Question: Current Attempt in Progress The following information is available for Wildhorse Corporation for 2 0 2 5 . Depreciation reported on the tax return exceeded

Current Attempt in Progress

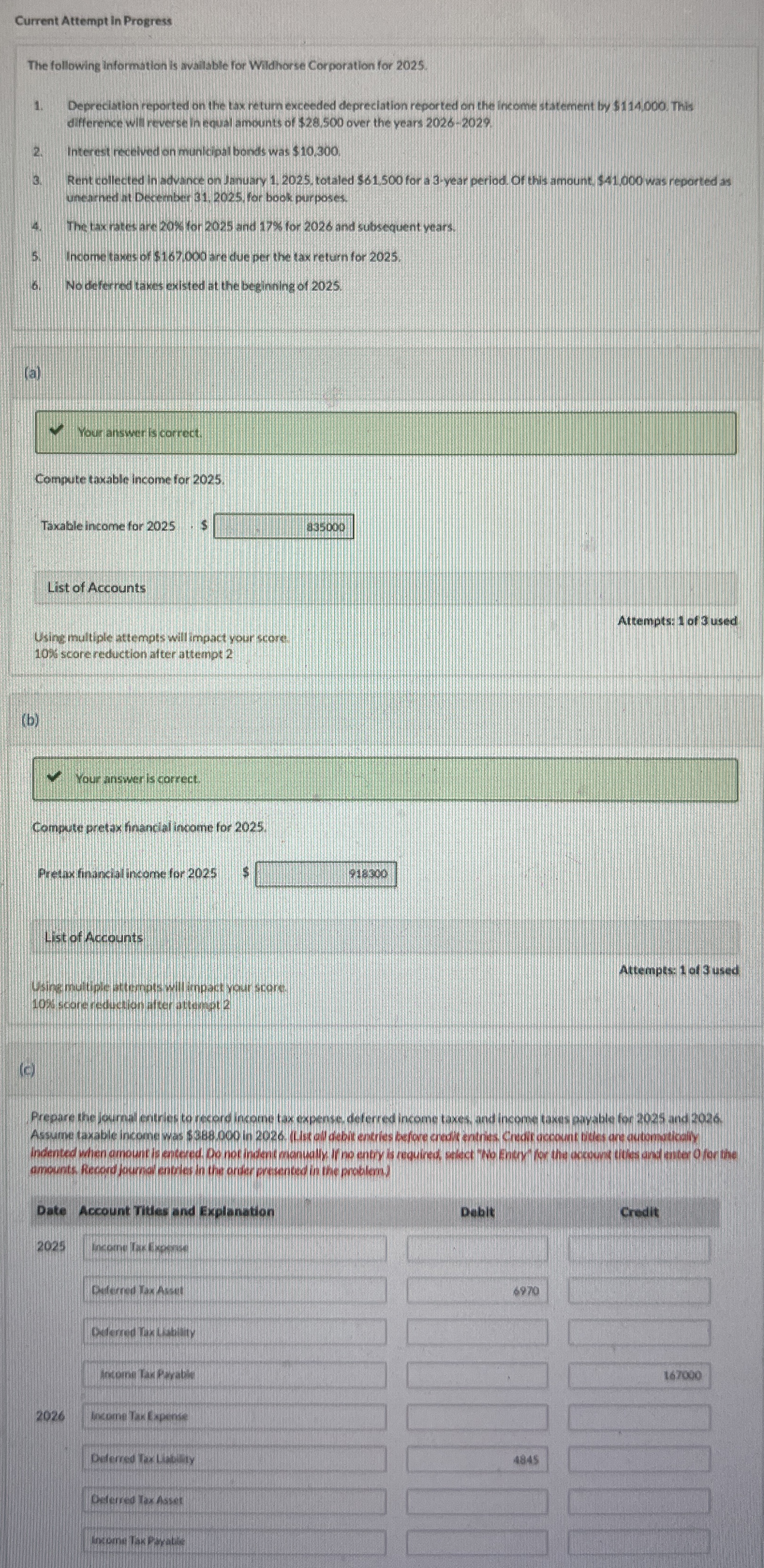

The following information is available for Wildhorse Corporation for

Depreciation reported on the tax return exceeded depreciation reported on the income statement by $ This difference with reverse in equal amounts of $ over the years

Interest necelved on munkipal bonds was $

Rent collected in advance on Jhnuary totaled $ for a year period. Of this amount, $ was reported as unearned an December for book purposes.

The tax rate are for and for and subsequent years.

Nnoome tawss of $ are due per the tax return for

Nodoferned takes existed at the beginning of

a

Your answer is correct.

Compute taxable income for

Taxable income for $

List of Accounts

Attempts: of used

Usine multiple attempts will impact your score

score reduction after attempt

b

Your answer ls correct.

Compute pretax financial income for

Pretux financial income for

$

Attempts: ol used

Usine multple at tempt whempact your soore

c

Prepare the journal entrle to thcond income tax expense deferred income taxes and income taxes payable for and

tableDateAccount Titles and,Dabit,Creditincome lex Diferred Tax Ansut,Oterned Max Lishlity,,Income Tax Peration,,Incume Tax Expente,,Dutersed lax Listity,Caterred lax Asset,,meane Tax Pryath,,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock