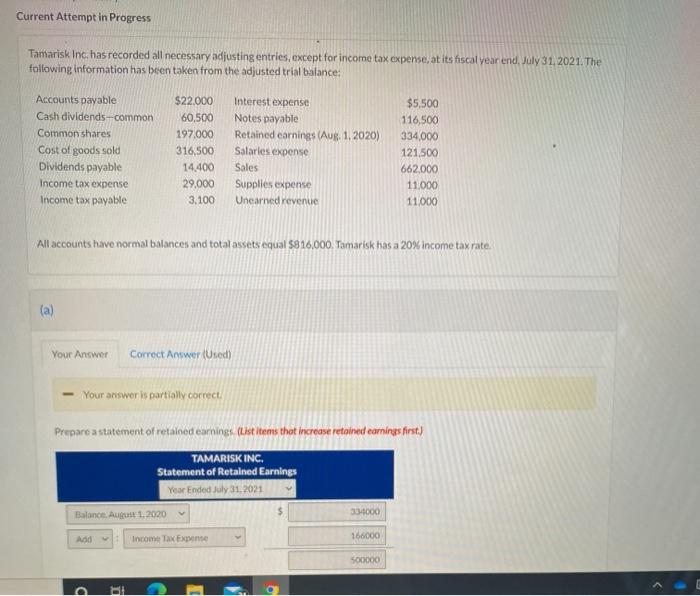

Question: Current Attempt in Progress Tamarisk Inc. has recorded all necessary adjusting entries, except for income tax expense, at its hscal year end, July 31 2021.

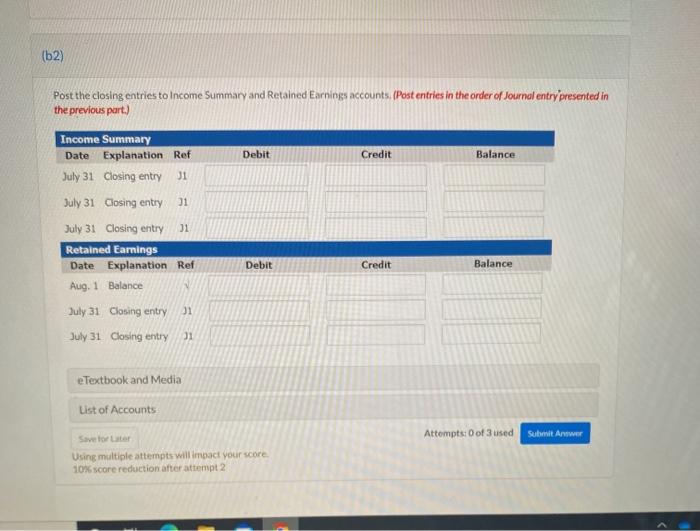

Current Attempt in Progress Tamarisk Inc. has recorded all necessary adjusting entries, except for income tax expense, at its hscal year end, July 31 2021. The following information has been taken from the adjusted trial balance: Accounts payable Cash dividends-common Common shares Cost of goods sold Dividends payable Income tax expense Income tax payable $22.000 60,500 197.000 316,500 14.400 29,000 3.100 Interest expense Notes payable Retained earnings (Aug 1, 2020) Salaries expense Sales Supplies expense Unearned revenue $5,500 116,500 334,000 121,500 662000 11.000 11000 All accounts have normal balances and total assets equal 5816,000. Tamarisk has a 20% income tax rate, (a) Your Answer Correct Answer (Used) Your answer is partially correct Prepare a statement of retained earnings. (List items that increase retained earnings first) TAMARISK INC. Statement of Retained Earnings Year Ended July 31, 2021 Balance August 1.2020 334000 Add Income Tax Expense 166000 500000 (62) Post the closing entries to Income Summary and Retained Earnings accounts. (Post entries in the order of Journal entry presented in the previous part.) Income Summary Date Explanation Ref July 31 Closing entry Debit Credit Balance 31 Debit Credit Balance July 31 Closing entry 31 July 31 Closing entry 31 Retained Earnings Date Explanation Ref Aug. 1 Balance Duly 31 Closing entry 31 July 31 Closing entry 31 eTextbook and Media List of Accounts Attempts: 0 of 3 used seborit Antwer Save for Later Using multiple attempts will impact your score 10% score reduction after attempt 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts