Question: Current Attempt in Progress Suppose you have a portfolio that has $ 2 5 0 in stock A with a beta of 1 . 0

Current Attempt in Progress

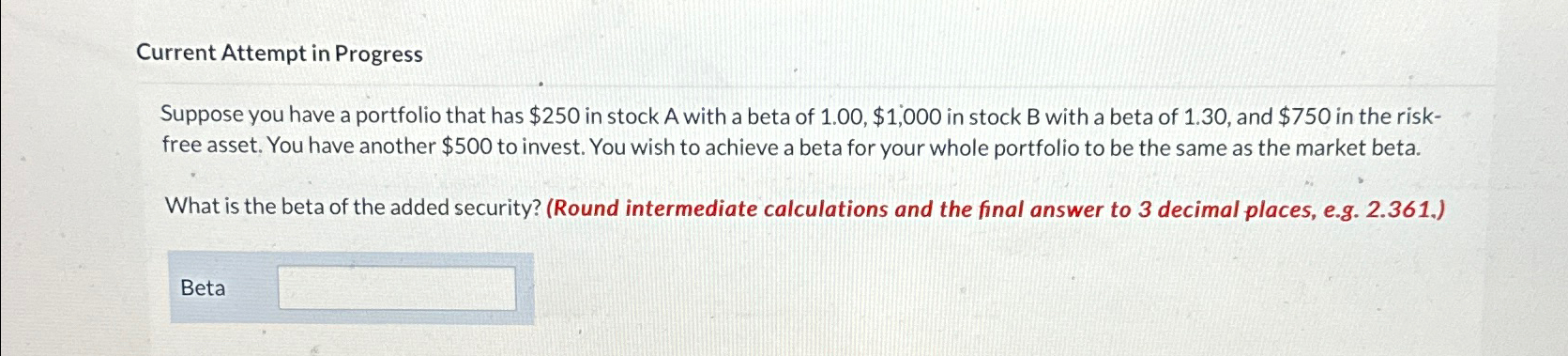

Suppose you have a portfolio that has $ in stock A with a beta of $ in stock B with a beta of and $ in the riskfree asset. You have another $ to invest. You wish to achieve a beta for your whole portfolio to be the same as the market beta.

What is the beta of the added security? Round intermediate calculations and the final answer to decimal places, eg

Beta

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock