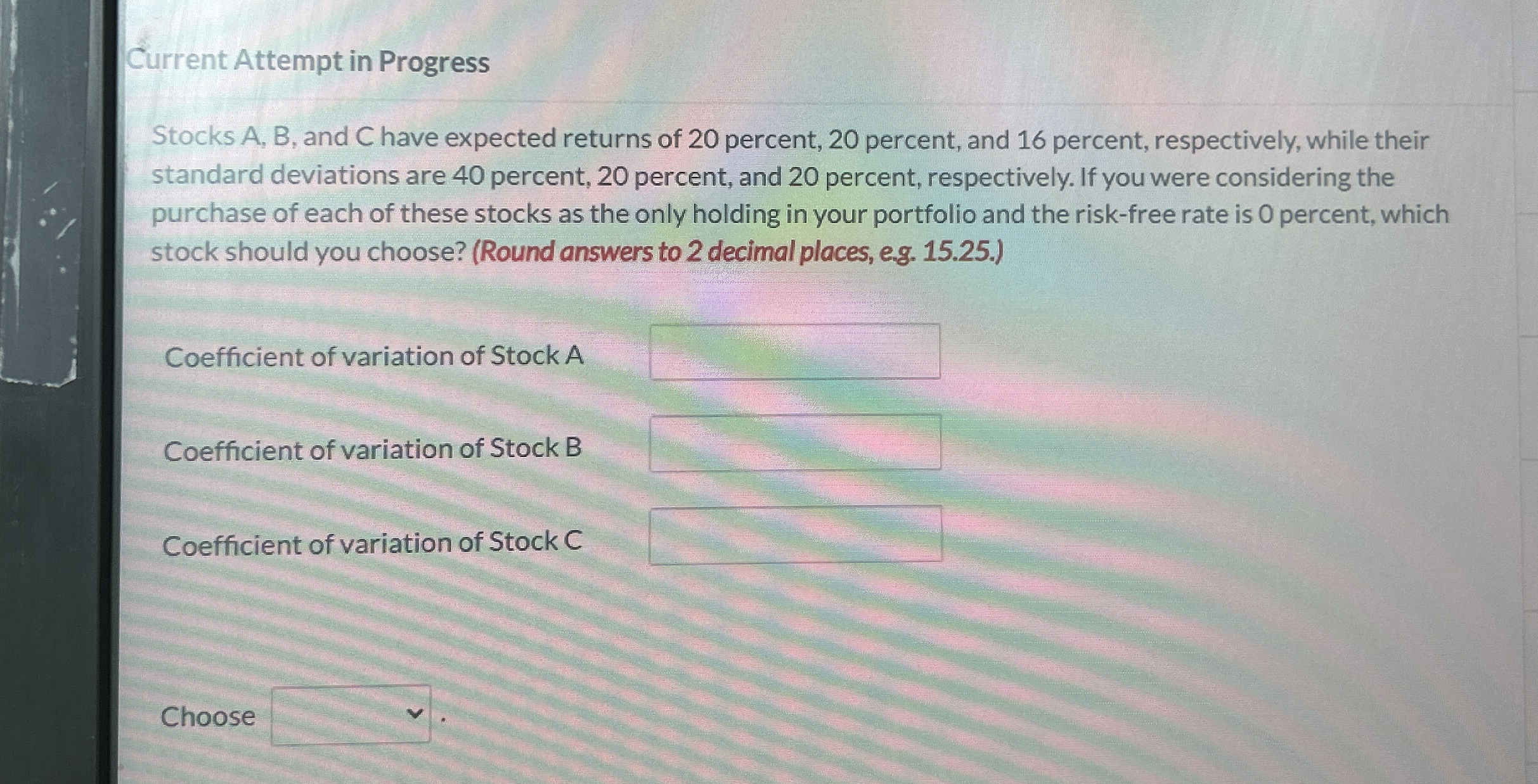

Question: Current Attempt in Progress Stocks A , B , and C have expected returns of 2 0 percent, 2 0 percent, and 1 6 percent,

Current Attempt in Progress

Stocks A B and C have expected returns of percent, percent, and percent, respectively, while their standard deviations are percent, percent, and percent, respectively. If you were considering the purchase of each of these stocks as the only holding in your portfolio and the riskfree rate is percent, which stock should you choose? Round answers to decimal places, eg

Coefficient of variation of Stock A

Coefficient of variation of Stock B

Coefficient of variation of Stock C

Choose

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock