Question: Current Attempt in Progress The following data relate to the accounts of Oriole Company: a . Unpaid salaries and wages at year end amount to

Current Attempt in Progress

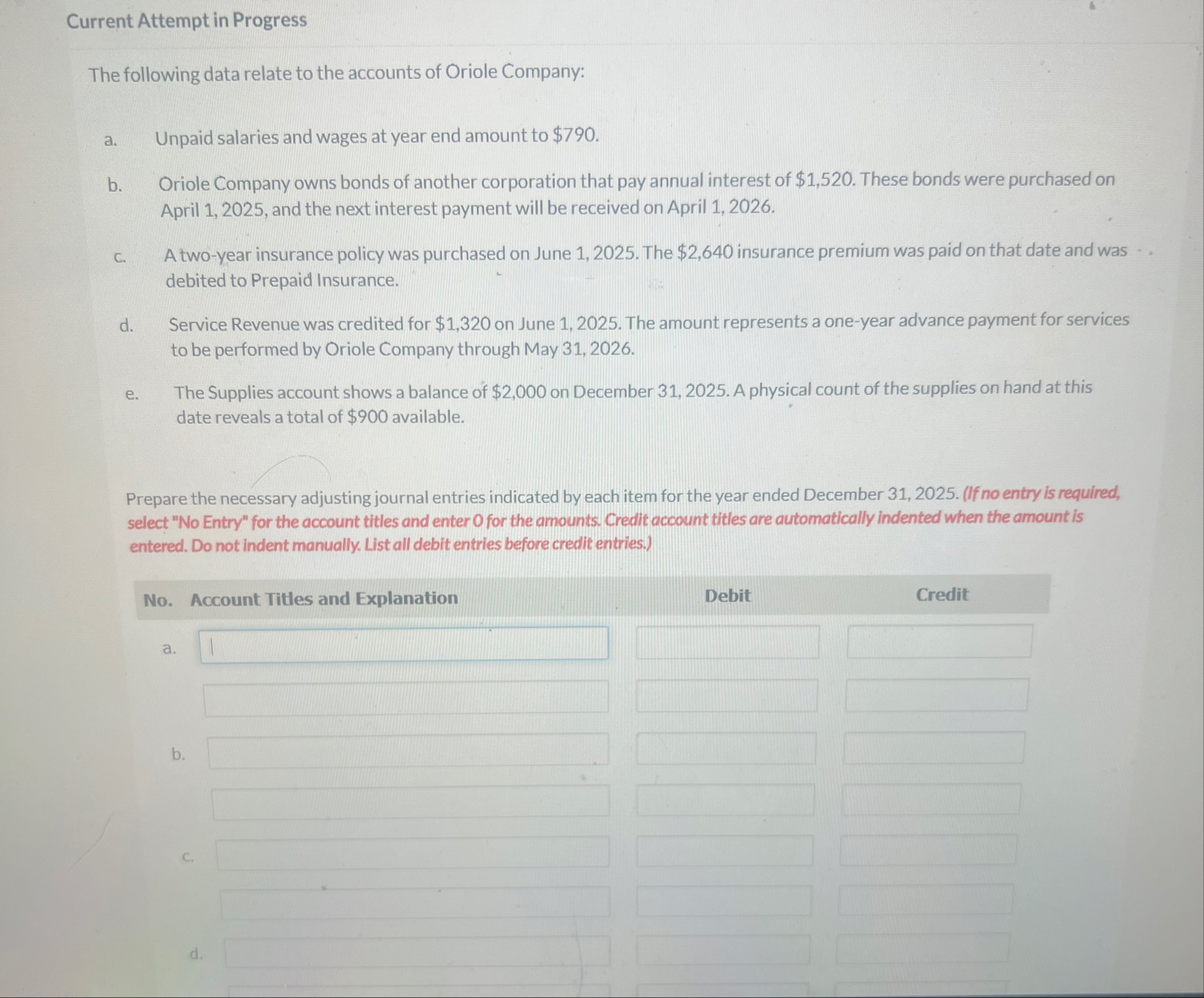

The following data relate to the accounts of Oriole Company:

a Unpaid salaries and wages at year end amount to $

b Oriole Company owns bonds of another corporation that pay annual interest of $ These bonds were purchased on April and the next interest payment will be received on April

c A twoyear insurance policy was purchased on June The $ insurance premium was paid on that date and was debited to Prepaid Insurance.

d Service Revenue was credited for $ on June The amount represents a oneyear advance payment for services to be performed by Oriole Company through May

e The Supplies account shows a balance of $ on December A physical count of the supplies on hand at this date reveals a total of $ available.

Prepare the necessary adjusting journal entries indicated by each item for the year ended December If no entry is required, select No Entry" for the account titles and enter O for the arnounts. Credit account titles are automatically indented when the amount is entered. Do not indent manually. List all debit entries before credit entries.

No Account Titles and Explanation

Debit

Credit

a

b

c

d

tion of

The Supplies account shows a balance of $ on December A physical count of the supplies on hand at this date reveals a total of $ available.

epare the necessary adjusting journal entries indicated by each item for the year ended December If no entry is required, lect No Entry" for the account titles and enter for the amounts. Credit account titles are automatically indented when the amount is itered. Do not indent manually. List all debit entries before credlt entrles.

No Account Titles and Explanation

Debit

Credit

a

b

c

d

e

List of Accounts

Assistance Used

Accounts Payable

Accounts ReceivabieQuestion of

Accounts Payable

Accounts Receivable

Accumulated DepreciationBuildings

Accumulated DepreciationEquipment

Administrative Expenses

Admissions Revenue

Advertising Expense

Allowance for Doubtful Accounts

Bad Debt Expense

Buildings

Cash

Common Stock

Cost of Goods Sold

Current Maturity of LongTerm Debt

Delivery Expense

Depreciation Expense

Dividends

Dues Revenue

Equipment

Green Fees Revenue

income Summary

Income Tax ExpenseQuestion of

Insurance Expense

Interest Expense

Interest Payable

Interest Receivable

Interest Revenue

Inventory

Land

Maintenance and Repairs Expense

Mortgage Payable

No Entry

Notes Payable

Notes Receivable

Office Expense

Owner's Capital

Owner's Drawings

Prepaid Advertising

Prepaid Insurance

Prepaid Rent

Property Tax Expense

Property Tax Payable

Rent Expenise

Rent ReceivableRent Revenue

Retained Earnings

Salaries and Wages Expense

Salaries and Wages Payable

Sales

Sales Discounts

Sales Returns and Allowances

Sales Revenue

Selling Expenses

Service Revenue

Subscriptions Revenue

Supplies

Supplies Expense

Telephone and Internet Expense

Utilities Expenses

Unearned Admissions Revenue

Unearned Dues Revenue

Unearned Rent Revenue

Unearned Service Revenue

Unearned Subscriptions Revenue

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock