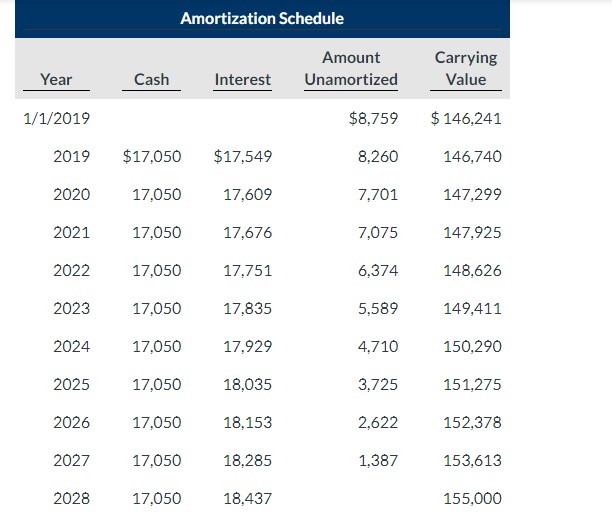

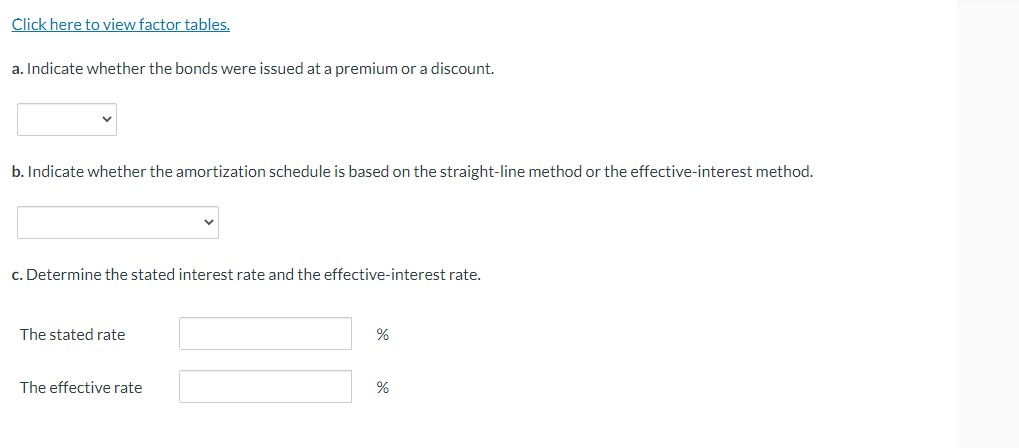

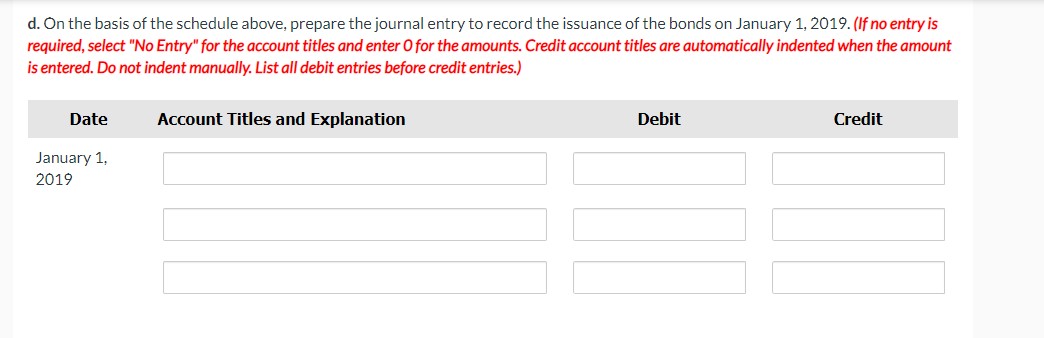

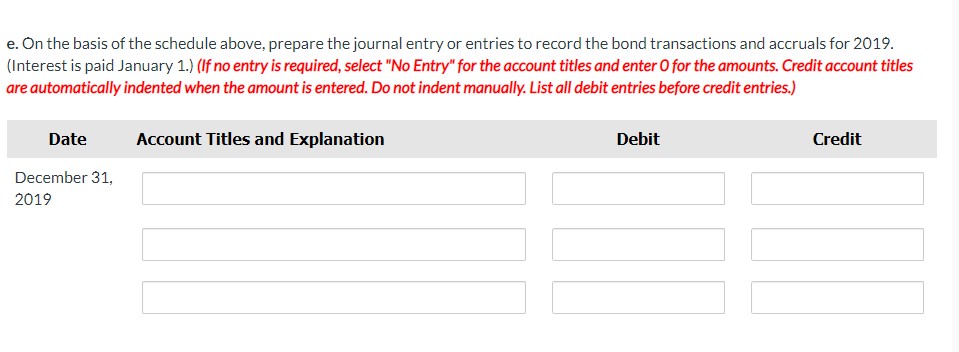

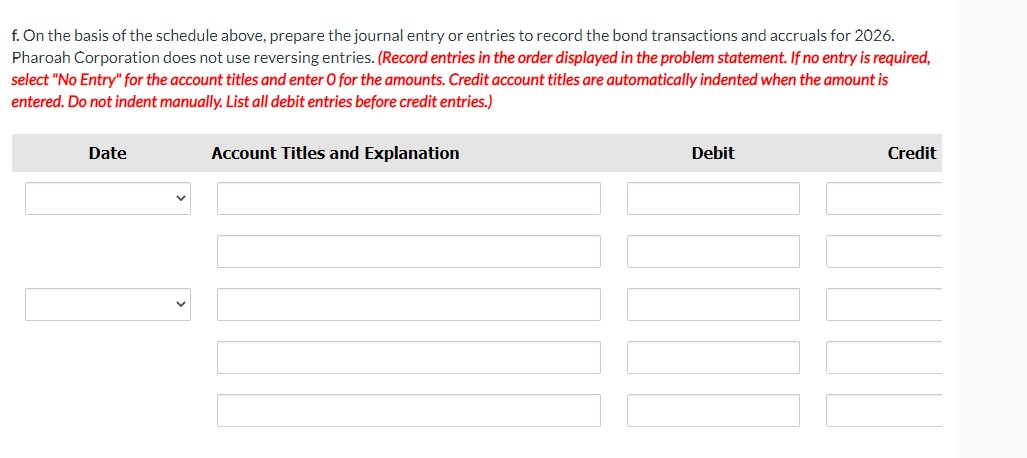

Question: Current Attempt in Progress The following amortization and interest schedule reects the issuance of 10year bonds by Pharoah Corporation on January 1, 2019, and the

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts