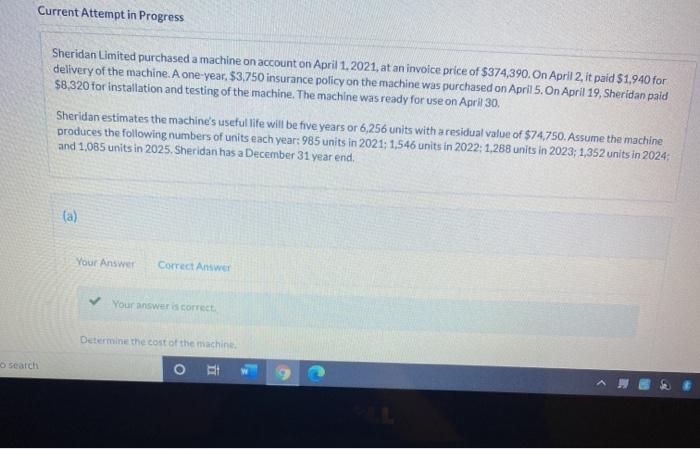

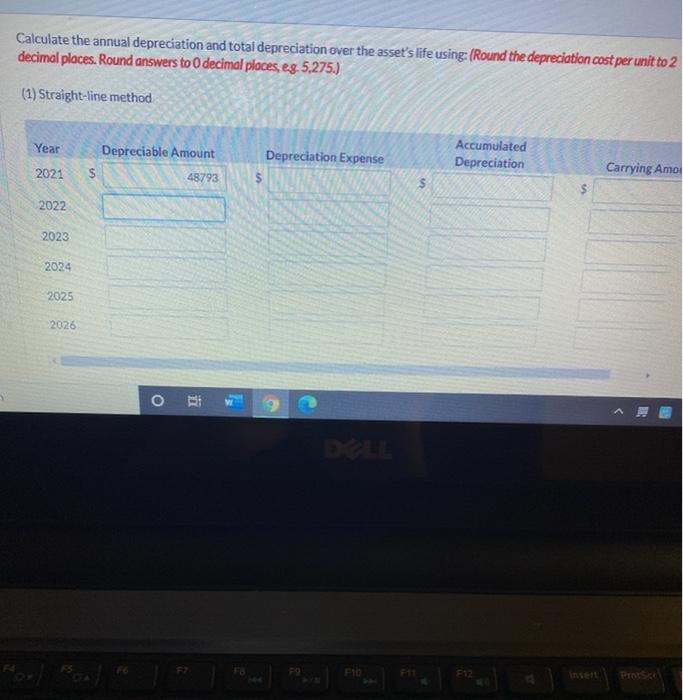

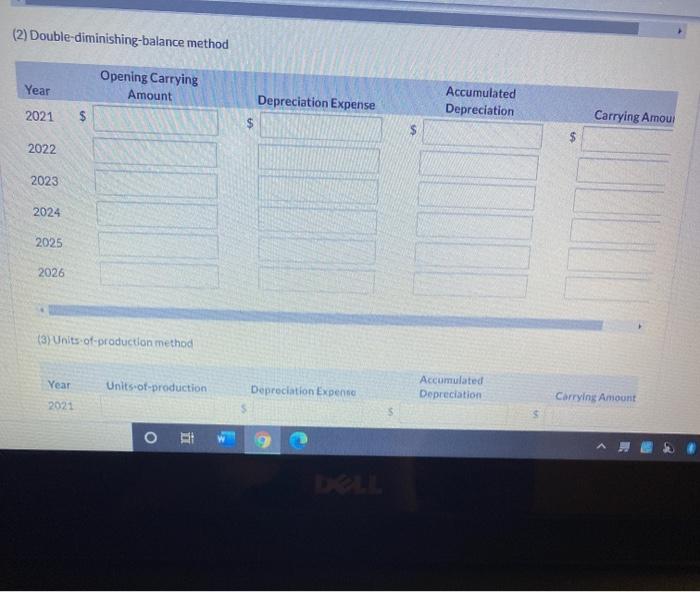

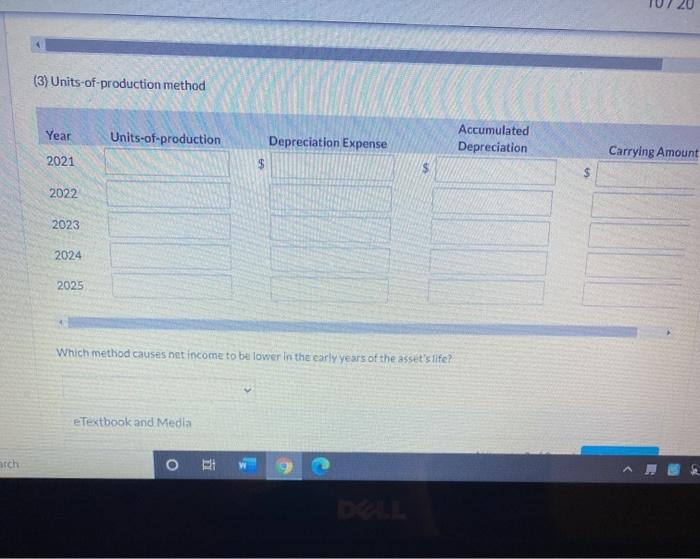

Current Attempt in Progress Sheridan Limited purchased a machine on account on April 1.2021, at an invoice price of $374,390. On April 2, it paid $1,940 for delivery of the machine. A one-year, $3,750 insurance policy on the machine was purchased on April 5. On April 19, Sheridan pald $8,320 for installation and testing of the machine. The machine was ready for use on April 30. Sheridan estimates the machine's useful life will be five years or 6,256 units with a residual value of $74,750. Assume the machine produces the following numbers of units each year: 985 units in 2021:1,546 units in 2022:1,288 units in 2023; 1,352 units in 2024 and 1,085 units in 2025. Sheridan has a December 31 year end, (a) Your Answer Correct Answer Your answer is correct Determine the cost of the machine Search Calculate the annual depreciation and total depreciation over the asset's life using: (Round the depreciation cost per unit to 2 decimal places. Round answers to decimal places, eg. 5,275.) (1) Straight-line method Year Depreciable Amount Depreciation Expense Accumulated Depreciation 2021 $ 48793 Carrying Amo $ $ 2022 2023 2024 2025 2026 o Fio F12 (2) Double-diminishing-balance method Year Opening Carrying Amount Depreciation Expense Accumulated Depreciation 2021 Carrying Amou 2022 2023 2024 2025 2026 (3) Units of production method Year Units-ot-production Depreciation Expenne Accumulated Depreciation Carrying Amount 2021 O 20 (3) Units-of-production method Year Units-of-production Depreciation Expense $ Accumulated Depreciation Carrying Amount 2021 2022 2023 2024 2025 Which method causes net income to be lower in the early years of the asset's life? eTextbook and Media arch O

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts