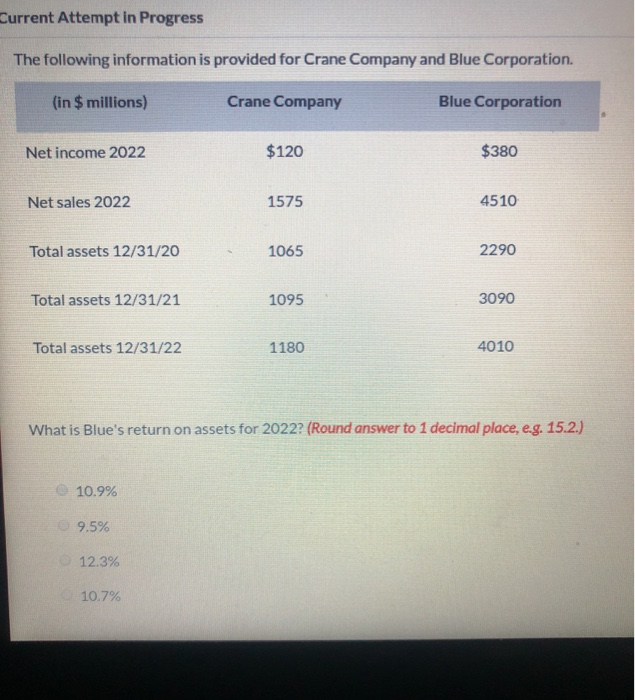

Question: Current Attempt in Progress The following information is provided for Crane Company and Blue Corporation. (in $ millions) Crane Company Blue Corporation Net income 2022

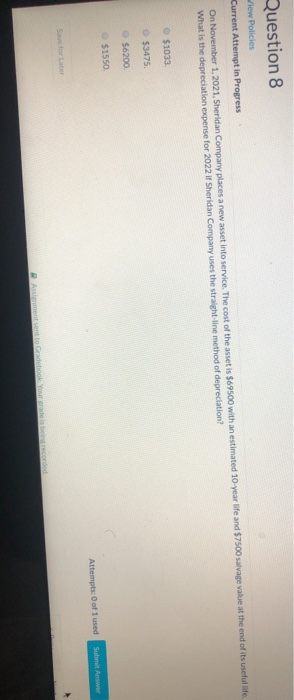

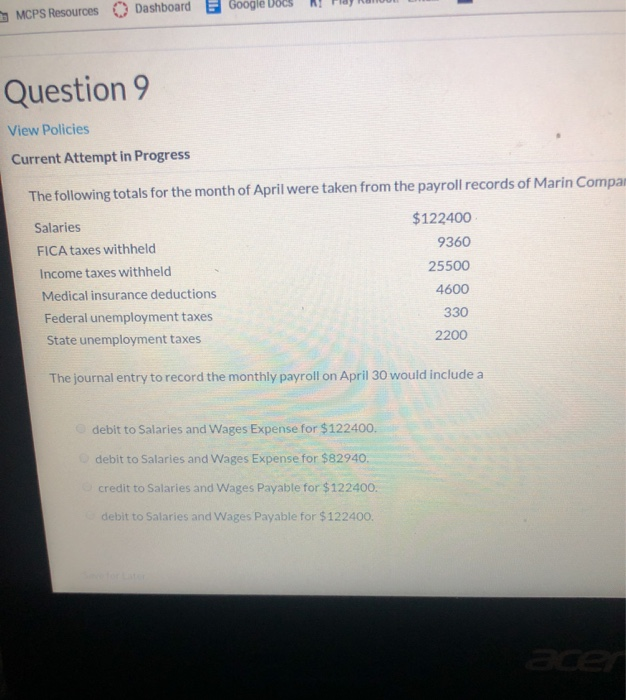

Current Attempt in Progress The following information is provided for Crane Company and Blue Corporation. (in $ millions) Crane Company Blue Corporation Net income 2022 $120 $380 Net sales 2022 1575 4510 Total assets 12/31/20 1065 2290 Total assets 12/31/21 1095 3090 Total assets 12/31/22 1180 4010 What is Blue's return on assets for 2022? (Round answer to 1 decimal place, e.g. 15.2.) 10.9% 9.5% 12.3% 10.7% Question 8 Wiew Policies Current Attempt in Progress On November 1.2021. Sheridan Company places a new asset into service. The cost of the asset is $69500 with an estimated 10 year life and $7500 salvage value at the end of its useful life. What is the depreciation expense for 2022 if Sheridan Company uses the straight-line method of depreciation? $1033 $3475 $6200 $1550 Attempts: 0 of 1 used Submit Answer Store radebook You Dashboard Google Docs MCPS Resources ! Play and Question 9 View Policies Current Attempt in Progress The following totals for the month of April were taken from the payroll records of Marin Compan Salaries FICA taxes withheld Income taxes withheld Medical insurance deductions Federal unemployment taxes State unemployment taxes $122400 9360 25500 4600 330 2200 The journal entry to record the monthly payroll on April 30 would include a debit to Salaries and Wages Expense for $122400. debit to Salaries and Wages Expense for $82940. credit to Salaries and Wages Payable for $122400. debit to Salaries and Wages Payable for $122400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts