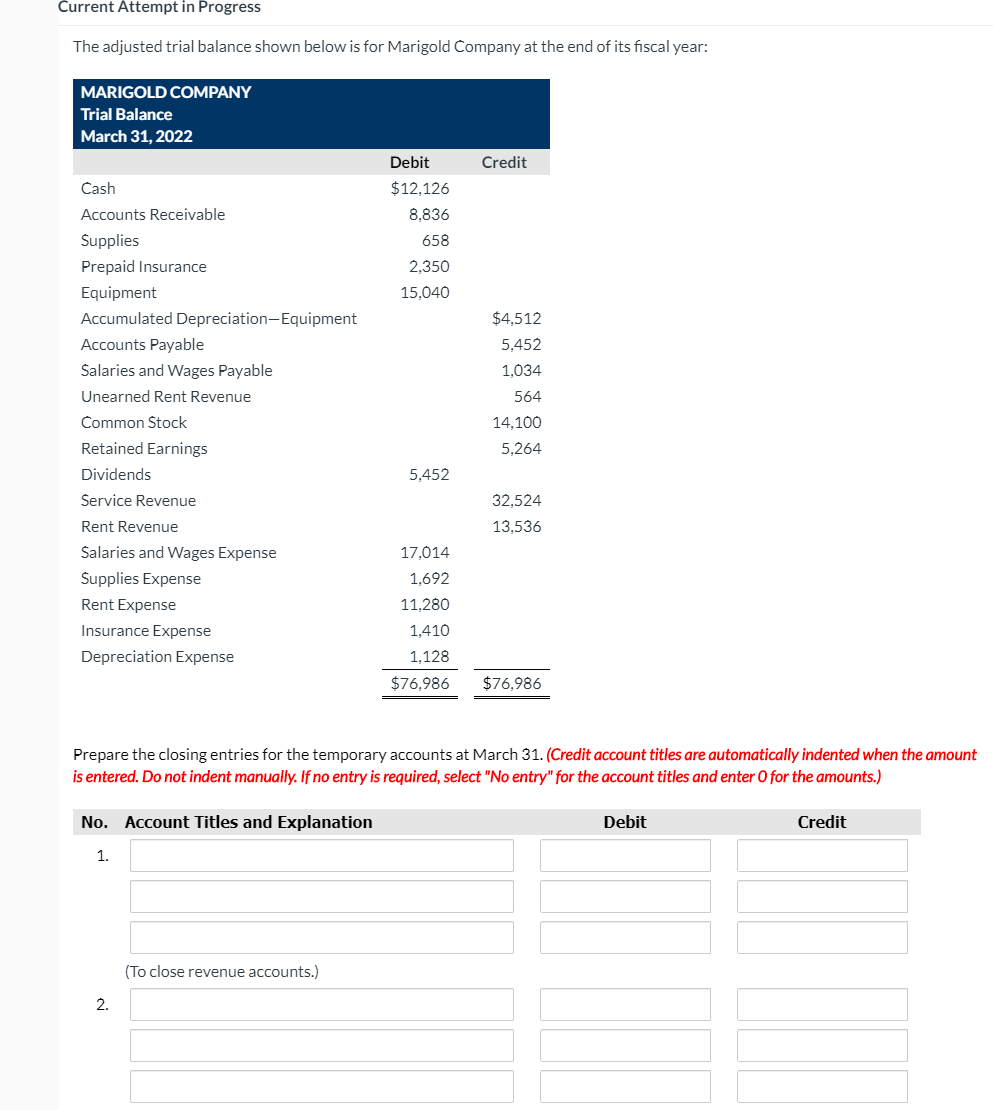

Question: Current Attempt in Progress The adjusted trial balance shown below is for Marigold Company at the end of its fiscal year: MARIGOLD COMPANY Trial Balance

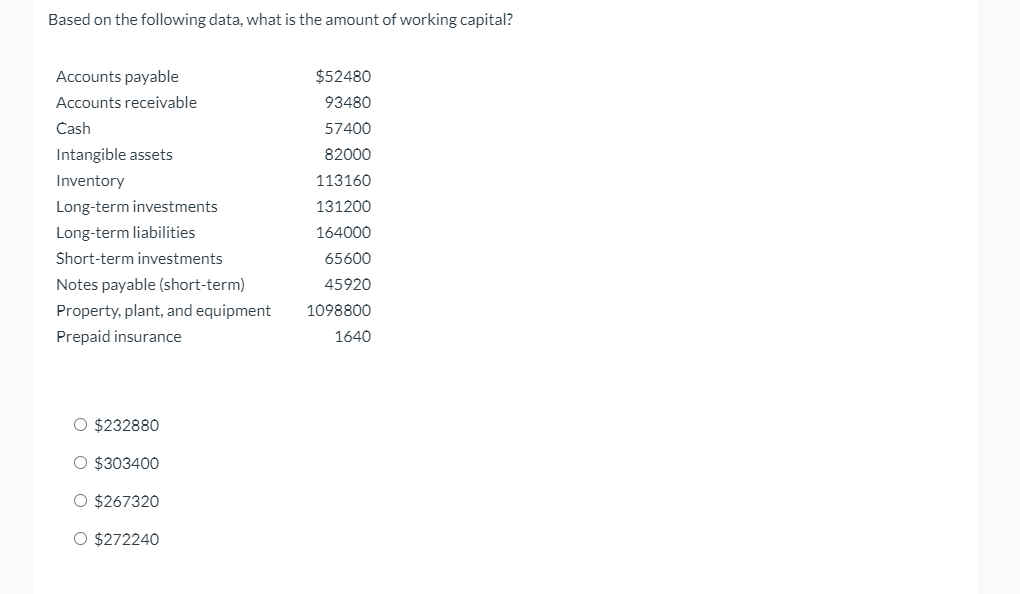

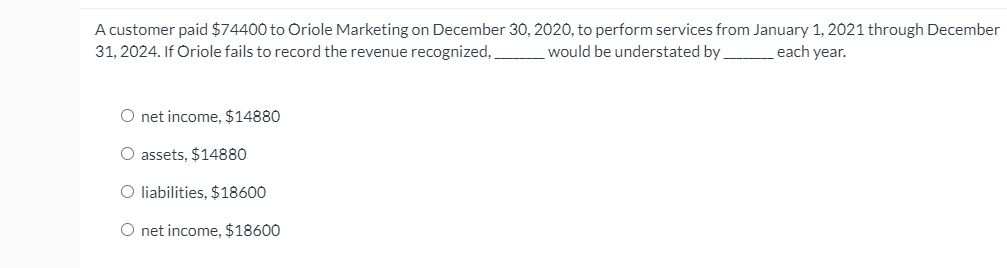

Current Attempt in Progress The adjusted trial balance shown below is for Marigold Company at the end of its fiscal year: MARIGOLD COMPANY Trial Balance March 31, 2022 Debit Credit $12,126 8.836 658 2,350 15,040 $4,512 5,452 1,034 564 Cash Accounts Receivable Supplies Prepaid Insurance Equipment Accumulated Depreciation Equipment Accounts Payable Salaries and Wages Payable Unearned Rent Revenue Common Stock Retained Earnings Dividends Service Revenue Rent Revenue Salaries and Wages Expense Supplies Expense Rent Expense Insurance Expense Depreciation Expense 14,100 5,264 5,452 32,524 13,536 17,014 1,692 11,280 1,410 1,128 $76,986 $76,986 Prepare the closing entries for the temporary accounts at March 31. (Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No entry" for the account titles and enter for the amounts.) No. Account Titles and Explanation Debit Credit 1. (To close revenue accounts.) 2. Based on the following data, what is the amount of working capital? Accounts payable Accounts receivable Cash Intangible assets Inventory Long-term investments Long-term liabilities Short-term investments Notes payable (short-term) Property, plant, and equipment Prepaid insurance $52480 93480 57400 82000 113160 131200 164000 65600 45920 1098800 1640 $232880 O $303400 O $267320 O $272240 A customer paid $74400 to Oriole Marketing on December 30, 2020, to perform services from January 1, 2021 through December 31, 2024. If Oriole fails to record the revenue recognized, would be understated by each year. O net income, $14880 O assets, $14880 O liabilities, $18600 O net income, $18600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts