Question: Current Attempt in Progress Sunland, Inc. leased equipment from Tower Company under a 4-year lease requiring equal annual payments of $404152, with the first payment

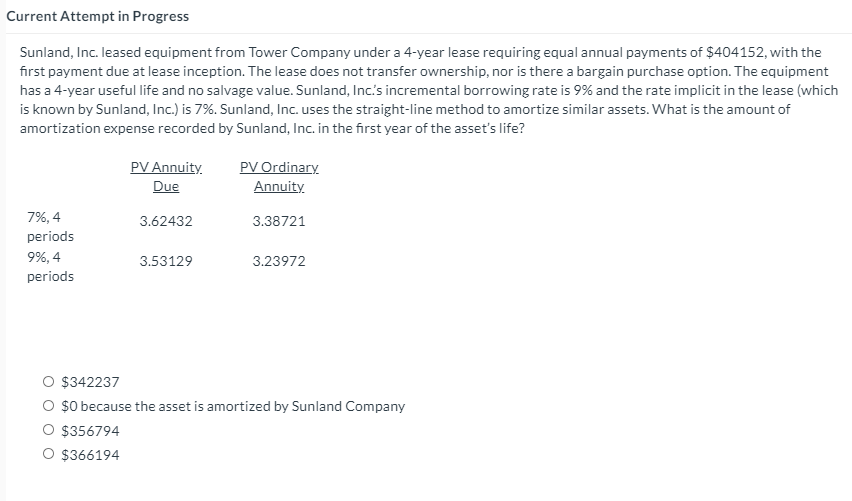

Current Attempt in Progress Sunland, Inc. leased equipment from Tower Company under a 4-year lease requiring equal annual payments of $404152, with the first payment due at lease inception. The lease does not transfer ownership, nor is there a bargain purchase option. The equipment has a 4-year useful life and no salvage value. Sunland, Inc's incremental borrowing rate is 9% and the rate implicit in the lease (which is known by Sunland, Inc.) is 7%. Sunland, Inc. uses the straight-line method to amortize similar assets. What is the amount of amortization expense recorded by Sunland, Inc. in the first year of the asset's life? PV Annuity. Due PV Ordinary Annuity 3.62432 3.38721 7%, 4 periods 9%, 4 periods 3.53129 3.23972 $342237 $0 because the asset is amortized by Sunland Company $356794 $366194

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts