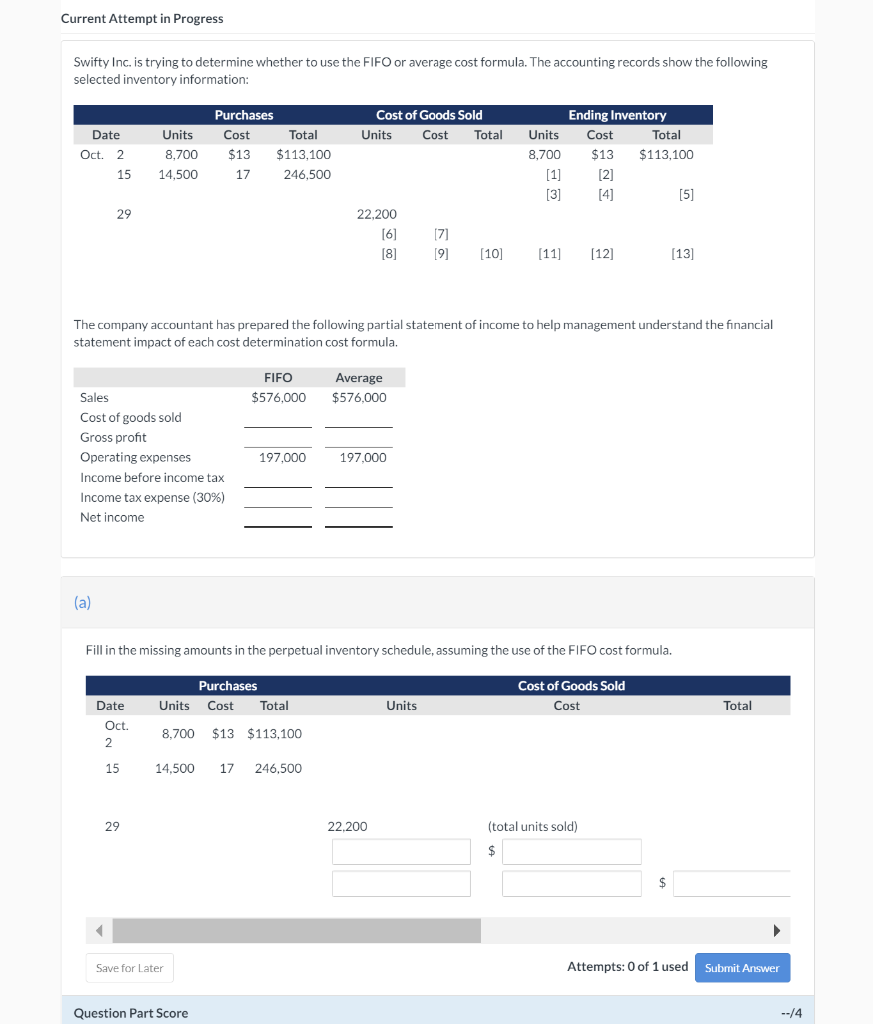

Question: Current Attempt in Progress Swifty Inc. is trying to determine whether to use the FIFO or average cost formula. The accounting records show the following

Current Attempt in Progress Swifty Inc. is trying to determine whether to use the FIFO or average cost formula. The accounting records show the following selected inventory information: Cost of Goods Sold Units Cost Total Date Oct. 2 15 Units 8,700 14,500 Purchases Cost Total $13 $113,100 17 246,500 Units 8,700 [1] [3] Ending Inventory Cost Total $13 $113,100 [2] [4] [5] 29 22.200 [6] [8] 17] [9] [10] [11] [12] [13] The company accountant has prepared the following partial statement of income to help management understand the financial statement impact of each cost determination cost formula. FIFO Average $576,000 $576,000 Sales Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense (30%) Net income 197,000 197,000 (a) Fill in the missing amounts in the perpetual inventory schedule, assuming the use of the FIFO cost formula. Purchases Units Cost Total 8,700 $13 $113,100 Cost of Goods Sold Cost Units Date Oct. 2 Total 15 14.500 17 246,500 29 22.200 (total units sold) ) $ $ Save for Later Attempts: 0 of 1 used Submit Answer Question Part Score --14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts