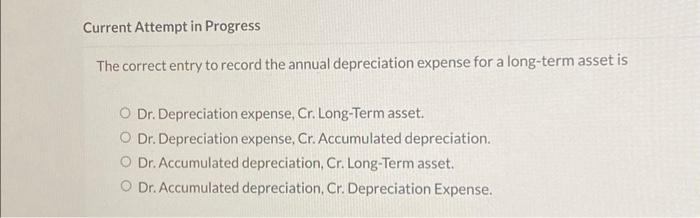

Question: Current Attempt in Progress The correct entry to record the annual depreciation expense for a long-term asset is Dr. Depreciation expense, Cr. Long-Term asset. Dr.

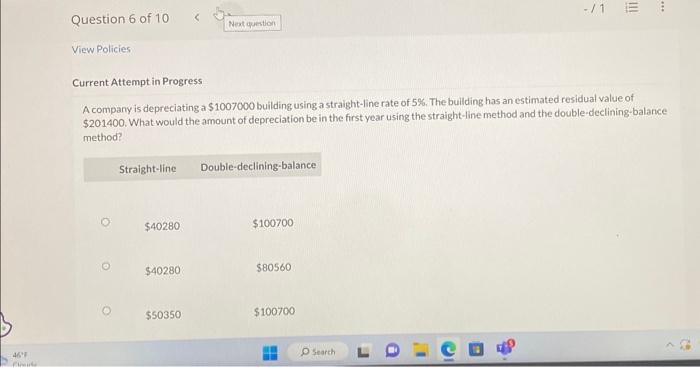

Current Attempt in Progress The correct entry to record the annual depreciation expense for a long-term asset is Dr. Depreciation expense, Cr. Long-Term asset. Dr. Depreciation expense, Cr. Accumulated depreciation. Dr. Accumulated depreciation, Cr. Long-Term asset. Dr. Accumulated depreciation, Cr. Depreciation Expense. A company is depreciating a $1007000 building using a straight-line rate of 5%. The building has an estimated residual value of $201400. What would the amount of depreciation be in the first year using the straight-line method and the double-declining-balance method

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts