Question: Current Attempt in Progress Sweet Inc., in its first year of operations, has the following differences between the book basis and tax basis of its

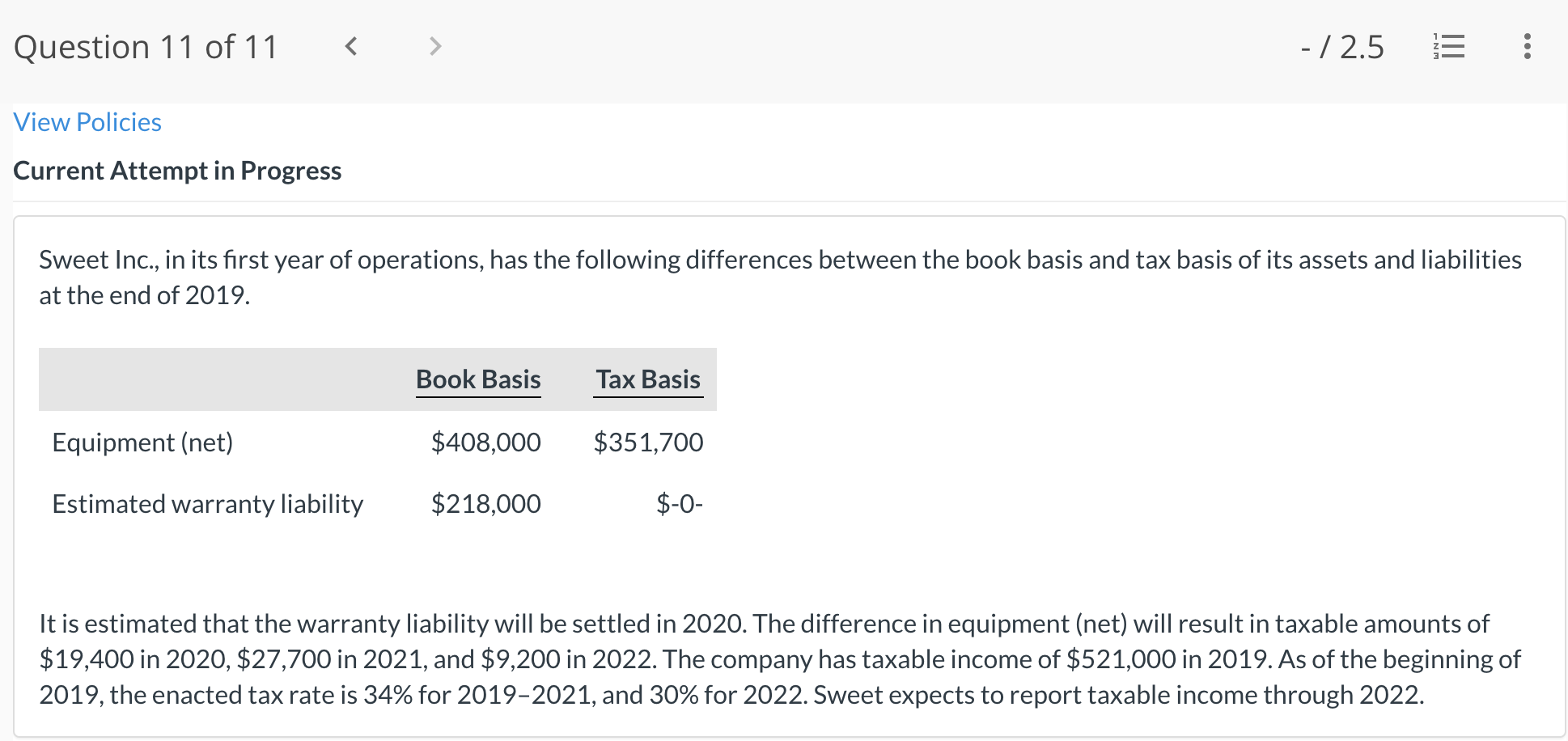

Current Attempt in Progress Sweet Inc., in its first year of operations, has the following differences between the book basis and tax basis of its assets and liabilities at the end of 2019. It is estimated that the warranty liability will be settled in 2020 . The difference in equipment (net) will result in taxable amounts of $19,400 in 2020, $27,700 in 2021, and $9,200 in 2022. The company has taxable income of $521,000 in 2019 . As of the beginning of 2019 , the enacted tax rate is 34% for 2019-2021, and 30\% for 2022. Sweet expects to report taxable income through 2022. Prepare the journal entry to record income tax expense, deferred income taxes, and income taxes payable for 2019 . (Credit account titles are automatically indented when amount is entered. Do not indent manually. If no entry is required, select "No Entry" for the account titles and enter 0 for the amounts.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts