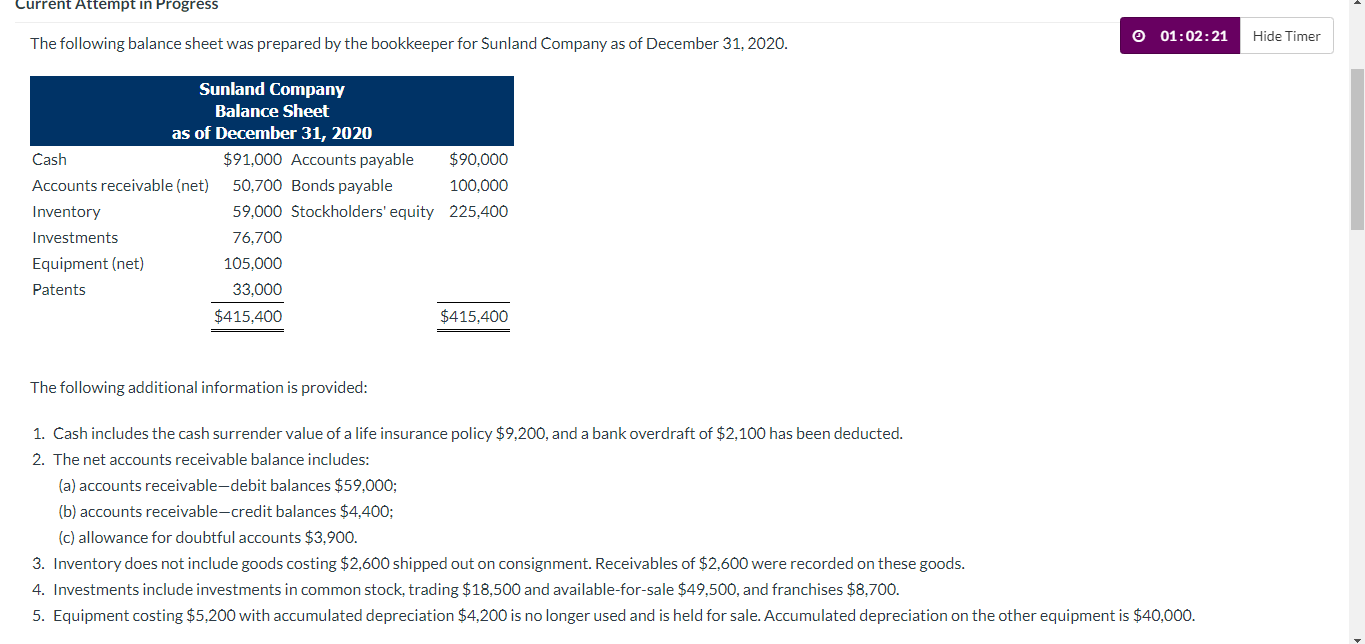

Question: Current Attempt in Progress The following balance sheet was prepared by the bookkeeper for Sunland Company as of December 31, 2020. 01:02:21 Hide Timer Sunland

Current Attempt in Progress The following balance sheet was prepared by the bookkeeper for Sunland Company as of December 31, 2020. 01:02:21 Hide Timer Sunland Company Balance Sheet as of December 31, 2020 Cash $91,000 Accounts payable $90,000 Accounts receivable (net) 50,700 Bonds payable 100.000 Inventory 59,000 Stockholders' equity 225,400 Investments 76,700 Equipment (net) 105,000 Patents 33,000 $415,400 $415,400 The following additional information is provided: 1. Cash includes the cash surrender value of a life insurance policy $9.200, and a bank overdraft of $2,100 has been deducted. 2. The net accounts receivable balance includes: (a) accounts receivable-debit balances $59,000; (b) accounts receivable-credit balances $4,400; (c) allowance for doubtful accounts $3,900. 3. Inventory does not include goods costing $2,600 shipped out on consignment. Receivables of $2,600 were recorded on these goods. 4. Investments include investments in common stock, trading $18,500 and available-for-sale $49,500, and franchises $8,700. 5. Equipment costing $5,200 with accumulated depreciation $4,200 is no longer used and is held for sale. Accumulated depreciation on the other equipment is $40,000. Current Attempt in Progress The following balance sheet was prepared by the bookkeeper for Sunland Company as of December 31, 2020. 01:02:21 Hide Timer Sunland Company Balance Sheet as of December 31, 2020 Cash $91,000 Accounts payable $90,000 Accounts receivable (net) 50,700 Bonds payable 100.000 Inventory 59,000 Stockholders' equity 225,400 Investments 76,700 Equipment (net) 105,000 Patents 33,000 $415,400 $415,400 The following additional information is provided: 1. Cash includes the cash surrender value of a life insurance policy $9.200, and a bank overdraft of $2,100 has been deducted. 2. The net accounts receivable balance includes: (a) accounts receivable-debit balances $59,000; (b) accounts receivable-credit balances $4,400; (c) allowance for doubtful accounts $3,900. 3. Inventory does not include goods costing $2,600 shipped out on consignment. Receivables of $2,600 were recorded on these goods. 4. Investments include investments in common stock, trading $18,500 and available-for-sale $49,500, and franchises $8,700. 5. Equipment costing $5,200 with accumulated depreciation $4,200 is no longer used and is held for sale. Accumulated depreciation on the other equipment is $40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts