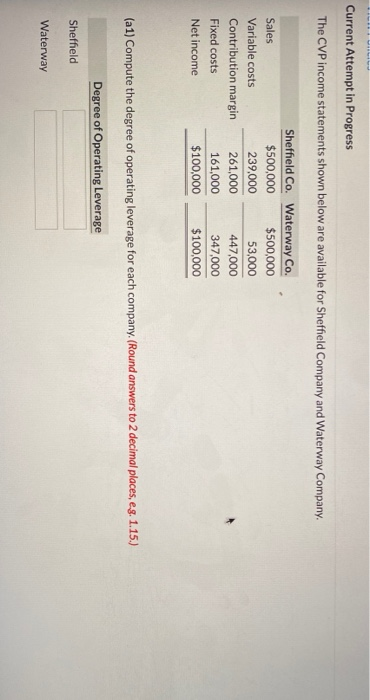

Question: Current Attempt in Progress The CVP income statements shown below are available for Sheffield Company and Waterway Company. Sales Variable costs Contribution margin Fixed costs

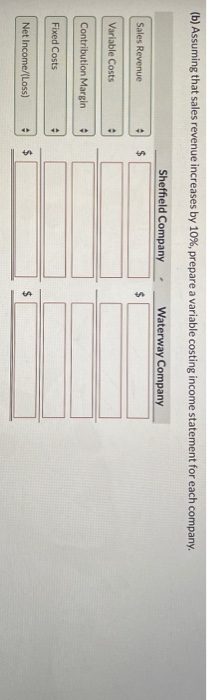

Current Attempt in Progress The CVP income statements shown below are available for Sheffield Company and Waterway Company. Sales Variable costs Contribution margin Fixed costs Net income Sheffield Co. Waterway Co. $500,000 $500,000 239,000 53,000 261,000 447,000 161,000 347,000 $100,000 $100,000 (a1) Compute the degree of operating leverage for each company. (Round answers to 2 decimal places, e.g. 1.15.) Degree of Operating Leverage Sheffield Waterway (b) Assuming that sales revenue increases by 10%, prepare a variable costing income statement for each company Sheffield Company - Waterway Company Sales Revenue Variable Costs Contribution Margin Fixed Costs Net Income/(Loss)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts