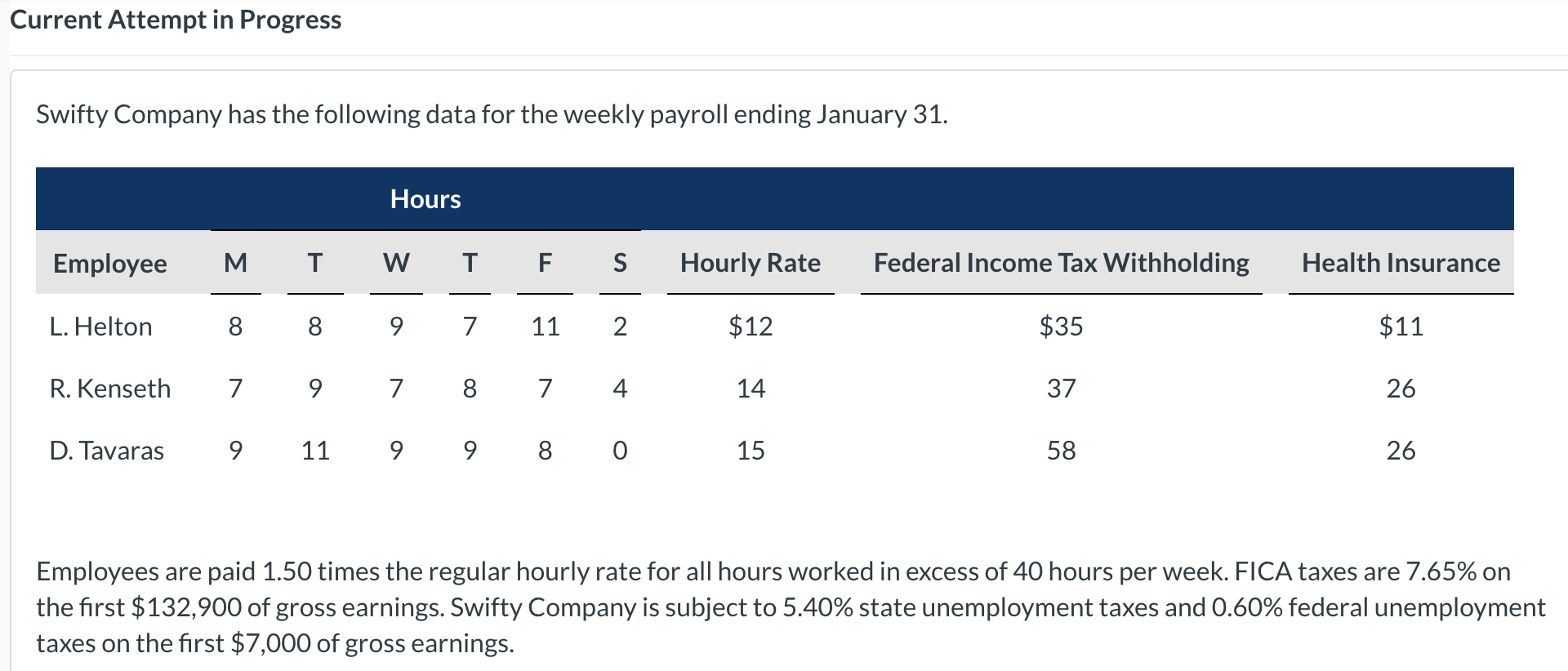

Question: Current Attempt in Progress Swifty Company has the following data for the weekly payroll ending January 31. Employees are paid 1.50 times the regular hourly

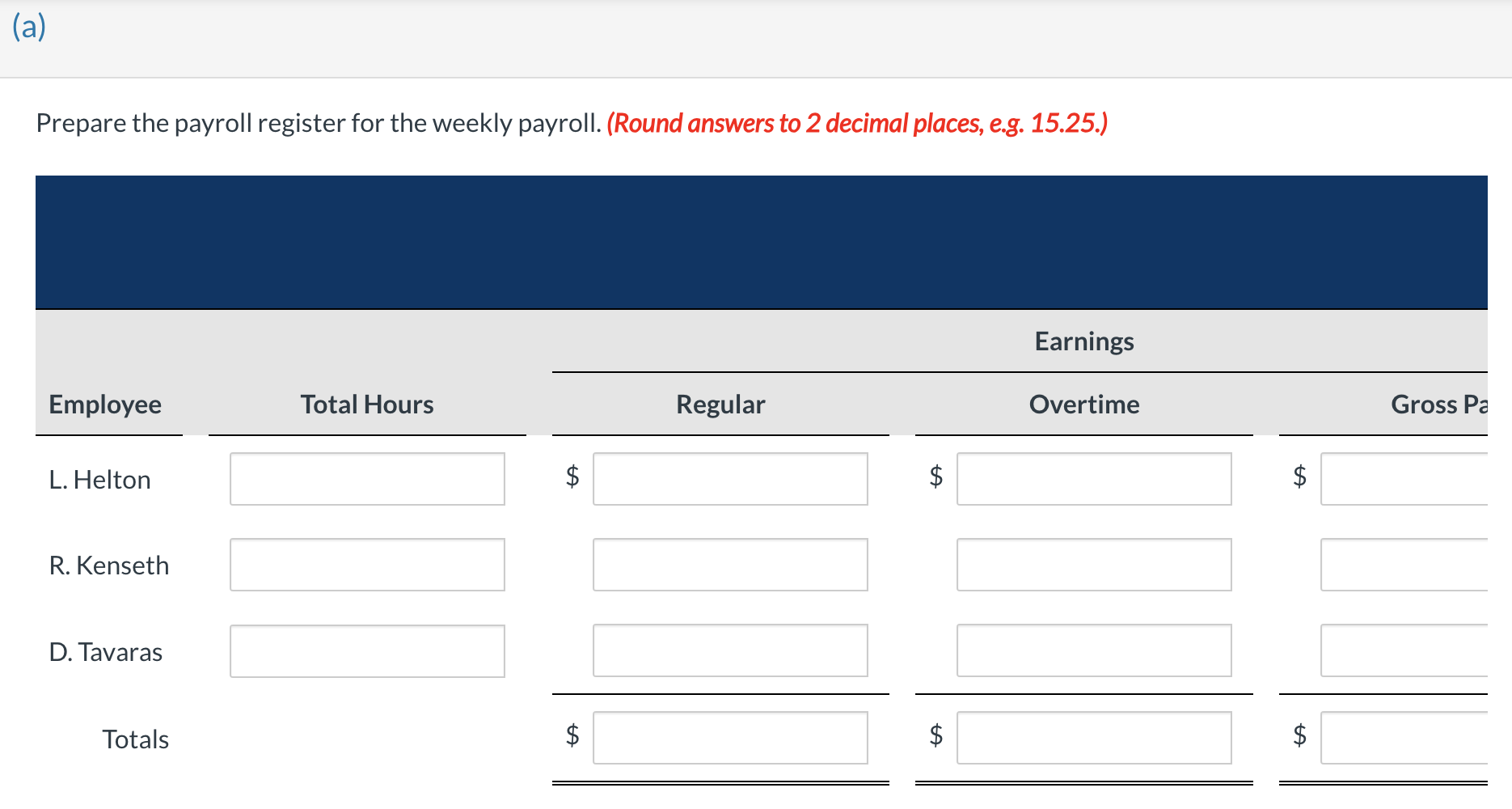

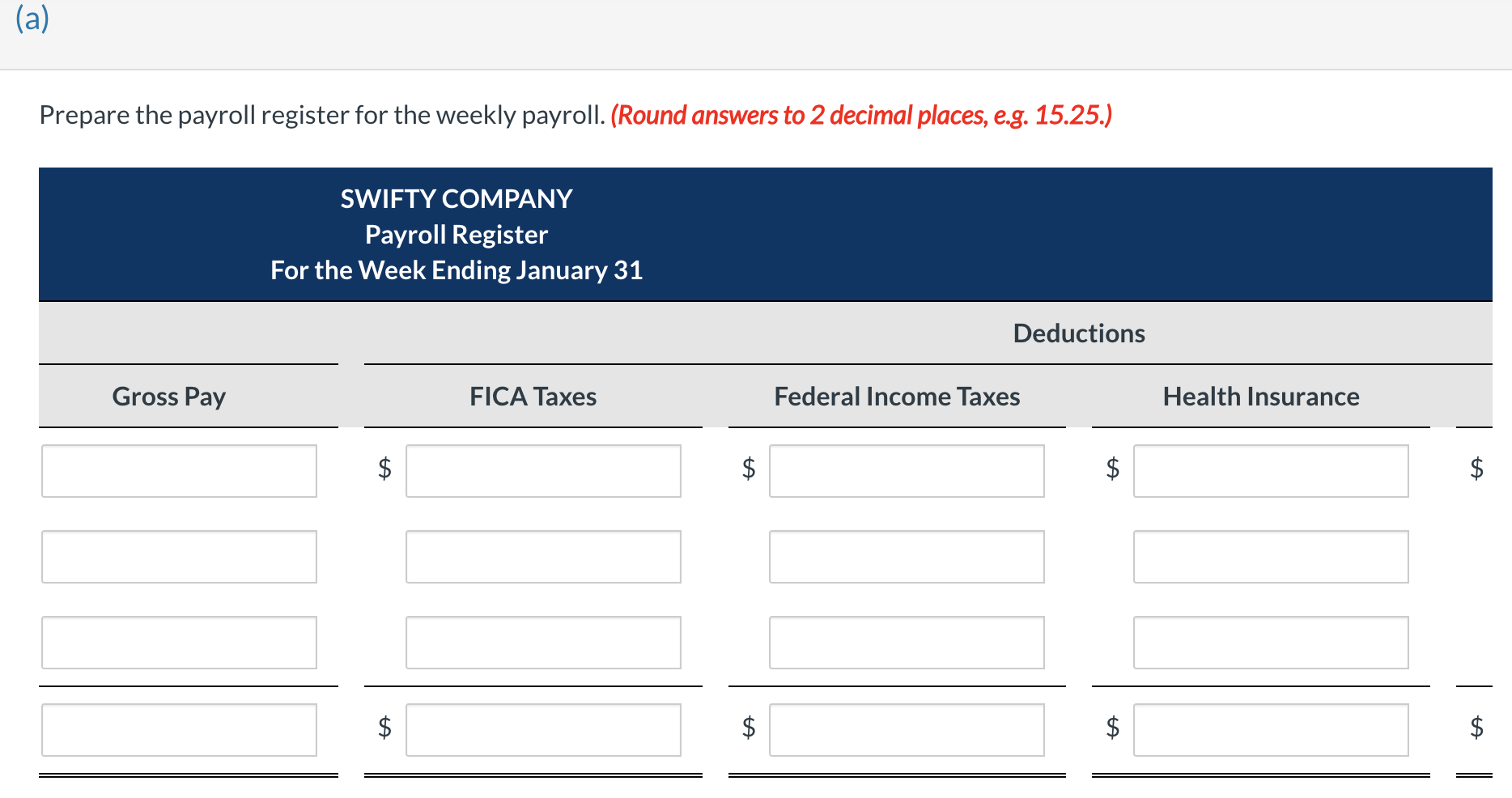

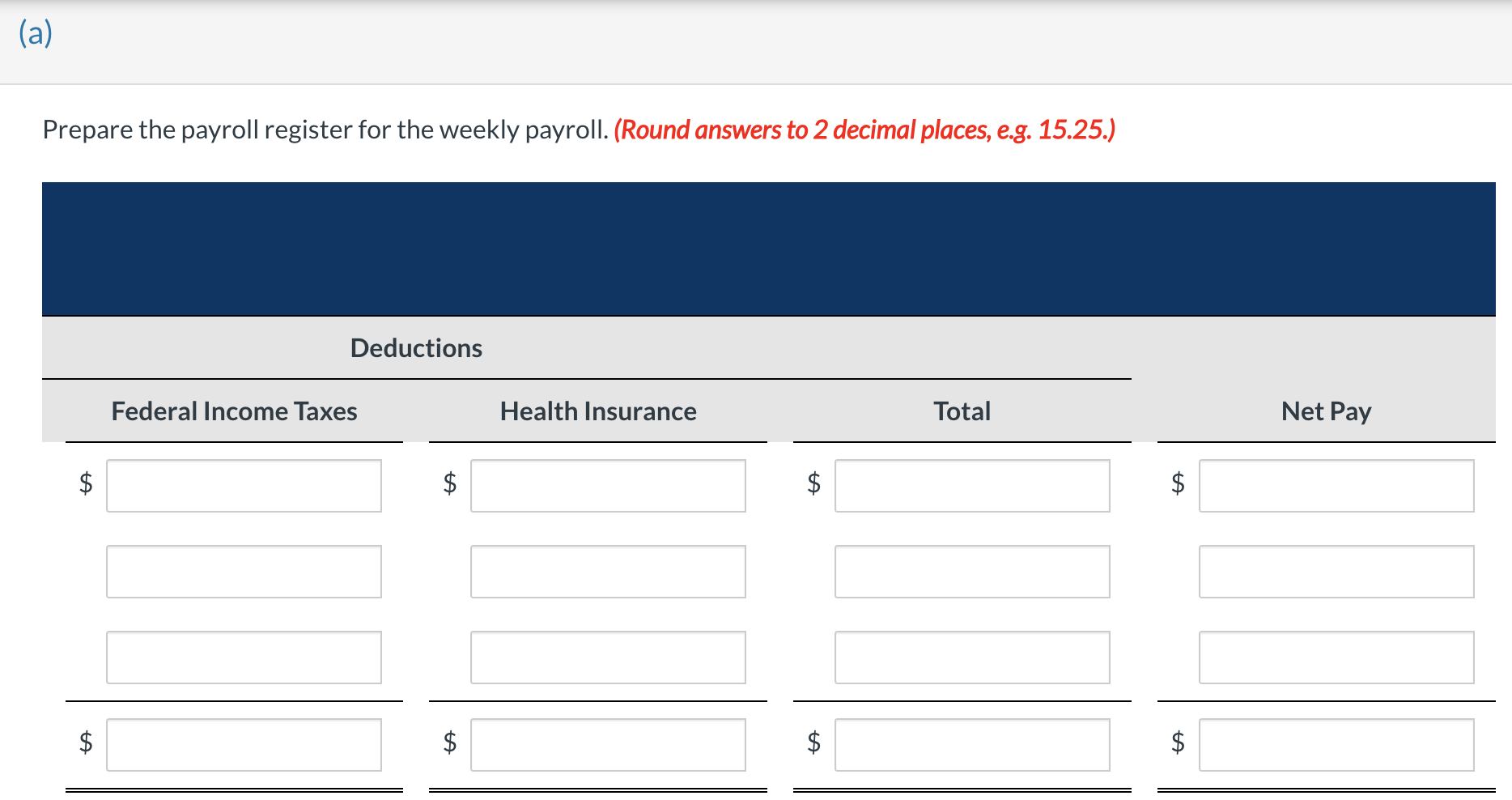

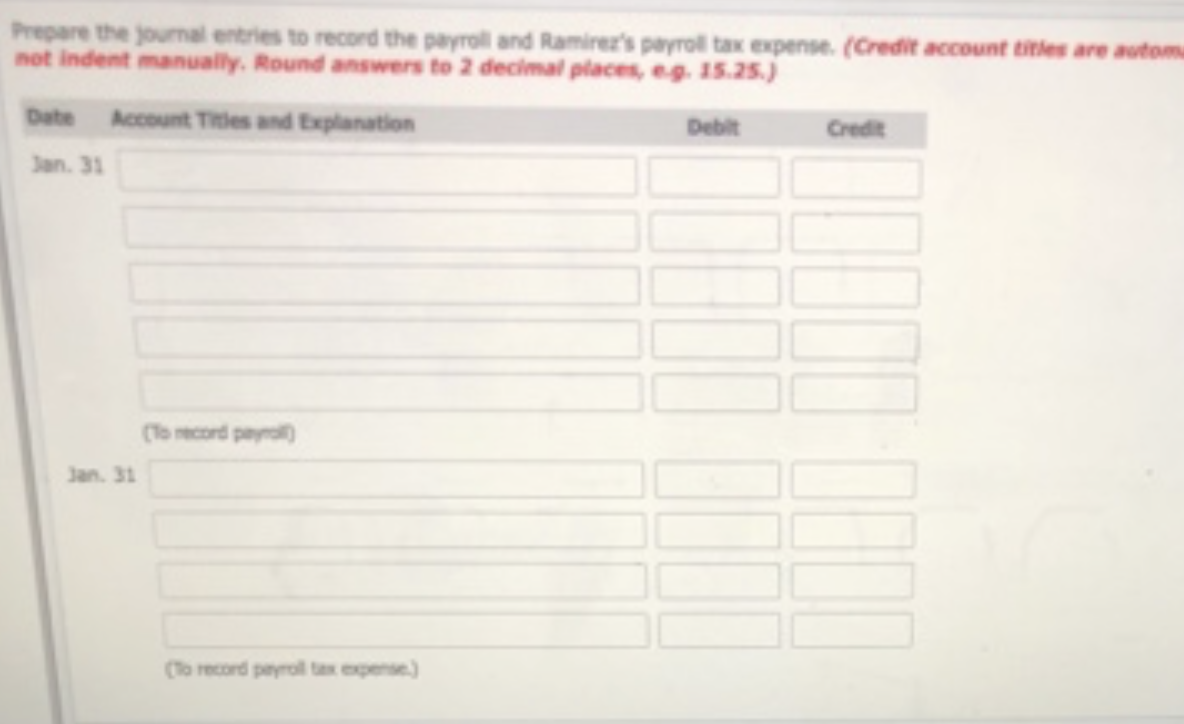

Current Attempt in Progress Swifty Company has the following data for the weekly payroll ending January 31. Employees are paid 1.50 times the regular hourly rate for all hours worked in excess of 40 hours per week. FICA taxes are 7.65% on the first $132,900 of gross earnings. Swifty Company is subject to 5.40% state unemployment taxes and 0.60% federal unemployment taxes on the first $7,000 of gross earnings. Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) Prepare the payroll register for the weekly payroll. (Round answers to 2 decimal places, e.g. 15.25.) Arepere the joumal entries to record the peyrol and Ramirer's purrol tax expense. (Credit account tifles are autom not indent manually, Round answers to 2 decimal places, e. . 15.25.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts